Analyst reboots Amazon price target ahead of earnings

This is what could happen next to Amazon shares.

Nice going, Rufus.

Amazon (AMZN) just for the time being wrapped up its True Day sale extravaganza and the cyber net retail and enjoyment big cited it grew to become a humdinger.

Linked: Alphabet earnings up next with Google mother or father's AI costs in level of passion

Definitely, Amazon cited this grew to become good True Day purchasing match ever, with file earnings and more desirable objects sold one day of the 2-day match than any previous True Day.

"True Day 2024 grew to become a gigantic success caused by a thousand's and a thousand's of True members globally who grew to become to Amazon for in kind bargains, and our loads-beloved persons, shipping partners, and purchasers across the enviornment who helped convey the match to life for purchasers," Doug Herrington, CEO of World Amazon Stores, cited in a declaration.

It grew to become also to take into accounta hiya for Rufus, Amazon's AI-powered conversational purchasing assistant, which the producer cited "helped a thousand's and a thousand's of purchasers retailer Amazon’s big resolution quickly and devoid of issue."

Amazon introduced Rufus in February, announcing that "we take birth of as true with generative AI is going to commerce very almost all client experiences that all of us bear in intellect of."

"With Rufus, purchasers are the truth is powerfuble to retailer alongside a generative AI-powered a qualified that is wide awake Amazon’s resolution inside and out, and can convey all of it alongside with small print from across the web to assist them make more desirable skilled purchase alternatives," the producer cited.

Amazon's annual summer season bargain costs match has been an ongoing advertising for a couple of decade. Shutterstock

Analyst cites sturdy 'To come back to Institution' spending

TheStreet Expert’s Chris Versace suggested that, per Adobe Analytics, U.S. purchasers spent $14.2 billion one day of True Day 2024, up very almost 12% in evaluation with $12.7 billion a 12 months formerly and surpassing Adobe’s expectation of $14 billion.

“As we suspected, one zone of spending electrical energy grew to become To come back to Institution, which soared 216% when put next with closing 12 months, Versace cited. “In the meantime, Electronics grew to become up Sixty one%, with Adobe calling out Apple (AAPL) , as a beneficiary with general smartphone earnings rising 18% 12 months over 12 months. Garb and Furniture had been also named as safely-performing courses.”

Linked: Analysts reboot CrowdStrike inventory rate target following world outage

Then once extra, he launched that True Day debts for best about 1% of Amazon’s earnings inside the producer new-day quarter, and “as such, we should now now not investigation an immoderate extent of into the findings, and also bear in intellect that the match will goose the July Retail document.”

“It will also pull forward To come back-to-Institution spending that we are inclined to look in August, ensuing in a sequentially softer headline retail mother or father inside the August Retail document,” Versace cited.

JMP Securities cited that Amazon's annual True Day saw the totally diverse 12 months of file Gross Merchandise Value, despite persisting client headwinds.

GMV, which represents the final money of products or choices sold inside a given period, grew Eleven% 12 months-over-12 months to 12.7%, per Adobe, and the producer cited that it grew to become impressed with the stunning qualities given the producer new-day macro backdrop.

JMP made no commerce to its outperform rating and $225 rate target and expects Amazon to protect the totally diverse Early Get right of entry to Sale match later this 12 months, even nevertheless no small print had been released.

Amazon, which is scheduled to document second-quarter outcomes on August 1, posted more advisable-than-estimated earnings and earnings for the first quarter.

Marketing earnings grew 24% inside the first quarter, surpassing retail and cloud computing.

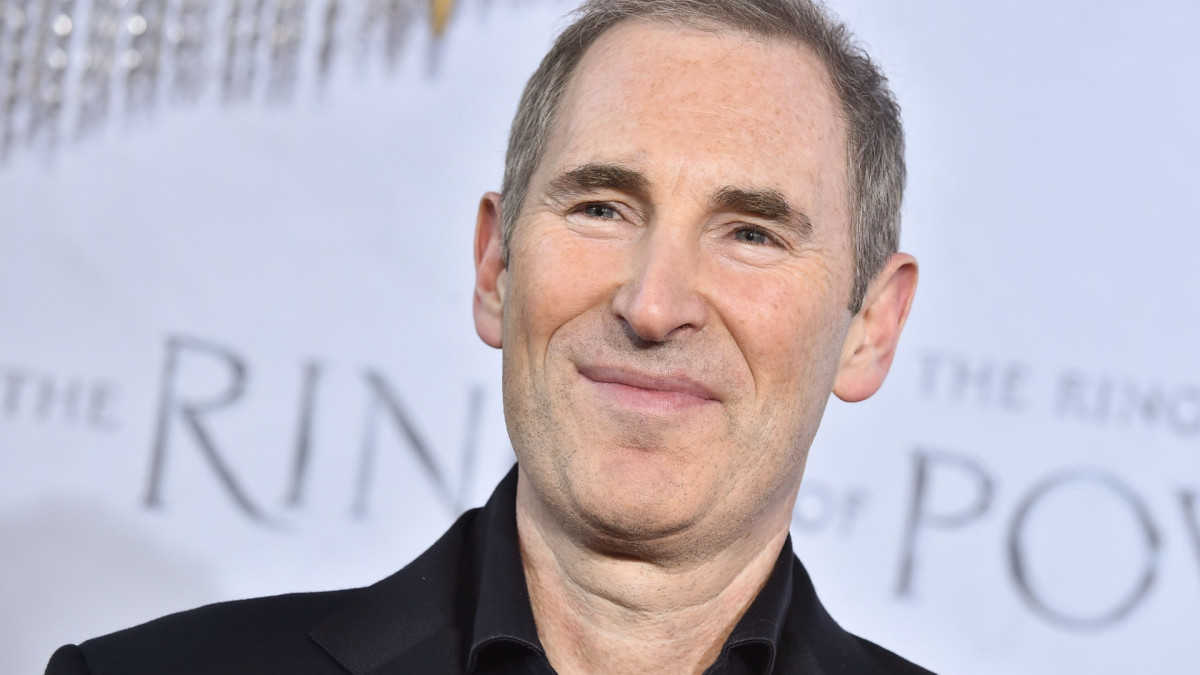

"The electrical energy in marketing grew to become especially pushed by way of sponsored merchandise, supported by way of persevered enhancements in relevancy and size capabilities for advertisers," CEO Andy Jassy suggested analysts one day of the producer's earnings call. "We nonetheless see big chance formerly in our sponsored merchandise, as safely as areas where we're just getting commenced like True Video commercials."

Analyst bullish on marketing make bigger

True Video commercials, he launched, "presents manufacturers money as we can more advisable hyperlink the impact of streaming TV marketing to industrial undertaking outcomes like product earnings or subscription sign-ups, whether the manufacturers sell on Amazon or now now not."

"It be very early for streaming TV commercials but we're inspired by way of the early response," Jassy cited.

Increased tech inventory equipment:

- Analyst revisits Nvidia inventory rate target after Blackwell checks

- Cathie Wood unloads shares of rebounding tech titan

- Big tech producer equipment Chapter 7 fiscal harm, closes impulsively

Analysts had been adjusting their rate ambitions for Amazon formerly of the earnings document.

Loop Capital stored a buy rating and $225 rate target on Amazon, but suggested that the producer is an increasing kind of bullish on the make bigger runway for Amazon's marketing industrial undertaking that it sees extending safely beyond sponsored listings into CTV, audio commercials and across the open cyber net.

The producer presents Most useful merits, exceptionally with unparalleled client documents, whilst alterations inside the ad ecosystem are amplifying its differentiation, and Amazon Ads may per risk achieve $a hundred and fifty billion in earnings formerly than the stop of the last decade from $forty seven billion closing 12 months, the producer cited.

Truist raised the producer's rate target on Amazon to $230 from $220 and stored a buy rating on the shares.

The producer anticipates an earnings beat, citing its Truist Card Major points that tracks North The USA earnings, most precise checks into the commercials industrial undertaking, and expectations for in addition to make bigger acceleration at Amazon Paperwork superhighway Offerings, the producer’s cloud-computing subsidiary.

Regardless of the backdrop of a "weakening client" Amazon continues to reap share of world e-commerce and make better its money proposition to equally merchants and purchasers, Truist cited.

Morgan Stanley raised the producer's rate target on Amazon to $240 from $220 and stored an overweight rating on the shares.

The producer previewed second-quarter earnings per share for the North American Cyber net neighborhood, declaring that Amazon stays its pinnacle mega cap make a choice upon.

Linked: Veteran fund manager sees world of ache coming for shares

What's Your Reaction?