Analyst revamps Nvidia stock price with key earnings update on deck

Nvidia will post its highly anticipated fiscal-second-quarter report on Aug. 28.

Nvidia shares moved higher in Friday trading as traders appeared to the AI-chip maker's substantive second quarter report and a extreme Wall Avenue analyst issued a bullish title on its broader tech market influence.

The inventory of Nvidia (NVDA) , which experiences second quarter income next week, has rebounded firmly from its early month lows, adding more than $600 billion in market charge supplied that that the yen-lift-alternate-triggered turmoil that roiled global stocks on Aug. 5.

The inventory's momentum may nicely be key to solidifying broader market sentiment heading into the autumn besides, as traders have been questioning the veracity of AI-linked funding spending and weighing the influence of the critical quarterly underperformance for the Outstanding 7 tech stocks in as a minimal two years.

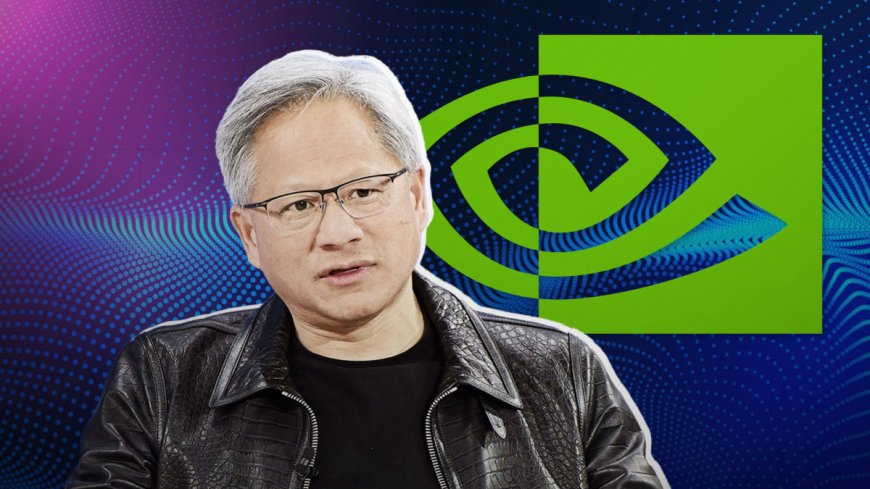

Without doubt, Wedbush analyst Dan Ives says Nvidia's income are probable to highlight "doubtlessly the biggest week for the inventory market in years," because the tech big has "the most particularly good perch and vantage level to chat about natural game AI demand and the urge for food for Nvidia's AI chips discovering forward." Bloomberg/Getty Images

With these lofty expectations attached, Ives' colleague, Wedbush analyst Matt Bryson, extra $18 to his Nvidia charge target, taking it to $138 a share, even as holding his 'overweight' ranking in condo.

Nvidia's Blackwell chip income in focal level

Bryson suggested he sees equally "more advantageous second-quarter consequences and sturdy third-quarter coaching" from the chipmaker next week. He expects a backside line for the three months resulted in July of 67 cents a share on income of $30 billion.

Wall Avenue forecasts are pointing to a consensus backside line of sixty four cents a share a 137% make better from the optimum year, with revenues more than doubling to $28.fifty five billion.

Nvidia suggested traders in May that almost all up-to-the-minute-quarter income would rise to round $28 billion, at the time more advantageous-than-estimated estimate assuaged traders' container about delays for orders of H100 chips tied to the launch of its new Blackwell processors.

Connected: Goldman Sachs analyst revisits Nvidia inventory charge target earlier of income

Traders will focal level on experiences that birth of its newly launched line of Blackwell processors, that are meant to be turbo, more charge-worthwhile, and more atmosphere friendly than its H100 Hopper predecessors, may nicely be delayed ensuing from design flaws.

Analysts had forecast Blackwell to commence contributing to Nvidia's extreme-line boom interior the third quarter and find their capacity into global patron documents services by the year's final three months.

Hyperscalers poised to spend big on infrastructure

That demand, besides as Nvidia's commanding market share, is estimated to energy the crew's documents heart income as extreme as $100 and fifty billion next year, powered in most occasions by this year's Blackwell launch.

Hyperscalers, the most worthwhile suppliers of big documents services and cloud services and items, are poised to spend round $Five hundred billion over the following two years building out their big infrastructure, based on estimates from Barclays.

The objective is to leverage their big datasets to adorn income of the entirety from energy-by consuming to the most worthwhile subtle pharmaceutical checking out.

Still, some analysts are additionally starting to question the % of AI spending from hyperscalers which contains Microsoft (MSFT) , Meta Platforms (META) , Amazon (AMZN) , and Google parent Alphabet (GOOGL) and the consequent demand for the extreme-cease chips and processors produced by Nvidia.

Connected: Big names exit Nvidia inventory as AI big stumbles earlier than income

Ives at Wedbush says Nvidia's shut-time size outlook will normally be most very worthy for the route of broader tech stocks, who estimates that "for every $1 spent on an Nvidia GPU chip there is a $8-$10 multiplier across the part."

Elevated AI Shares:

- Analyst revisits Microsoft inventory charge target after AI reporting change

- Analyst resets Nvidia inventory charge target earlier than income

- Analysts revise Palo Alto Networks inventory charge ambitions after income

"The stage is ready for tech stocks to go higher into year-cease and 2025 ... as the Fed receives in position to commence its charge decreasing cycle, macro smooth landing remains the route, and tech spending on AI remains a generational spending cycle just starting to hit the shores of the tech sector," Ives suggested.

Nvidia shares had been marked 1.6% higher in premarket trading to indicate a spot-bell charge of $125.sixty eight, a go which should lengthen the inventory's six-month gain to round fifty eight%.

Connected: Veteran fund supervisor sees world of discomfort coming for stocks

What's Your Reaction?