Analyst revisits Microsoft stock price target amid AI spending ramp

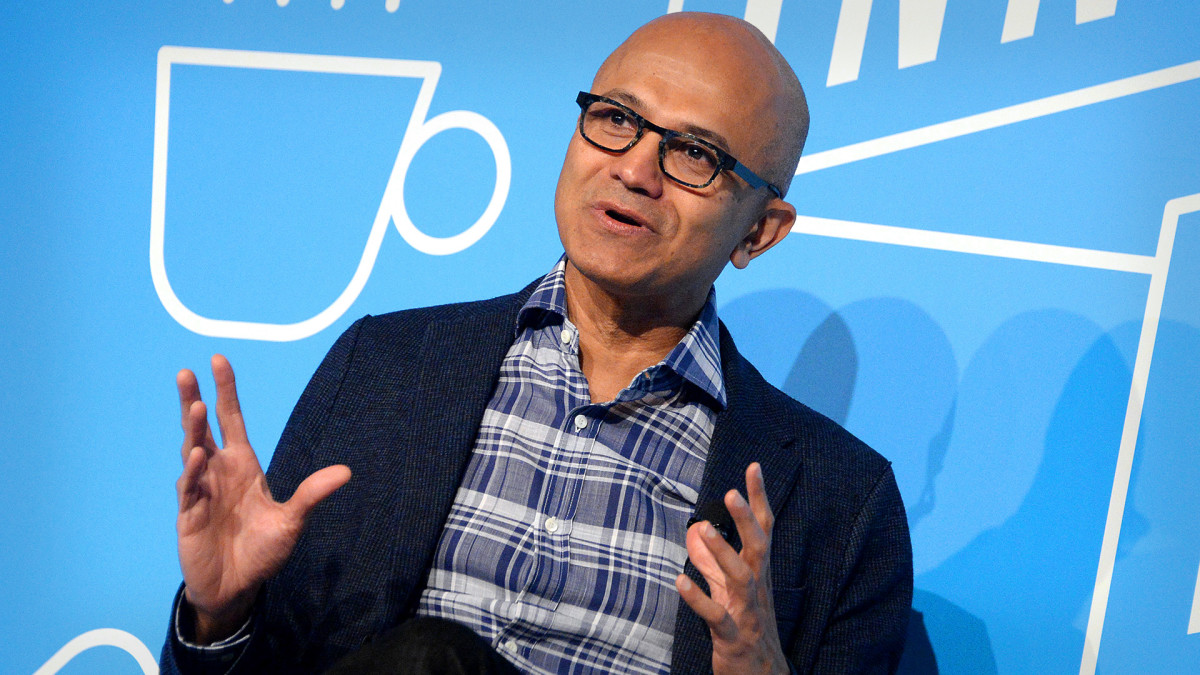

CEO Satya Nadella's AI ambitions for Microsoft will require significant spending increases over the coming years.

Microsoft shares edged cut in early Friday trading, kids remain on p.c. for a unbelievable weekly obtain, after a excessive Wall Boulevard analyst revisited the tech great's ranking and fee target following its muted quarterly ahead of this month.

Microsoft (MSFT) , which has been the second-worst performer of the so-famous as Very good 7 stocks to this factor this 12 months, dissatisfied Wall Boulevard with plans to extend its capital spending on AI infrastructure whilst as growth in its flagship cloud division endured to moderate.

The regional's Azure cloud division, its best growth driver, posted growth of 29% for the three months ended in June, simply shy of Wall Boulevard's 30% forecast. Identified Powerful Cloud rose 19% to $28.52 billion, also narrowly missing Wall Boulevard's $25.8 billion consensus forecast.

Microsoft referred to, kids, that around 8 percent materials of Azure growth bought here from AI investments, big than the 7-percent-factor enrich from the prior quarter.

Capital spending for the quarter rose seventy seven.6% from a 12 months ahead of to $19 billion, nicely upfront of the $14 billion tallied over the three months ended in March, taking its fiscal 12 months complete to $fifty five.7 billion.

Microsoft, which perpetually guidelines investors on a quarterly foundation, spoke of Azure growth would accelerate over its fiscal second 1/2, which ends subsequent June. For the three months ending in September, the Azure parent is estimated to improve at a p.c. clone of that of the previous quarter. Picture source: Brad Barket/Getty

BMO analyst Keith Bachman, who reiterated his overweight ranking and $five hundred value target on Microsoft in a note posted Friday, spoke of the longer-view outlook reflects a bullish vision of AI demand.

Microsoft AI demand visibility in center of know-how

"We believe the intent management furnished coaching beyond the hassle-free one-quarter look-upfront is on the grounds that of predicted easing of skill constraints and a sturdy demand/pipeline," Bachman spoke of

"In diverse phrases, we settle for as true with management has visibility into accelerated aggregate skill to allow more productive growth in the second 1/2 of the economic 12 months," he introduced.

Bachman, who lists Microsoft as a excessive p.c. on for the bank alongside cloud utility regional SAP (SAP) , says skill constraints have held lower again Azure's growth, kids he sees that easing over the fiscal second 1/2.

Essential: Microsoft stock tumbles after key regional disappoints

Close to about capital spending, Bachman spoke of that meetings with Microsoft management propose around 1/2 its 2024 capex converted into based on "long-life assets including land and buildings, and 1/2 converted into for shorter-life assets including p.c.-processing contraptions and servers. The massive majority of capital money owed had been based on cloud infrastructure.

Big spending plans at Microsoft

"Microsoft desires to invest upfront of demand, and on occasion, years upfront of demand," on the subject count of buildings and land, he argued, "whereas purchases of servers, racks, and routers may nicely be made toward when demand arises."

The regional's annual 10-Ok submitting with the Securities and Alternate Fee indicated Microsoft would seemingly spend around $35 billion on archives-center building fees, with most coming in the lowering-area-day fiscal 12 months. That can nicely be extra than double the $13.5 billion tally from the prior fiscal 12 months.

Essential: Microsoft exec warns of an ongoing hassle

"As consensus capex forecasts make higher by method of extra than consensus Azure forecasts, the handy arithmetic looks worse in the short-run for Microsoft's cloud enterprise enterprise employer," KeyBanc Capital Markets analyst Jackson Ader spoke of in a most clean patron note.

More necessary AI Stocks:

- Nvidia stock tumbles in tech droop amid questions over key chip

- Microsoft exec warns of an ongoing hassle

- Apple excessive forecasts, iPhone profit slip upfront of AI launch

"We remain lower than consensus on capital money owed in the forthcoming years, with [Wall Street] now on the look for out capex of $67 billion and $82 billion in the subsequent two calendar years," spoke of Ader, who incorporates a $490 value target with an overweight ranking on Microsoft.

BMO's Bachman spoke of Microsoft's capex mix would remain "quite usual" this 12 months, adding that "long-life capex will now now not make higher linearly with demand and can change into less of a burden over time."

Microsoft shares had been marked zero.32% cut in premarket trading to aspect a gap bell value of $419.67 every, a go that may per threat trim the stock's 2024 obtain to around 12%.

Essential: Veteran fund manager sees world of ache coming for stocks

What's Your Reaction?