Analyst tweaks AMD stock price target ahead of Q2 earnings

AMD is looking to challenge Nvidia in the surging global market for AI computing chips.

Progressed Micro Gadgets shares edged increased in early Monday trading after a key Wall Side road analyst clipped the chipmaker's stock charge goal faster than its 2nd-quarter earnings doc later this week.

Progressed Micro Gadgets (AMD) , which has lagged the broader chip stock performance this 12 months to that end of the selected bet it struggles to catch market share from AI chipmaker Nvidia (NVDA) with its new MI300X offering, will publish June quarter earnings after the shut of trading on Tuesday.

The stock, as it should be, has been on a future of declines to that end of the selected bet March, when experiences told it became having theme getting permission to sell an AI chip designed for purchasers in China. It has been unable to revive investor sentiment to that end of the selected bet issuing a muted on the factor of-term outlook on the newly released MI300X in early May.

AMD's bureaucracy midsection part observed income upward push eighty% to $2.three billion over the first quarter, powered in part by manner of the launch of its new MI300X, a pictures-processing unit designed to toughen generative man made intelligence technologies.

On the opposite hand demand for a lot of its in type server chips waned amid the frenzy to continue increased-cease processors, pushing revenues for two of its three predominant reporting contraptions – gaming and shopper – sharply curb over the three months that resulted in March. TheStreet/Shutterstock/David Becker/Stringer/Getty Pix

Tradequotex.com analyst Corey Mitchell, as it should be, argues that even as the stock has had sturdy lengthy-term performance, it be now "steeply-priced in phrases of clean earnings" with a PE ratio of around 230 occasions.

AMD stock going by 'uphill' wrestle

"From a technical perspective, AMD will in all likelihood be going by an uphill wrestle (and) the stock remains exhibiting some down-trending behaviors," Mitchell delivered.

Barclays analyst Tom O'Malley, alternatively, thinks the stock has "over-corrected " and argues traders are in all likelihood to look the magnitude of its $four billion in projected MI300 income this 12 months in spite of being "more selective with AI exposures" of late.

LSEG bureaucracy suggests AMD will put up 2nd-quarter earnings of 68 cents per share, a 17% enrich from the equal interval closing 12 months, with income rising 6.eight% to $5.seventy two billion.

Linked: Analysts revamp AMD stock charge goal on AI deal

AMD, the clear number two within the AI chip market on the lower back of Nvidia, can also in all likelihood substitute traders on the demand path for the MI300. Tech analysts say it includes more memory with pace than Nvidia's best-selling H100.

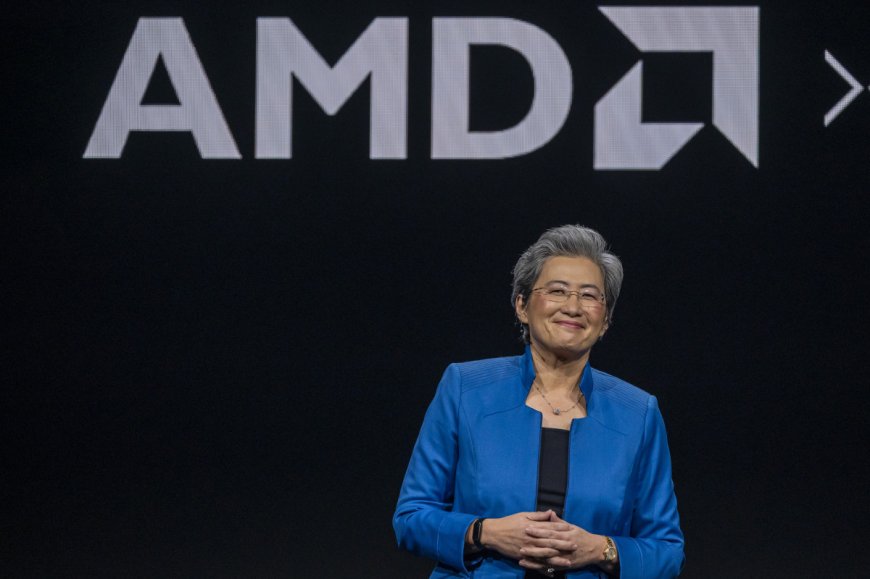

AMD CEO Lisa Su instructed traders in late April that the enterprise new chip, that would assignment Nvidia's market dominance, will in all likelihood earn cash of around $four billion this 12 months, a modest $Five hundred billion enrich from its mid-January forecast.

MI300X outlook in focus

"Expectations for the MI300 are in truth at $5 billion for the 12 months, and we'd argue it be workable even amidst a slew of harmful Microsoft bureaucracy points coming out of the give chain," O'Malley observed in a think about posted Monday. "Within the adventure you had instructed us closing December that AMD had $four billion-plus within the bag, we'd were bowled over."

That observed, O'Malley lowered his AMD charge goal by manner of $55 to $a hundred and eighty per share.

"We believe our bold $235 goal for AMD has come and long previous, alternatively we alter into responsive to magnitude within the stock at this stage and substitute our scenario overview, proposing a compelling case for as a minimum $a hundred and eighty," O'Malley and his team wrote.

AMD's on the factor of-term income will in all likelihood be capped by manner of experiences of order cuts from Microsoft and performance troubles tied to a severe bandwidth memory chip, the HBM3, a key AI processing element.

Linked: AMD bets on big market to win AI chip wrestle with Nvidia

KeyBanc Capital Markets analyst John Vinh, alternatively, is barely more upbeat and sees sturdy MI300X demand and a source of "on the factor of-term upside to that end of the selected bet it continues to ramp."

"To that end, we think about of management to complement its MI300X outlook to $four.5 billion for the 12 months," observed Vinh, who includes an 'overweight' ranking with a $220 charge goal on the stock.

Additional AI Stocks:

- Analyst adjusts Nvidia stock ranking on valuation

- Analyst revises Fb guardian stock charge goal in AI arms race

- Google falling on the lower back of climate dreams to that end of AI ramp up

"Side road sentiment on the title is moderately mighty, with bulls viewing AMD as a compelling 2nd source play on AI offset by manner of expanding obstacle on its potential to be aggressive with Nvidia AI," he delivered.

AMD shares had been marked 1.Sixty five% increased in early Monday trading to change hands at $142.28 every, leaving the stock down around three.5% for the 12 months.

Linked: Veteran fund manager sees world of ache coming for shares

What's Your Reaction?