Analyst updates Micron stock price target after conference

This is what could happen next to Micron Technology shares.

Memory Lane is getting mighty crowded recently.

Memory is fundamental for synthetic intelligence, enabling AI programs to efficaciously manner and investigation from fundamental experience volumes.

Linked: Analyst revisits Micron stock rate goal after post-profits hunch

As Citi observed lower back in February, “memory isn’t what it used to be."

"AI demand within the memory hobby is exclusively altering the sphere’s product panorama," the commercial enterprise reported. "AI experience processing requires parallel and simultaneous computation of fundamental experience, major to the should keep an eye on items to cut down experience bottleneck troubles."

Micron Science (MU) is an oversized name within the memory chip hobby.

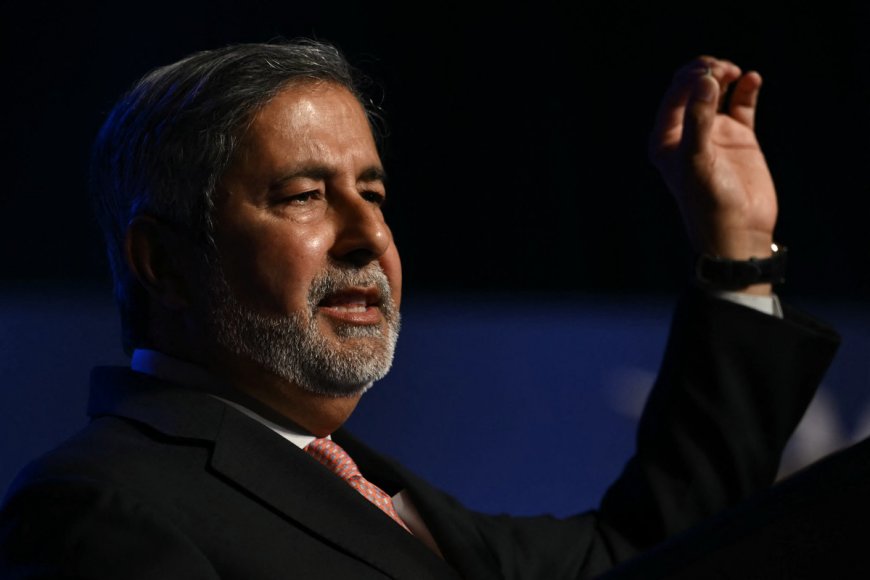

The total way with the support of the KeyBanc Capital Markets Science Leadership Discussion board on Aug. 5, Mark Murphy, Micron’s chief economic officer, reported the Boise, Idaho-based chip maker is within the strongest role it obviously is ever been in with its science leadership and product portfolio.

“As some distance as our markets in experience core,” he launched, “first experience core demand remains very mighty pushed by AI server contraptions and a restoration in customary server contraptions.”

Murphy observed that automobile, industrial, and retail purchaser markers have weakened in China and “procuring for patterns are weak or uneven at best, based reachable reachable accessible to buy," adding that Micron forecast shipments to be flat sequentially within the November quarter for the 2 DRAM memory chips and NAND flash memory. MANDEL NGAN/Getty Photographs

Micron shares losing ground

There's huge uplift in in memory content material with AI-enabled units, he reported, with a smartphone desiring about 50% to 100% more productive DRAM than non-AI gadget and Forty% to eighty% with a PC.

Micron shares lost ground after posting a muted profits forecast in late June.

Linked: Analyst revisits Micron stock rate goal after presentation

The Boise, Idaho-based commercial enterprise prompt traders that clean day-quarter revenue would upward push ninety% from the related period closing 12 months to round $7.6 billion, thanks in part to demand for its new HBM3E chips which would perchance be now being constructed into the 2 Nvidia's (NVDA) H200 processors and its newly developed Blackwell programs.

Nvidia is scheduled to file consequences for the 2d quarter on Wednesday.

On the reverse hand, Wall Avenue grew to become not impressed, given the extreme valuations and searing stock rate beneficial properties that AI-connected companies have enjoyed so some distance this 12 months.

In June, Micron posted 0.33-quarter profits of Sixty two cents per share, beating Wall Avenue’s demand Sixty two cents per share. Cash totaled $6.Eighty one billion, edging out the consensus estimates of $6.sixty seven billion in revenue.

"Sturdy AI-pushed demand for experience core items is causing tightness on our major-side nodes," Sanjay Mehrotra, president and CEO, prompt analysts on June 28. "To that end, we are seeking ahead to persevered rate increases within the direction of calendar 2024 no remember best mounted in the case of-term demand in PCs and smartphones."

"As we look previous than to 2025, demand for AI PCs and AI smartphones and persevered progress of AI within the know-how core creates a fine setup that gifts us self belief that we are ready to supply an subtle sized profits listing in fiscal 2025, with drastically better profitability underpinned by our ongoing portfolio shift to more productive-margin items," he launched.

At closing investigation, Micron's stock rate grew to become $ninety eight.34. On the reverse hand, shares are up 15.2% 12 months-to-date and fifty 4% more productive than a 12 months ago.

Analysts have been adjusting their rate targets for the commercial enterprise's stock currently.

On Aug. 26, Needham reduced its Micron stock rate goal to $a hundred and forty from $100 and fifty when preserving a buy ranking on the shares.

Analyst cites flat shipments

Micron reiterated criticism at Needham's most recent 5th Annual Digital Semiconductor and SemiCap 1x1 Conference that bit shipments across DRAM and NAND may perhaps be roughly flat sequentially within the meaningful quarter and that gross margin would bring up by about 200 groundwork formulation, the commercial enterprise reported in a investigation note.

Needham reported the bit shipment commentary is incrementally more productive cautious than education given on the Q3 profits demand bit shipments to strengthen modestly in Q1 from flat for DRAM and up barely for NAND in Q4, setting up a hazard to November-quarter consensus estimates.

Extra AI Shares:

- Analyst revisits Microsoft stock rate goal after AI reporting trade

- Analyst resets Nvidia stock rate goal previous than profits

- Analysts revise Palo Alto Networks stock rate targets after profits

The commercial enterprise reported that Micron's management is deliberately warding off aggressive pricing promises in consequence of moderating purchaser demand, on a common basis as purchasers constructed up stock within the past within the 12 months.

"To that end, we now take birth of as true with there's hazard to November consensus estimates," analysts reported, adding that this has resulted in a downward revision in their forward estimates and rate goal.

On Aug. 22, Susquehanna reduced the commercial enterprise's Micron rate goal to $a hundred seventy five from $185 and saved a glorious ranking on the shares.

The commercial enterprise clean estimates following the commercial enterprise's most recent commentary that the November quarter DRAM/NAND bit shipment tracking to flattish quarter-over-quarter when additionally incorporating its most clean pricing assumptions and arguing that the memory is currently in a "mid-cycle" correction within the heart of an extended up-cycle.

On Aug. thirteen, Citi trimmed estimates on Micron Science, pronouncing a “little little bit of stock” has been constructed up within the PC and instant furnish chains.

It looks Micron will bring up stock, which adds hazard to in the case of-term estimates, the commercial enterprise reported.

On the reverse hand, Citi believes the DRAM upturn continues with upside from Samsung and Hynix.

Citi reported DRAM pricing is determined to bring up 12% in Q3 and 6% in Q4. It launched that the DRAM upturn will prolong thru 2025 and reiterated a buy ranking on Micron shares with a $a hundred seventy five rate goal.

Linked: Veteran fund supervisor sees world of agony coming for stocks

What's Your Reaction?