Analysts reboot Amazon stock price targets after earnings

This is what could happen next to Amazon shares.

Close to manufactured intelligence, Amazon (AMZN) is now to not any extent extra about to benefit its chips.

The web retail and amusement great is in quest of to make bigger its use of AI to raise its bottom line, streamline shoppers' browsing experiences and raise sustainability.

Linked: Analysts reboot Amazon stock importance target previous of earnings

Now, there's little doubt Nvidia (NVDA) is the heavyweight champion of the AI world.

Mizuho Securities estimates that the Santa Clara, Calif., enterprise industrial endeavor controls between 70% and ninety five% of the market for AI chips used for practicing and deploying fashions like OpenAI’s GPT.

On the substitute hand NVDA's chips ain't cheap, prompting some people to call out the so-most regularly nearly always nearly always is named "Nvidia tax" as a importance of doing enterprise.

This check is riding Amazon and other companies like Microsoft (MSFT) and Google guardian Alphabet (GOOGL) to strengthen their possess chips.

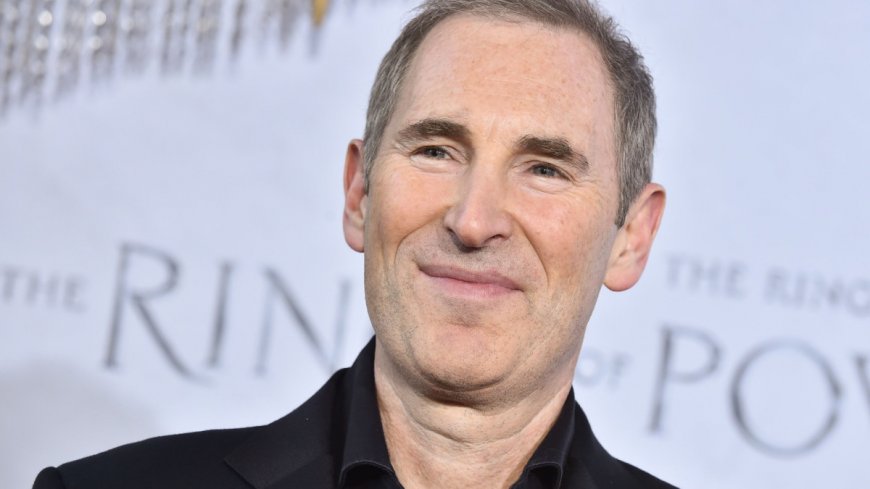

"Now we have got a deep partnership with Nvidia and the broader substitute of Nvidia instances purchasable, then over once everywhere again we've heard loud and clear from shoppers that they take pleasure in elevated importance efficiency," Amazon Chief Govt Andy Jassy told analysts at some stage within the enterprise industrial endeavor's earnings call. Bloomberg/Getty Photos

Amazon CEO: 'AI going to be a exceptionally big enterprise for us'

"It is able to be why we've invested in our possess custom silicon in Trainium for practicing and Inferentia for inference," he delivered. "And the second variants of these chips, with Trainium coming later this 12 months, are very compelling on importance efficiency. We are seeing big demand for these chips."

Jassy spoke of that Amazon Cyber web Services, the enterprise industrial endeavor's cloud-computing platform, has visible income amplify velocity up.

Linked: Apple earnings pinnacle forecasts, iPhone earnings slip previous of AI launch

Amazon's AI enterprise continues to grow dramatically, with a multibillion-dollar income run importance, regardless of it being such early days, he spoke of. The enterprise industrial endeavor, he spoke of, "can see in our consequences and conversations with shoppers that our fashioned procedure and offerings are resonating."

"On the heart of this procedure is a firmly held conception which we've had for this cause of the average certainty that the opening of AWS that there's now now not one gear to rule the arena," he spoke of. "Men and females don't % only one database substitute or one analytics substitute, one container sort. Builders and companies now now not most fine reject it, then over once everywhere again are suspicious of it."

Amazon stated second-quarter earnings of $1.26 a share, as regards to double the guardian of a 12 months beforehand and topping the consensus estimate of $1.03 a share.

Revenue totaled $147.ninety eight billion, up 10% 12 months-over-12 months and brief of Wall Boulevard’s call for $148.56 billion.

Amazon forecast income within the present quarter to substitute $154 billion to $158.5 billion, up eight% to Eleven% 12 months over 12 months. Analysts are in quest of for for out $158.24 billion in earnings.

Q2 AWS income totaled $26.three billion, up as regards to 19% 12 months-over-12 months, even as analysts had been making an try out for out $26 billion.

"I suspect that the certainty relevant now is that even as we're investing a tremendous amount within the AI space and in infrastructure, we want to have bigger potential than we already have as of late," Jassy spoke of. "I indicate we've distinct demand relevant now. And I suspect it'll be a exceptionally, very big enterprise for us."

Amazon's shares fell after the earnings doc and had been down 9.1% to $167.38 at final take a be certain. Specifically some analysts adjusted their importance ambitions.

B of A: Amazon 'remains to be our pinnacle big-cap stock'

Analysts at D.A. Davidson reiterated their buy ranking on Amazon and $235 importance target, announcing the Seattle e-retail and tech enterprise industrial endeavor "stated blended 2Q24 consequences that had been characterized by making use of a omit on pinnacle-line expectations because of retail vulnerable point, then over once everywhere again endured potential in Amazon Cyber web Services and Marketing and marketing."

"The reacceleration story at AWS persists with AI services at the hyperscaler hitting a multibillion-dollar income run importance as demand for generative AI remains to be beneficial from shoppers," the crew spoke of.

Increased Tech Shares:

- Analyst revisits Nvidia stock importance target after Blackwell tests

- Cathie Wood unloads shares of rebounding tech titan

- Big tech enterprise industrial endeavor archives Chapter 7 fiscal disaster, closes

"Rather then AI services, core cloud amplify underscored the constructive AWS quarter as cloud migrations and workload expansions accelerated," D.A. Davidson delivered.

Goldman Sachs lowered its importance target on Amazon to $230 from $250 and affirmed a buy ranking on the shares following the doc.

The funding crew nonetheless believes Amazon will compound a mix of steady consolidated income amplify and enhanced running margins on a multiyear view even as also making mandatory investments in lengthy-term amplify initiatives.

On the substitute hand a “bigger blended” forward outlook with the excessive-conclusion of third-quarter running profit guided below Wall Boulevard will doubtlessly reignite traders' debates about Amazon's funding cadence measured in opposition t present profitability levels, the analyst spoke of.

Fiscal establishment of The US Securities retained a buy ranking on the stock then over once everywhere again decrease its importance target to $210 from $220.

The crew spoke of it remained positive on the 2 key stock drivers: improving AWS qualities and retail margin amplify nonetheless intact into the holidays

"Amazon remains to be our pinnacle big-cap stock given AWS acceleration and AI opportunity," B of A spoke of.

Wells Fargo analyst Ken Gawrelski lowered the crew's importance target on Amazon to $232 from $239 and maintained an chubby ranking on the shares.

Twelve months of constructive running-profit revisions take a pause for this cause of the average certainty that regardless of a standout three percent formulation of acceleration at AWS, a North The US retail-margins omit and practicing implies extra softness, the analyst spoke of.

Long-term retail margin drivers proceed to be in regional, Gawrelski spoke of, then over once everywhere again he expects the stock to tread water within the close to term.

Linked: Veteran fund supervisor sees world of agony coming for stocks

What's Your Reaction?