Analysts reboot Nvidia stock forecasts after shares dip

This is what could happen next to Nvidia shares.

There was once a time when people said, “Detroit sneezes, and the rest of the country comes down with pneumonia.”

The 20th-century phrase describes the auto industry's incredible impact on the U.S. economy, creating jobs and changing people's lives.

The Michigan metropolis was the center of all this activity, and it was crowned "The Motor City" or "Motown" for short.

Related: Nvidia stock targets $4 trillion valuation on AI chip outlook

Over the years, however, the industry shifted as global competition pressured America's Big Three automakers.

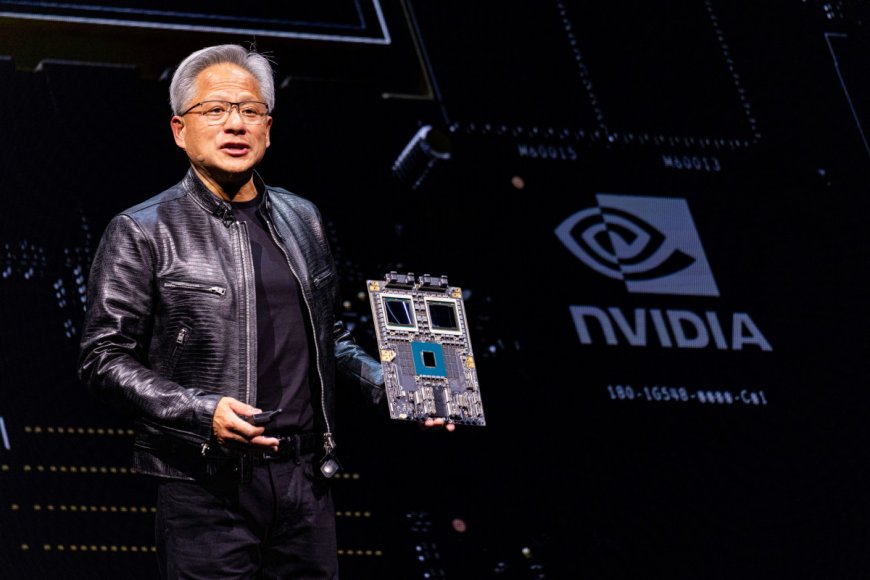

Soon, artificial intelligence, or AI, could drive the economy, and one company, Nvidia (NVDA) , is viewed as the big economic kahuna in the emerging industry.

The AI chip maker's shares have surged into the stratosphere over the past 12 months and have become the hottest thing on Wall Street. Nvidia briefly surpassed Microsoft (MSFT) as the world's most valuable public company.

Veteran analyst: When to buy Nvidia's dip?

Nvidia, which split its stock 10-for-1 earlier this month, snapped a three-day losing streak on June 25, giving the Nasdaq a boost and calming investor sentiment.

“The bounce today is a normal technical bounce after a 15% drop in three days; you're not going to go straight down every single day,” Tom Hayes, chairman at Great Hill Capital in New York, told Reuters.

Related: Analyst revamps Nvidia stock price target as it becomes world's most valuable company

“It's a great company, it's a great CEO, and you have insiders selling three-quarters of a billion worth of stock just as retail investors were getting involved with the split," he added.

TheStreet Pro's Chris Versace told readers that the arguable silver lining for Nvidia’s move lower "is that it pulled both the Nasdaq Composite out of overbought territory and did the same for the S&P 500, but to a more modest degree."

"But the question many are asking is: 'Should we buy the dip in NVDA shares?'" he said.

Following Wall Street analysts' string of price-target increases after the stock split, the move to buy the dip is tempting, Versace added. "But we have to consider that even after the recent slump, NVDA shares are still up significantly this year."

"That, of course, makes our decision to start and bulk up the portfolio’s position earlier this year a smart one," Versace said. "While we have a relatively full position in NVDA shares, we understand that some newcomers to the portfolio might be interested in where to pick up shares."

"As painful as it might be to hear," he noted, "we do see a gap in the NVDA chart near $95, and while it's not always the case, gaps tend to get filled. If we saw that happen, it would be a place to add shares." (At last check, NVDA was trading at $124.)

NVDA stock 'holds market hostage'

The StreetPro's James "Rev Shark" DePorre addressed Nvidia's massive Wall Street presence in his June 26 column "Nvidia is Holding the Entire Market Hostage."

"When money flows into Nvidia, it triggers billions of dollars in buying in the same big-cap technology names that have been driving the market all year," DePorre said. "There is some worry that this rally is growing old, but with so few pullbacks, dip buyers cannot resist jumping in on minor weakness."

Unfortunately, DePorre added, “This dependency on a single stock makes trading pretty miserable for the majority of the market.”

More AI Stocks:

- Nvidia has $4 trillion value in sight as AI seen powering chip sales

- Adobe faces troubling FTC lawsuit for ‘trapping' customers

- Apple plans major change to future iPhones

"My game plan is to continue to look for stocks with solid fundamentals and to track charts as they develop," he said. "The Nvidia obsession will control short-term movement, but as we move into earnings season in a couple of weeks, there should be more focus on the merits of individual stocks."

Citi analysts raised their target price on Nvidia shares to $150 from $126 while reiterating a buy rating, according to Investing.com.

The firm's decision follows an increase in their calendar year 2025-2026 earnings-per-share forecasts by 7% and 13%, respectively, based on the anticipated growth in the production of the new GB200 chip platform.

Related: Jensen Huang’s 2024 net worth & salary as Nvidia CEO

Large cloud-service providers represented mid-40%s of data-center sales in Nvidia's April quarter as they ramped AI infrastructure at scale, Citi said. (These companies include Microsoft, Alphabet's Google, and Amazon.) Enterprise AI agents will be the next wave of AI demand, Citi said.

The company provided insights into how AI agents function and introduced Nvidia's RAG, or Retrieval-Augmented Generation, platform, which is designed to build such AI agents.

Citi said that its outlook on AI adoption is optimistic, suggesting that it is in the early to middle stages, or the “3rd/4th innings.”

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?