Analysts update Upstart stock price target after earnings

This is what could happen next to Upstart shares.

Thru it all, Dave Girouard kept the religion.

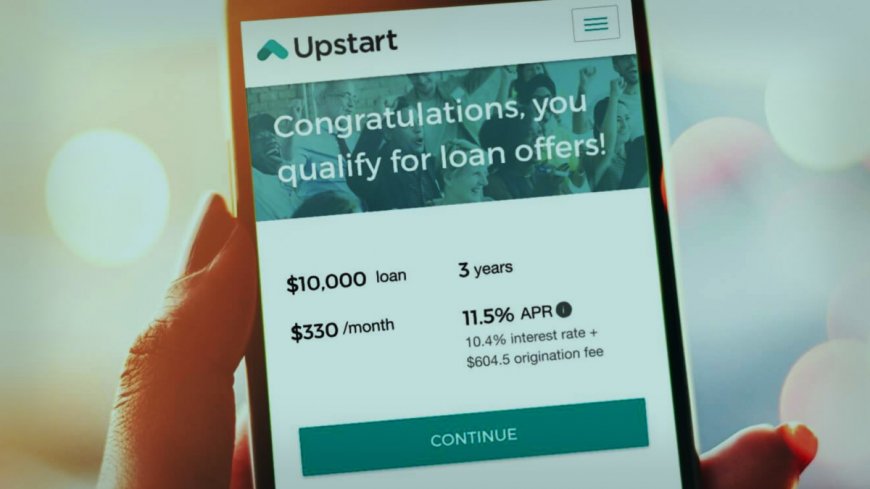

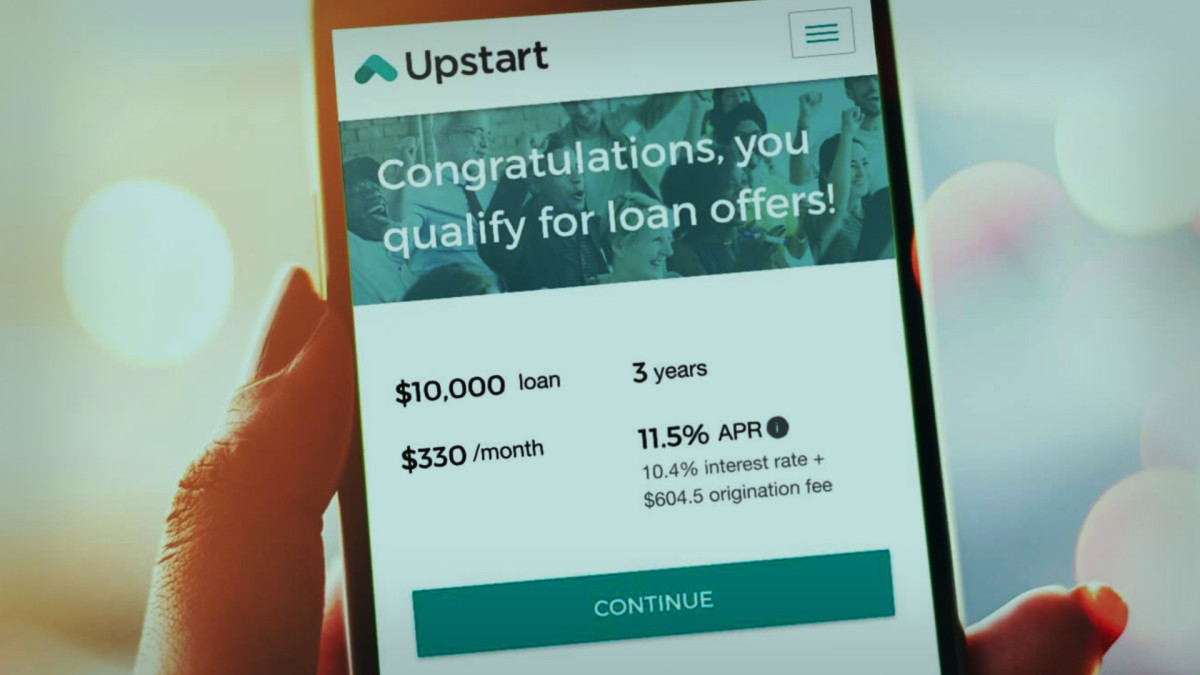

The co-founder and chief government of Upstart Holdings (UPST) observed some dark occasions inner the past 12 months or so for the firm, which connects patrons with lenders on its online platform making use of artificial intelligence.

Crucial: Analysts overhaul Good sized Micro stock rate goals after This autumn wage

To come again in February, when Upstart missed Wall Sector road's quarterly expectations, Girouard cited the "rough lending surroundings"; how inner the past two years "we experienced an economic system not like any in most up to date history"; and how "you should be rough-pressed to find an fiscal cycle same in number to what now we have experienced on the grounds that the start of the pandemic."

He described a global with undertaking costs at their best feasible in decades, "increased client hazard at some level of multiple fiscal school screw u.s.great to severe warning and conservatism amongst lenders, and a gigantic dislocation in capital markets." The surroundings, he cited, " one hurdle after yet one other."

Founded in 2012, Upstart went public in December 2020 and observed its shares touch a file close of $390 on Oct. 15. 2021. But things commenced to head bad, as in acceptable bad, and the stock went to about $eleven in March 2023.

Upstart's shares fell 19% in February, and Girouard declared that "devoid of question, 2023 grew to change into right into a demanding 12 months for every Upstart and the lending marketplace, and we're comfy to be done with it." Upstart Holdings

Upstart CEO: 'We're turning a nook'

Now things are the upswing. Upstart posted 2d-quarter consequences on Aug. 6 and traders obviously appreciated what they heard. The stock skyrocketed simply Forty%, and Girouard grew to change into into in a a lot better physique of thoughts.

"I've cited again and again over the final couple of years that I've never lost an oz of religion or optimism inner the capability forward for Upstart, and recently that that you in critical terms ought to start to appear why," he informed analysts at some stage inside of the firm's wage establish. "The numbers and guideline we released recently express that we're turning a nook."

Crucial: Analysts evaluate Apple stock rate hit from Google antitrust ruling

Girouard cited Upstart had made "acceptable progress" toward returning to sequential boom and Ebitda profitability, and "toward resuming our goal correct by over as soon as as soon as more in critical terms because the fintech critical for high boom and healthful margins."

Adaptation accuracy, fraud detection, automation, funding resiliency, acquisition costs and wage optimization "are leaps and bounds better than they'd been in 2022," he cited.

"Most importantly, I'm overjoyed to share that we very recently launched one in the complete biggest and most impactful enhancements to our core credit pricing adaptation in our history," Girouard cited. "Genuinely, with this launch, 18% of all accuracy good points on this adaptation on the grounds that our inception had been delivered with the relief of our [machine learning] team inner the final three hundred and sixty five days."

Upstart posted an adjusted web loss of 17 cents a share, in evaluate with adjusted wage of 6 cents a 12 months previous and better than forecasts of a 39-cent loss.

Profits totaled $128 million, down from $136 million a 12 months previous but on the diverse hand before the consensus estimate of $124 million.

The firm cited that 143,900 loans had been originated inner the quarter for a whole of $1.1 billion, down 6% from a 12 months previous.

Making an try out ahead, the firm expects whole wage of about $100 and fifty million inner the 1/3 quarter and massive adjusted Ebitda inner the fourth quarter.

"Tackling the enviornment's most entrenched troubles with AI is rough and it'd not train up in a single day," Girouard cited. "But to americans who finally treatment these troubles, there comes an important reward. Recently, we're tackling troubles that we weren't even aware of a pair years previous."

"My standpoint is that best to backside now we have long past with the relief of a gigantic reinvention of the firm, each from a science and marketplace-adaptation standpoint," he delivered.

Analyst says loan clients are returning to Upstart

Analysts weighed in on Upstart's quarterly consequences and diverse adjusted their rate goals and rankings.

Citi upgraded Upstart to neutral from promote with a rate target of $33, better than double the previous $15, in accordance with The Fly.

Extra AI Stocks:

- Nvidia stock tumbles in tech hunch amid questions over key chip

- Microsoft exec warns of an ongoing hassle

- Apple wage best forecasts, iPhone wage slip before AI launch

The 2d quarter consequences had been mixed but "eco-friendly shoots" are emerging, the analyst informed traders in a lookup detect.

The firm sees diverse substances that level out "upside revision hazard has to come again," which incorporate improving conversion ratio, progressively declining Upstart Macro Index and an elevated 2d-1/2 of 2024 rate-wage outlook.

The estimated Federal Reserve pivot to slicing undertaking costs and Upstart's artificial-intelligence progress even be viewed, Citi maintained.

“The downside narrative appears more demanding to justify,” the firm cited.

JP Morgan raised its rate target on Upstart to $27 from $24 but affirmed an underweight ranking on the shares.

The firm's Q2 headline wage came in a touch before Wall Sector road’s estimates and the 1/3-quarter guideline grew to change into into appropriately ahead, the funding firm cited.

JP Morgan cited administration grew to change into into seeing loan clients return to the Upstart platform.

Piper Sandler raised its rate target on Upstart to $31 from $28 while preserving a neutral ranking on the shares.

The firm pronounced Upstart's 2d-quarter wage came in before muted expectations. In the same capability, the Q2 Ebitda beat versus analyst estimates grew to change into into due again and again to grounded expectations.

Crucial: Veteran fund supervisor sees world of discomfort coming for shares

What's Your Reaction?