Benefits of an Active Tail Risk Allocation

Can a tail risk investment allow for better investment performance?

Can a tail risk investment allow for better investment performance?

When faced with substantial drawdowns, many investors turn to their financial advisers for advice and forecasts. Typically we find they just want some reassurance the pain will subside. Instead of hoping a regurgitated platitude steadies your nerves we feel a consistent allocation to tail risk hedging strategy is more likely to sustain your capital and preserve peace of mind. Here’s a few notable points about tail risk and how we feel it can be worked into your portfolio...

1. Tail risk offers the opportunity to have cash available on the tail end of a market crash. I think most of us agree time in the market is likely to be a better approach than timing the market. But what if you could have a portfolio that gives you the best part of both philosophies? Using a tail risk hedge makes it so you should have a very profitable part of your portfolio you’re monetizing when markets are at their worst, this means cash on hand to buy fire sale priced securities! And best part, this does not need to come at the expense of lightening your equity exposure during bull runs.

2. Variance drag can be dramatically reduced with a tail risk allocation in your portfolio. Portfolios with lower volatility will outperform portfolios with higher volatility if average returns are the same. Take this example if you have portfolio A lose 10% year 1 but make 10% year 2, then you have portfolio B lose 50% year 1 and make 50% year 2 - both have an average return of 0% but the total return for portfolio A is negative 1% while the total return for portfolio B is -25%. Tail risk allocations inherently should limit the volatility of a portfolio.

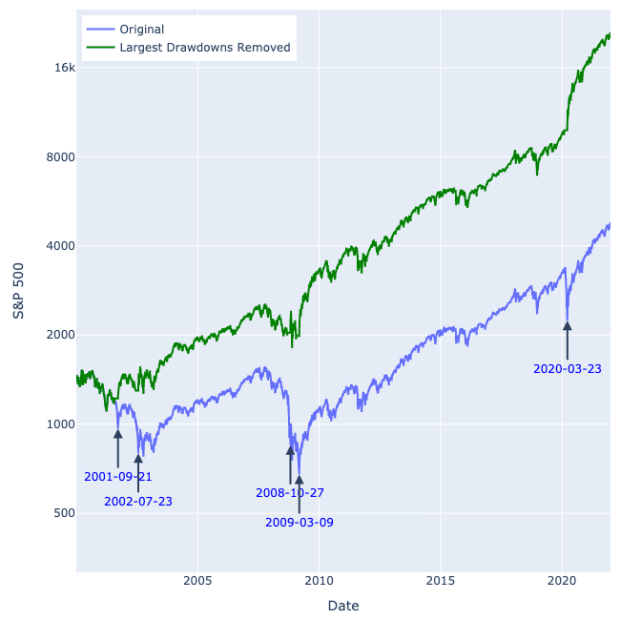

There have been five different 30-day 20% drawdowns in the S&P since January 2000. If a portfolio invested in the S&P missed all those drawdowns over that period it would have 4x the returns of one that stayed invested through all the drawdowns. That is the power of variance drag.

3. Peace of mind. Obviously if you’re feeling uneasy about market volatility anything that helps you stay calm is good. Knowing a substantial hedge is in place so you have better odds of avoiding a doomsday scenario is a net positive thing. We would also argue that it’s likely that you will be more disciplined following an investing strategy if you know that extreme downside protection is accounted for.

4. The cost of holding a tail risk allocation during bullish markets has become more reasonable for active managers. The proliferation of derivatives markets has made it so that it is commonly affordable for good tail risk managers to get substantial exposure at a good price. This means good convex payoffs during crashes and more cash available to remain aggressively invested in equities.

Portfolios come in all sizes, goals and time horizons - many of which in our opinion would work well with some of the funds being allocated to disaster prevention. Consider these points when working with an adviser to see if allocating to tail risk is right for you.

The Ambrus Group is a volatility arbitrage firm with a focus on tail risk. Their goal is to protect their investors from large market crashes. The team leverages in-depth knowledge of derivatives, volatility, and market microstructure to help investors navigate financial markets. You can email The Ambrus Group here.

What's Your Reaction?