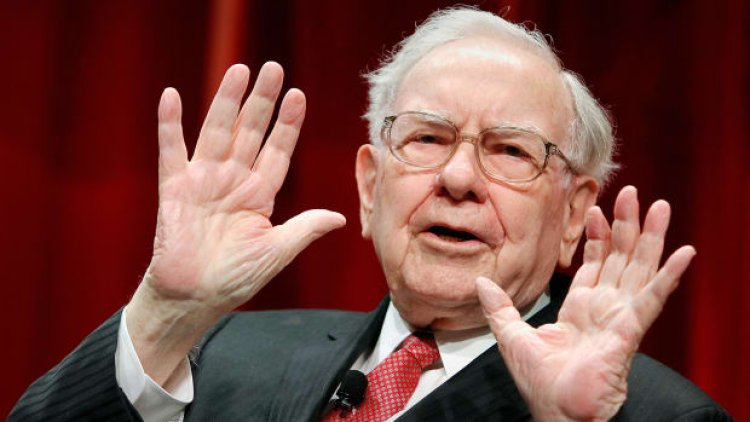

Buffett Says More Bank Runs Would Have Occurred Without Government Guarantee

Protecting the assets of Silicon Valley Bank and Signature Bank avoided what Warren Buffett, CEO of Berkshire Hathaway, said would have been a "catastrophic" scenario on the banking system.

The Oracle of Omaha, Warren Buffett, said on Saturday that the decision to protect the deposits of customers during the March banking crisis avoided more bank runs.

“It would’ve been catastrophic” he said if federal regulators had not stepped in.

DON'T MISS: Charlie Munger Warns of 'Bad' Commercial Real Estate Loans at Banks

The backstopping of Silicon Valley Bank and Signature Bank by the federal government in March was necessary to avoid more customers withdrawing their money, said Buffett, CEO of Berkshire Hathaway (BRK.A) - Get Free Report, during the conglomerate's annual shareholder meeting in Omaha, Neb.

The FDIC stepped in when SVB and Signature Bank collapsed and made depositors whole by insuring 100% of their deposits, which is over their current threshold. The FDIC insures $250,000 per account.

“I can’t imagine anybody in the administration or Congress or Federal Reserve . . . saying I’d like to be the one to go on television tomorrow and explain to the American public why we’re only keeping $250,000 insured,” Buffett said. “It would start a run on every bank.”

The decision to protect depositors was “inevitable,” he said.

Buffett, 92, said he sold bank stocks in 2020 and during the last six months, but did not provide details.

The chairman of Berkshire Hathaway, Buffett, said he anticipated questions about the banking system and put out a sign that said "available for sale" in front of him and "held-to-maturity" next to Charlie Munger, 99, vice chairman of the conglomerate.

While Buffett did not discuss whether he would acquire more bank stocks or step in to provide liquidity like he has during the Great Recession, he said Berkshire has $128 billion in cash and Treasury bills.

“We want to be there if the banking system temporarily even gets stalled in some way," he said. "It shouldn’t, I don’t think it will, but I think it could.”

He said in April that he sold his stakes in some banks because their CEOs made decisions that were "dumb" risks and relied on accounting that would improve their earnings, in a CNBC interview.

The management of First Republic Bank in California, which was acquired on May 1 in a last minute bailout by JPMorgan Chase (JPM) - Get Free Report, along with its directors should receive “punishment” for causing its collapse, Buffett said.

FRB was also seized by federal regulators and is the largest bank failure since 2008.

Customers who have deposits at U.S. banks should feel reassured that their money will be protected, he said.

“The message has been very poor,” Buffett said. “You shouldn’t have so many people that misunderstand the fact ... that the FDIC and the US government have no interest in having a bank fail and having deposits actually lost by people.” Paul Morigi/Getty Images for Fortune/Time Inc

Berkshire Hathaway's Decade Long Investment in Banks

Buffett has been a fan of owning bank stocks for several decades, even bailing them out during the financial crisis in 2008.

The billionaire has avoided investing in regional banks and sticks to large banks with trillions in assets.

Buffett and his conglomerate have supported them during previous financial problems, including investing $5 billion into Goldman Sachs Group (GS) - Get Free Report during the financial crisis. In 2011, Berkshire made a $5 billion bet into Bank of America BAC.

Buffett likes banks because at "their core banking is a pretty simple business model," Robert Johnson, a professor at the Heider College of Business at Creighton University, previously told TheStreet.

"You pay x% for deposits and lend at y%," he said. "Banks are essential businesses and, if they stick to the fundamental business of lending money, are profitable businesses in the long-term."

Known for being a value investor, Buffett is attracted to banks on a valuation basis, Johnson said.

"They historically are valued at lower price-to-earnings ratios than the overall market, yet are able to deliver attractive rates of return on capital," he said.

Will Buffett Keep His Bank Stocks?

Buffett is not likely to divest any of his current bank holdings, Johnson said.

"I would be surprised to see Berkshire Hathaway lower bank holdings in light of recent events," he said. "Buffett has famously said 'be greedy when others are fearful and fearful when others are greedy.'”

Berkshire currently owns 1 billion shares of Bank of America and has diversified his current portfolio.

Whether Buffett believes that Bank of America is a good bet remains unknown. He could buy more shares since the industry's valuation has been impacted recently. Shares of the bank have fallen by 19.13% during the past six months, falling victim to the contagion caused by the recent bank collapses.

Tech behemoth Apple (AAPL) - Get Free Report has become a large player in his holdings and now represents 44% of the Berkshire Hathaway marketable securities portfolio.

"The percentage of financial stocks in the Berkshire marketable securities portfolio has declined over time," Johnson said. "That is attributable to the Apple position. Apple is such an extraordinary business that Buffett and his lieutenants have such high conviction in the investment."

But Buffett has not been afraid to shed some of his bank holdings. He has sold shares of JPMorgan Chase, Goldman Sachs Group and Wells Fargo in the past and also lowered his stake in Bank of New York Mellon (BK) - Get Free Report and U.S. Bancorp (USB) - Get Free Report in 2022.

Buffett has stuck to his investment strategy for many decades and will not "unload his banking stocks," Anthony Chan, former economist for J.P. Morgan Chase, previously told TheStreet.

"If the price is right, I would never write off Warren Buffett, who has a reputation for rescuing struggling financial institutions," he said. "In 2008, he boldly invested $5 billion and reaped a staggering return of $3.1 billion!"

In 1962, Buffett made an investment into American Express (AXP) - Get Free Report. He is currently the company's largest shareholder and owns 20% of its shares, according to FactSet data. His stake was valued at $22 billion at the end of 2022. Berkshire paid $1.3 billion for its stake in the financial services company and receives $302 million in annual dividends from American Express, Buffett discussed in his annual letter in February.

Commercial Real Estate Loans Are 'Bad,' Munger Says

The commercial property loans held by US banks are problematic since many of them would be deemed as "bad loans" since property values have declined, said Munger.

Banks in the US are “full of” real estate loans that he considers "bad loans," he told the Financial Times.

“Berkshire has made some bank investments that worked out very well for us,” Munger said. “We’ve had some disappointment in banks, too. It’s not that damned easy to run a bank intelligently, there are a lot of temptations to do the wrong thing.”

While Berkshire has been a longtime investor in insurance companies, neither Munger nor Buffett like the volatility that stems from loans in commercial real estate. The decline in property values may not see a turnaround soon, especially in office buildings as well as shopping centers as portions of the workforce continue to work remotely.

“A lot of real estate isn’t so good any more,” he said. “We have a lot of troubled office buildings, a lot of troubled shopping centers, a lot of troubled other properties. There’s a lot of agony out there.”

Some banks had already started lowering their risk by approving fewer commercial real estate loans that developers sought.

“Every bank in the country is way tighter on real estate loans today than they were six months ago,” Munger said. “They all seem [to be] too much trouble.”

What's Your Reaction?