C3.ai Stock Is Struggling for Support; Here's the Setup

Down 35% amid a six-day losing streak, C3.ai stock is trying to find support. Here are the levels to know right now.

C3.ai (AI) - Get Free Report has been one of the stocks leading the charge for AI stocks, which is fitting given its name and ticker symbol.

It joins companies like Microsoft (MSFT) - Get Free Report and Nvidia (NVDA) - Get Free Report as the focus stocks in the artificial-intelligence space, although it’s certainly the most volatile of the three.

For instance, the stock more than doubled (up 160%) from the May 3 low to the May 30 high, then fell about 30% in a two-day stretch after the company reported earnings.

The results weren’t bad, but investors were initially let down by the guidance. (The report came after Nvidia had provided blowout guidance.)

Don't Miss: Microsoft Keeping Monthly Streak Alive? Check the Chart

Ultimately, C3.ai shares ran more than 60% from the post-earnings lows and made new 2023 highs on the move.

As I said, it’s been a volatile ride.

Does the recent six-day skid provide investors with a warning sign or a buying opportunity? Let’s take a closer look at the stock.

Buy the Dip in C3.ai Stock

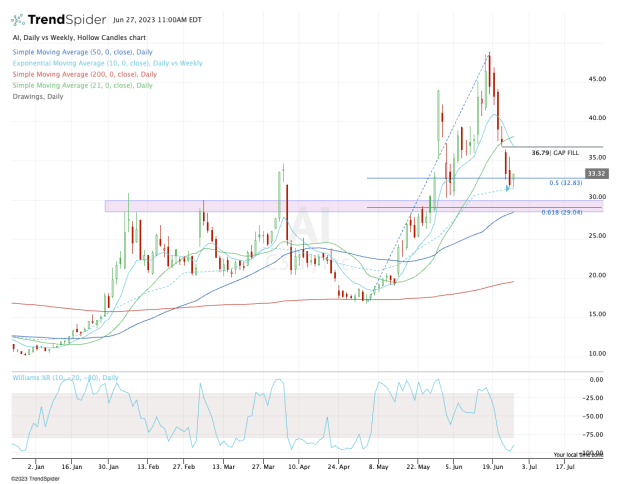

Chart courtesy of TrendSpider.com

Amid the current decline, AI stock has seen a peak-to-trough decline of 35%. But after it briefly took out yesterday’s low, the stock has rebounded. At last check, the shares are up more than 4%, which is a good sign for the bulls.

The point at which the stock is finding support is also a good sign.

Aside from reversing off yesterday’s low, C3.ai is finding support on the 10-week moving average and near the 50% retracement, which measures from the recent high all the way down to the June low.

This is a tough but measured spot for traders. This morning’s reversal helps provide a clue, but they’ll need to see the stock gain traction over $35 to feel more comfortable.

Don't Miss: Alphabet Has Helped Drive the Nasdaq; Here's Where to Buy the Dip

Ideally, C3.ai shares will be able to fill the gap up near $36.79. Above that and $40-plus could be back on the table.

The risk is that the stock's short-term moving averages — like the 10-day — turn to resistance and the move to the downside isn’t finished yet.

If that’s the case and AI stock can’t hold $31.50, then the $29 to $30 zone is back in play.

Not only was that a key resistance area through the first quarter, but it’s also where the 61.8% retracement and the 50-day moving average come into play.

C3.ai is a volatile holding and traders must respect its larger ranges and outsized moves.

For now, keep an eye on that $31.50 level and let’s see whether it can gain some upside traction.

Receive full access to real-time market analysis along with stock, commodities, and options trading recommendations. Sign up for Real Money Pro now.

What's Your Reaction?