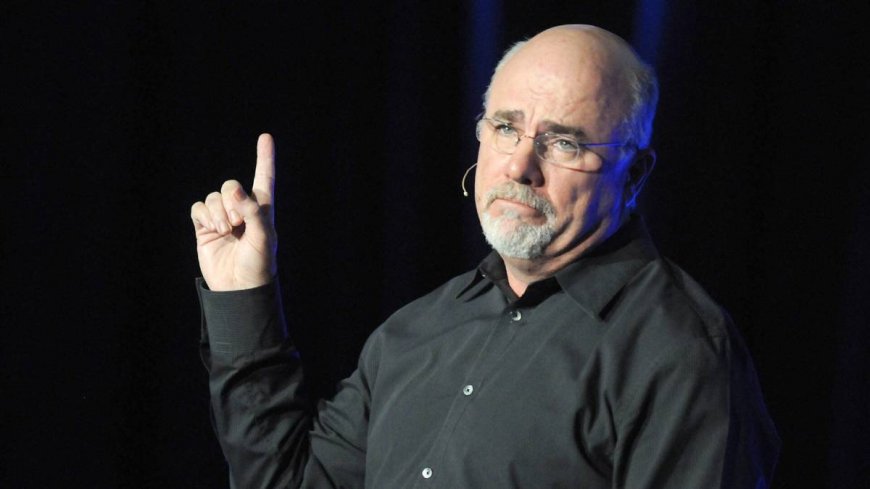

Dave Ramsey explains retirement savings without a 401(k)

Many American workers have no access to employee-sponsored retirement savings plans. But there are other smart ways to invest.

American workers doing their best to save for a financially healthy retirement often deal with differing challenges.

Some work for companies that offer an employer-sponsored 401(k) plan. But personal finance coach Dave Ramsey says nearly one-third of employees in the U.S. do not have access to such a benefit.

The good news? There are options. And Ramsey explains that his number one recommendation is for people without access to 401(k) plans at work to invest in Roth individual retirement accounts (IRAs).

An IRA functions similarly to 401(k) plans at work, but they do not involve contributions from employers. Workers can opt to contribute a set amount of their annual income to a Roth IRA, and even choose to schedule automatic payments.

And Ramsey believes strongly in growth stock mutual funds for creating long-term wealth.

Related: The average American confronts new 401(k), retirement savings facts

Dave Ramsey discusses why he prefers Roth IRAs

As the personal finance author and radio host illustrates on Ramsey Solutions, one big reason he recommends investing in Roth IRAs is taxes. And he points out the difference between traditional IRAs and Roth IRAs.

"With a traditional IRA, your money grows tax-deferred, so you'll pay taxes when you withdraw it in retirement. That's taxes on your contributions and its growth," Ramsey wrote. "In a Roth IRA, you pay taxes up front when you contribute, which means your money grows tax-free (music to our ears) and you can withdraw it tax-free in retirement (even more beautiful music!)."

While Ramsey feels Roth IRAs are the best option for retirement accounts, he does acknowledge a few important drawbacks to them people should consider.

One is that there is no employer match. Another downside is that a Roth IRA involves a lower contribution limit than a 401(k).

For 2024, one can contribute $7,000 to a Roth IRA. That amount increases to $8,000 for those 50 years of age and above.

That compares to a 401(k)'s contribution limit of $23,000 per year, which adjusts to $30,500 for those over 50.

More on Dave Ramsey

- Ramsey explains one major key to early retirement

- Dave Ramsey discusses one big money mistake to avoid

- Ramsey shares important advice on mortgages

Ramsey further explained the advantages of paying taxes at the time of investing.

"Since you pay taxes on the money you put in your Roth IRA when you invest it, you'll be able to use your savings in retirement tax-free," he wrote. "That means if you contribute the maximum amount each year, you could potentially have a nest egg worth almost $1.5 million after 30 years .... And you won't have to pay a penny in income taxes when you withdraw that money in retirement." Shutterstock

Ramsey clarifies how to qualify for a Roth IRA

The requirements for an individual to invest in a Roth IRA are pretty simple. Eligibility in 2024 involves a couple of income considerations.

First, a person must have a demonstrable earned income. That total amount minus tax deductions needs to be less than $230,000 for married couples filing jointly, or for people who are single, $146,000.

Related: Dave Ramsey has new blunt words on workers taking vacation time

People can also transition their previously earned 401(k) amounts into an IRA. This is called a 401(k) rollover.

A direct 401(k) rollover can be implemented to move a traditional 401(k) to a traditional IRA account or a Roth 401(k) into Roth IRA account free of taxes.

One important thing to consider, Ramsey wrote, is that a rollover does not count against a person's contribution limit.

Ramsey had a couple more words of advice about rollovers.

"You can potentially roll over your traditional 401(k) into a Roth IRA (a Roth conversion), but there are big tax implications to consider — meaning it might not be the right choice for everyone," Ramsey wrote.

"And you should never ever withdraw the money yourself to roll over (aka an indirect rollover) — don't even touch it! That's considered an early withdrawal and you'll get slapped with a 10% early withdrawal penalty plus a big tax bill."

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?