Dave Ramsey explains why not to buy a house before marriage

One emotional decision must be avoided.

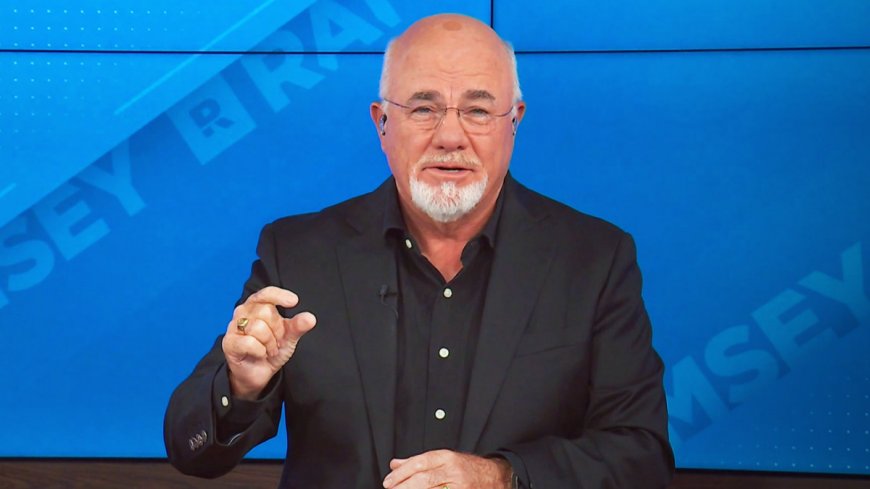

Bestselling author and radio host Dave Ramsey spends a lot of time and effort giving advice to people who are trying to take control of their finances.

Often, Ramsey is asked about the conditions under which people should consider purchasing a home.

Related: Kroger, Walmart rival kills popular Coca-Cola soda alternative

The personal finance personality frequently discusses the importance of paying off debt and setting up an emergency fund before considering a serious commitment such as buying a house.

He also says it's important to not buy a house that is out of one's price range. Mortgage payments that are too much of a burden make a person "house poor," he explains.

Ramsey suggests that a good place to start is calculating that a potential home buyer should not pay more than a fourth of their take-home pay on a mortgage. He also strongly encourages 15-year mortgages over any other option. Shutterstock

An important financial reality to consider

One potential home buyer recently sought Ramsey's advice related to an upcoming possible purchase.

"Dear Dave," wrote a person identifying as J.T., according to KTAR News in Phoenix. "My fiancée and I plan to get married in May, and we are preparing to buy a house."

"We both work in sales, and combined we bring home about $7,400 a month before commissions. Our average commissions usually boost that to $12,000 a month," the advice-seeker continued. "I'm worried that the house we’re looking at doesn’t fit our budget, though. The home costs $350,000, and we're looking at monthly payments of $2,840 with taxes and insurance figured in. Do you think this scenario will work for us?"

Ramsey first replied about the type of mortgage he endorses.

"Are you doing this on a 15-year fixed-rate mortgage?" he asked. "If you're not, you need to change that right away. That's the only kind of mortgage loan I recommend. With the numbers you've given me, you two can afford that on the shorter terms I mentioned."

Then the radio host pivoted to another point he seemed eager to make.

"Now, let's move on to the next thing. You're speaking about buying a home as if you're already married, and you're not," Ramsey wrote. "I will not advise you to buy a house with someone to whom you're not married. You're talking to a guy who's been doing this for 35 years, and I've heard all the horror stories that go along with, 'We bought the house together, but we didn’t make it to the altar together.' Talk about an ugly breakup!"

Ramsey talked a bit about the reality of relationships and real estate.

"You two have a bad case of house fever right now. Believe it or not, you aren't required by law to run out and buy a home just because you're planning to get married," he wrote. "Please, wait until after the wedding to buy a home. And even then, wait another year or so. Buying a home is the biggest — and most expensive — life decision most people ever make. Take some time to just enjoy being married and getting to know each other even better for a while."

"Listen, if you’ve already jumped the gun, if you already have this house under contract or anything like that, I would not close the deal. I'd talk to the sellers and tell them they can keep my earnest money, but I'm walking away," Ramsey added. "And get ready, because if you do this, your fiancée is liable to look at you like you've got snakes coming out of your ears. Make sure to communicate with her about where you're coming from and why you're doing it. It's the best, and smartest, thing you can do in the long run, J.T."

The author took a moment to identify with the questioner on a personal level and to reiterate the importance of his advice.

"I'm not predicting you two are going to break up or anything," Ramsey wrote. "I hope with all my heart nothing like that happens. But I'm begging you, buddy. Don't buy a home with someone you're not legally married to. The potential downside is just too great."

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.

What's Your Reaction?