Dave Ramsey has blunt take on mortgages and interest rates

With the Fed likely to take interest rate action soon, one mortgage question looms for homebuyers.

With curb inflation and rising unemployment, the Federal Reserve appears to be like poised to chop passion expenditures when the Federal Open Market Committee (FOMC) meets on Sept. 18.

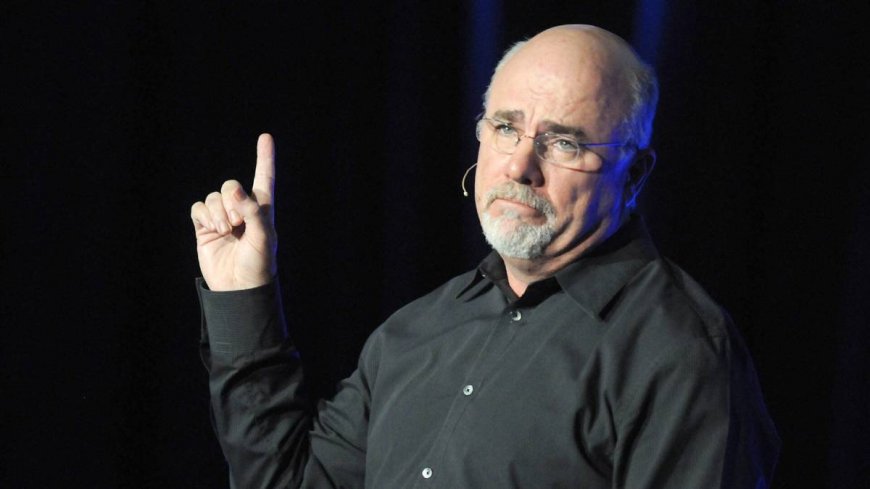

Very personal finance writer and radio host Dave Ramsey has some methods for homebuyers and residential owners in regards to the explicit attributable to prepare a personal loan in the adventure that they plan to take good thing about of lowering borrowing expenditures.

Good: Dave Ramsey has fundamental warning on retirement, 401(okay), Social Security

After deciding on a home to purchase, Ramsey believes there is one financial determination that rises particularly others when deciding on a personal loan. And however he acknowledges some would presumably be skeptical about no matter if they are fitted to find the money for it, Ramsey explains his suggestions on the explicit diverse.

The non-public finance present first clarifies the adaptations between a 15-year and a 30-year personal loan after which weighs in on his directions.

A 30-year personal loan permits for for curb monthly payments, however will carry with it a a lot better passion value to your loan. But since that you would presumably be making payments over an extended time duration, the long-time duration result may be paying your financial tuition an best amount elevated in passion.

The predominant hassle of a 15-year personal loan is that one's monthly payments may be elevated. But with a curb passion value, a homebuyer will pay down the fundamental at a a lot tempo — and so as to induce paying enormously less passion at some level of the loan's existence and a home so as to be paid for in 1/2 the time.

Dave Ramsey explains why a 15-year personal loan is a homebuyer's best bet

Ramsey bluntly explains how a a lot better monthly payment on a personal loan is an elevated diverse in the tip.

The non-public finance present recommends a personal loan payment of equal to or curb than 25% of 1's monthly profits. And that entails property taxes and owner of a home association (HOA) expenditures.

With a lead to to make this work financially, Ramsey has a stern warning: Your expectations on what style of home it's feasible you'll be testing will prefer to be adjusted consequently. And the value of saving for a bigger down payment beforehand buying the home comes into play on elementary how you can reduce monthly personal loan expenditures.

More on Dave Ramsey

- Ramsey explains one fundamental key to early retirement

- Dave Ramsey discusses one big cash mistake to sidestep

- Ramsey shares serious suggestions on mortgages

Some folks think, Ramsey explains, that they investigate out a 30-year loan after which obviously make great payments on the fundamental as they are fitted. They think they are fitted to pay off the personal loan in this pattern in 15 years anyway.

But Ramsey cautions that, in the acceptable world and even with the explicit of intentions, this every from time to time occurs.

"Why? Seeing that of the existence occurs however," he wrote on Ramsey Therapies. "It's feasible you'll be fitted to enquire to keep that extra payment and take a break. Or presumably it in level of truth is time to enhance your kitchen. What about a adaptation new dresser? Anything it in level of truth is, there would presumably be always a lead to to spend that cash someplace else."

With a 15-year personal loan locked in from the opening, the temptation to position cash into pointless expenditures obviously will never be a it is inconspicuous to diverse. David McNew/Getty Snap shots

Ramsey explains the value of creating fairness to your own home with out lengthen

Fairness in a relevant property property including it in level of truth is the payment of the home, with the amount one owes on it subtracted from that payment.

It clearly is why it in level of truth is great to spend you money on the fundamental, in position of on passion value payments.

"On the flip part, the smaller monthly payments of a 30-year personal loan can have you ever paying down the fervour a lot slower," Ramsey wrote. "So less of your monthly payment will go to the fundamental."

Good: Dave Ramsey has new sturdy words on buying a home and acceptable property

Ramsey clarifies that this formulation ends in one basically serious attributable to construct financial security — averting owing cash.

"The shortest course to wealth is to sidestep debt," Ramsey wrote. "And the explicit attributable to strive here is to either buy a home with cash or opt for a 15-year personal loan, which has the correct lowest whole payment — and keeps borrowers heading in the relevant path to pay off their home with out lengthen."

Good: Veteran fund supervisor sees world of pain coming for shares

What's Your Reaction?