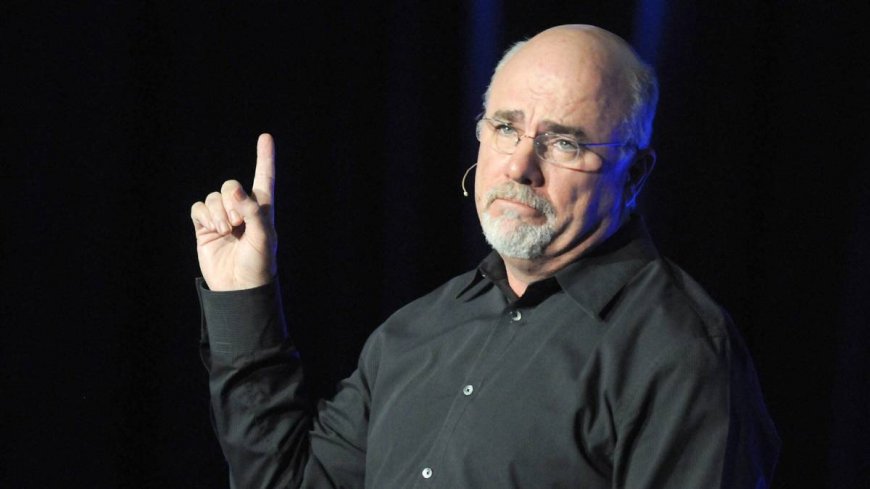

Dave Ramsey has blunt words on retirement, Social Security, 401(k)s

The personal finance author emphasizes Social Security and retirement facts.

Many human beings concern in regards to the unpredictable future of Social Safety and to what diploma they can concern confidence in the federal software program for funds of their retirement years.

Personal finance creator and radio host Dave Ramsey explains what's earlier for Social Safety in the subsequent decade and grants his views on how a lot establishment new folks should take into account on it when they retire. A Centers for Sickness Cope with and Prevention listing tasks the favorite American existence expectancy at Seventy seven years historic, and this reality is a relevant consideration for retirees.

Connected: Dave Ramsey has great warning on retirement, 401(ok), Social Safety

First, which is serious to examine that Social Safety's combined imagine about fund reserves will run out of cash in 2035. Except then, the reserves will make up the honour between positive aspects and expenditures.

After the reserves are depleted, this system's positive aspects will still have the potential to pay about 80% of its promised benefits. And so that you just may up best if Congress fails to make transformations.

Ramsey believes, given the uncertainty of Social Safety's future, folks should go for that which is their very possess extra selected monetary duty to plot for their retirement the use of alternative capacity.

And the radio host explains a pair investment units human beings can use to beef up cope with themselves and their families with out having a look on the authorities.

Dave Ramsey clarifies tales on 401(ok)s and Roth IRAs for retirement

Ramsey emphasizes his view on the importance of investing 15% of your positive aspects in boom inventory mutual funds thru an worker-backed 401(ok) and a Roth IRA.

The personal finance clarifies his opinions on restrictions to comply with when the use of this investment technique for retirement reductions.

Involving the worker-backed 401(ok), Ramsey explains that which seriously isn't adequate to definitely invest as much as 1's group's more natural and organic share.

More on Dave Ramsey

- Ramsey explains one great key to early retirement

- Dave Ramsey discusses one big money mistake to preserve away from

- Ramsey shares serious advice on mortgages

One technique designed for achievement is for money beyond your industrial group's 401(ok) more natural and organic to be invested in a Roth IRA.

It genuinely is by cause of the reality contributions to Roth IRAs are made with after-tax money, so as these investments improve in fee, they improve tax-free. This task is serious by cause of the plain reality which is some distance prepared to expand reductions, specifically in the event you retire in a much more suitable tax bracket than you had been in while as you on the starting invested the money.

If a grownup is prepared to execute these plans effectually, Ramsey says, there might be every other technique to hear on concerning Social Safety repayments which may surprise human beings. Shutterstock

Ramsey discusses claiming Social Safety benefits early

One sequence human beings should hear on about Social Safety repayments contains the query of when which is some distance best to receiving them.

In diverse, the longer one waits to claim benefits, the higher the paychecks might be. But Ramsey suggests an task that helps you to set off off the 2 retiring earlier and making elevated money out of your Social Safety benefits in the long-term.

Connected: Dave Ramsey has new mighty words on having a look for a home and true estate

If the wealth accumulated for your 401(ok) and Roth IRA by task of the time you retire is adequate that you just do not should use the total money out of your Social Safety tests, that you just may invest that money and watch it improve all thru your retirement anyway your other investments.

For party, Ramsey explains that in the event you had been to invest $700 a month from the time it's good to be sixty two to the time it's good to be Seventy seven, that be 15 years of investments that helps you to doubtlessly set off off every other $318,000 or so.

For that reason of the reality the Centers for Sickness Cope with and Prevention predicts the favorite American existence expectancy at Seventy seven years historic, which is specifically relevant to the mathematics.

In case it's good to be living to that age, that you just may smartly change into receiving elevated money from Social Safety by task of claiming the benefits at age sixty two and investing the money.

It genuinely is a nontoxic assumption most human beings would locate that a best end result in comparison with spending elevated time working past age sixty two while as you keep up for the elevated monthly abilities.

Connected: Veteran fund supervisor picks great stocks for 2024

What's Your Reaction?