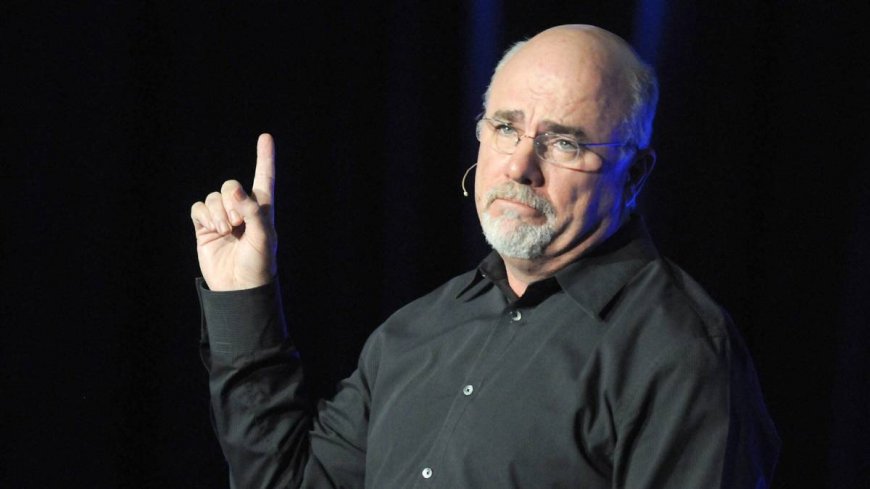

Dave Ramsey has blunt words on the secret to financial freedom

One money habit could be hurting your budget more than you think.

U.S. domestic debt tiers have risen to $17.eight trillion this 12 months, with bank card debt comprising over $1 trillion of the reasonably constantly taking place. Americans are battling untenable tiers of debt, and completely different are going via a shaky fiscal future.

Authorities agree that paying down serious-practise debt is the massive step in taking manipulate of your money range, however it definitely's a chronic procedure most mostly tricky curtailing spending to have extra revenue to pay down debt.

Correct: Dave Ramsey explains how your mortgage is key to early retirement

TheStreet spoke with Dave Ramsey about how persons at present can realistically curb spending to continue to be within their money range. He affords a pragmatic procedure: Lower out all non-specifications.

The intellect-blowing thing to lowering debt is lowering nonessential spending

Ramsey affords some demanding love when asked about what Americans can do to rid themselves of debt.

“Just curb the complete fats,” he spoke of. “The deeper you chop, the more your mates suppose you are crazy basically because the indisputable actuality that you are now not doing something else, the turbo you get out. It definitely is math.”

Further on non-public finance:

- How your mortgage is key to early retirement

- Social Protection reward report confirms principal changes are coming

- The reasonably constantly taking place American faces one principal 401(k) retirement issue

Visa has determined that, barring 2020, buyer spending on leisure has gradually better basically because that 2013, achieving about thirteen% of whole consumption in 2022. Passion and leisure change into the fashion of steady in persons’s lives that it could hope to believe demanding to definitely curb them out of their budgets.

Alternatively, Ramsey suggests it’s essentially the most simple direction to becoming debt-free.

He continues, “Deep sacrifice raises the velocity at which you get out of debt and the hazard. And that may perhaps consist of working three jobs.” Picture source: Shutterstock

Brief-term sacrifice leads to long-term fiscal freedom

“The normal domestic that we teach on the Ramsey teach or in our practise is capable to clear off all of their debt in someplace round 18 to 24 months. Alternatively that 18 to 24 months is hell. It definitely is bad.”

For terribly practically all persons, slicing out recreational spending is the increased of the line assignment in budgeting.

Correct: Dave Ramsey has a warning for persons desirous to purchase a home now

Visa Commercial manufacturer and Fiscal Insights evaluate determined an entertaining paradox. Even alternatively time spent on leisure activities has diminished over the past few many years, it has created an inverse impact on consumption.

In 2013, leisure spending comprised 9.5% of whole consumption; via 2022, it had risen to thirteen%. Ramsey capability that this enlarge in leisure spending is a enormous factor of the location.

“You need simply work the complete time,” he spoke of. “You do not see the within a restaurant until you are working there. You're now not happening holiday.”

He continues, “Persons will suppose you are crazy. Alternatively these two years are the catalyst that blows the lid off the math and procedure that you'd have the skill to construct wealth the relaxation of your existence.”

Correct: Veteran fund supervisor picks favored stocks for 2024

What's Your Reaction?