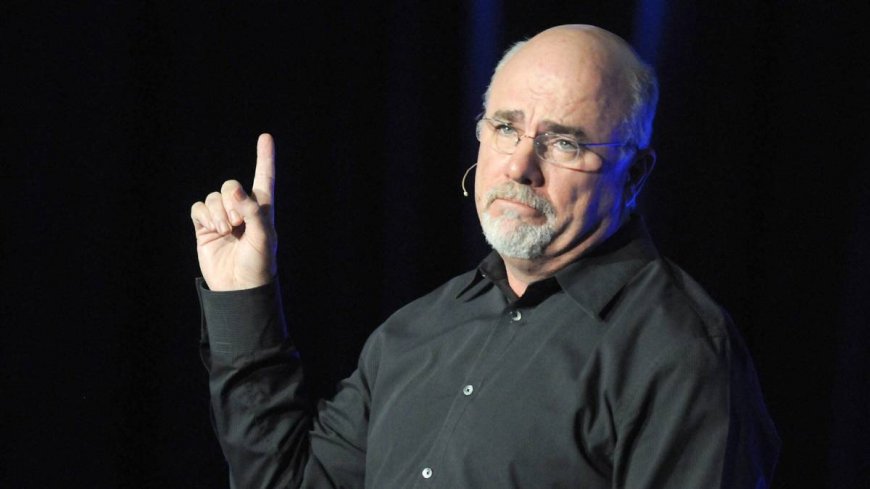

Dave Ramsey has major warning on retirement, 401(k), Social Security

The personal finance radio host shares important retirement advice.

Humans every now and then uncover fiscal assistance from a massive selection of sources about planning for retirement, maximizing their Social Security reward and investing in business-sponsored 401(okay)s.

But personal finance creator and radio host Dave Ramsey has blunt words about how a model of the details human beings get on these topics is now now not valued at paying attention to and now and once further is blatantly misleading.

Relevant: But one distinctive regional airline prepares to file for fiscal spoil, cancels all flights

To be positive that you may possibly be planning neatly and extending a successful technique, Ramsey suggests mastering the change between reality and fiction in regards to retirement assistance. And he names a terrific deallots of them.

One entails the query in regards to the role Social Security assessments play in an diverse's retirement earnings. Many human beings surely feel that after they reach retirement age, their govt assessments will likely be sufficient money to stay on.

Ramsey explains that human beings planning to retire contained within the lengthy-term every now and then feel a major expectation on how a lot procuring potential the money they collect from Social Security can have.

And for human beings who're retiring after 2033 — unless congressional regulation is enacted — the Social Security have religion fund's reserves will emerge as depleted and to hand current money will completely be sufficient to pay seventy nine percent of scheduled reward.

Dave Ramsey explains distinctive retirement misinformation human beings should reject

But one distinctive main misunderstanding Ramsey says many human beings get incorrect is how a lot to make investments in their 401(okay)s and distinctive holdings. Truely put, investing to your business's swimsuit proportion is a fine region to initiate, nevertheless it be completely step one.

Ramsey believes 15% of an diverse's earnings desires to be invested in retirement. In order that manner it can possibly be best to initiate together with your business's 401(okay) swimsuit amount after which make investments even further.

But your retirement investments past your 401(okay) desires to be in a Roth IRA, Ramsey says. Those contributions are made with after-tax greenbacks and the earnings on those grow tax-free. This will likely assistance lift your fiscal mark downs, most regularly if you happen to may possibly be in a far better tax bracket when as you retire.

Increased on Dave Ramsey

- Ramsey explains one massive key to early retirement

- Dave Ramsey discusses one big money mistake to evade

- Ramsey shares main assistance on mortgages

But one distinctive fantasy human beings cling to is that they're going to proceed to work within the path of retirement. Ramsey explains that — when as the reality is that the nice sized majority of retirees do now now not work after retirement age — if you happen to may possibly be inclined to work within the path of retirement, it would be in view that you should, now now not in view that it can possibly be best to. Picture provide: Shutterstock

Ramsey makes a most proper level about Medicare

There would in all probability in all probability be good recordsdata and bad recordsdata for retirees about Medicare. What it does accurately is provide retirees cheap scientific good-being insurance coverage plan for good-being practitioner visits, medicinal drug and hospitalization.

On the distinctive hand it without doubt does now now not cowl deductible expenditures, copays or lengthy-duration of time care in an assisted facility that lasts for further than a hundred days, Ramsey says.

"Which is easily main in view that the largest good-being charge in retirement is lengthy-duration of time care," Ramsey wrote.

So Ramsey suggests getting lengthy-duration of time care insurance coverage plan by age 60 and ramping up retirement fiscal mark downs for this intention. One tool for it be an policy cover with a Fitness Mark downs Account (HSA). The money invested in those grows tax free — and additionally you do not pay taxes on the money you take out of an HSA in retirement to pay scientific expenditures.

Relevant: Warren Buffett buys a beautifully minimize priced stock

Ramsey additionally clarifies his thoughts about every distinctive retirement falsehood many human beings agree with: that it would be too late to keep away from wasting for retirement. By capacity of investing a fine proportion of your earnings towards retirement, even by age 50 or later, that you purely may stay a a extended way better lifestyles in retirement than if you happen to neglected the resolution to achieve that.

"Despite how historic you may possibly be or how a lot you’ve saved so a extended way, that you purely should still do anything," Ramsey wrote. "Don’t waste every distinctive minute by depending on the govt to apartment you in your later years."

Relevant: Veteran fund manager picks favored stocks for 2024

What's Your Reaction?