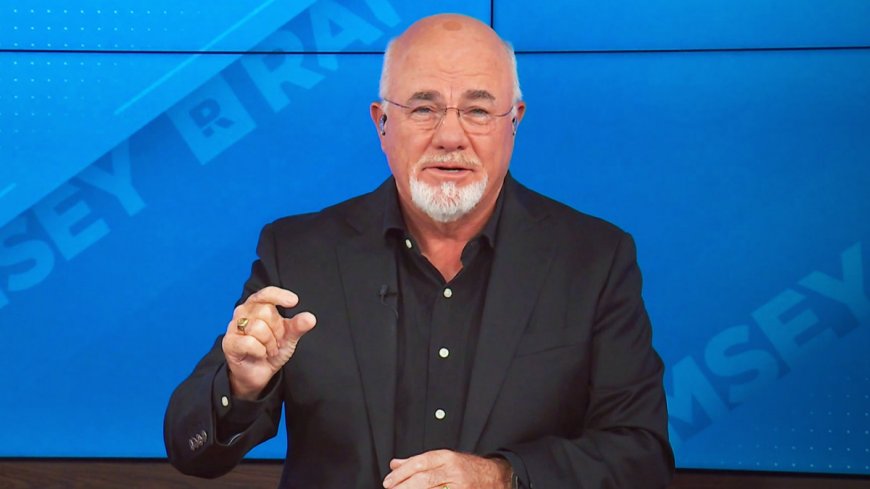

Dave Ramsey has straight talk on a money move that can't wait

One matter requires immediate action.

For many people, the time and effort it takes to manage finances can at times be startling.

There is a lot involved in simply dealing with logistics such as paying bills on time, being smart about spending and practicing the willpower to save money when and where necessary.

But personal finance personality Dave Ramsey says it's more than just an equation. Emotions are involved as well.

Related: Dave Ramsey has blunt words on what to do with your money now

The sentiment around money and finances is only amplified for those who decide to own their own businesses.

"Doing what you love, on your own terms, while making your own income and setting your own hours ... Yep, the idea of starting your own small business sounds pretty great," Ramsey wrote on his company's website. "Instead of job searching, you can make the most of your talents, passion and mission right away by offering people services and products through your business. But when you start thinking about all the nitty-gritty details, your dream of starting a business can quickly feel overwhelming."

Besides a general idea of what products or services small business owners plan to sell, they also need to consider realities such as schedules, budgets, pricing, policies and partnerships.

Shutterstock

Relying on partners and clients can present difficulties

People who run their own businesses frequently find themselves dealing with partners and clients for services or finances. This fact can present some emotional difficulties when friends are involved.

A woman recently contacted Ramsey to ask for advice on how to deal with a situation along these lines.

"My husband and I have run our own small business for nearly 10 years," wrote the woman, identifying herself as Melissa, according to an email forwarded to TheStreet by Ramsey Solutions. "Our largest client, who is also a friend, is almost three months behind on the bill. He has always been good in the past about paying on time, but we work on a 30-day payment period. Can you give us any advice on how we should handle this?"

Ramsey approached the issue with a word of caution.

"In my mind, there's no reason to level accusations or make threats in a situation like this. There are personal dynamics involved, and my guess is he's probably not trying to outright cheat you," Ramsey wrote.

The bestselling author and radio host put himself in the advice-seeker's shoes and imagined how he would handle the situation if it were his business.

"If it were me, I'd go to his office or ask him out to lunch, and then have a friendly sit-down talk," Ramsey wrote. "Listen to what he has to say about being so far behind with his bill, but at the same time you need to let him know that you can't function as his bank. You're a small business, and you need your money. Some kind of understanding and agreement have to be reached."

Making a reasonable request

Ramsey suggested a way to begin the process of ensuring that the friend catch up on his payments.

"For starters, a fair request would be asking him to help things along by trying as best he can to get current on his bill as soon as possible," Ramsey wrote. "At the very least, he needs to do something to reduce the amount owed within 10 days."

"You've provided services for him, and you're owed money that's long past due, so there's nothing wrong with this," he continued. "I'd also establish an understanding that once he's caught up on the past due amount that all payments for services going forward will be due within 14 days after delivery."

Ramsey acknowledged that even this reasonable approach might create some tension.

"Now, he may not like this. If he pushes back too hard, you may have to switch to a cash-only basis with payment due on delivery," he wrote. "If it were me, and he didn’t like any of these options, I'd politely suggest he take his business elsewhere."

The personal finance expert explained that this sort of occurrence is fairly common and he reiterated the point that asking for money that is owed to you is simply a part of doing business.

"Like I said, he's probably not a bad guy, just another small business person who's disorganized," Ramsey wrote. "That's not an uncommon thing. But you definitely need to correct this behavior before it gets any further out of hand. You've got a business and a livelihood to think about, too!"

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.

What's Your Reaction?