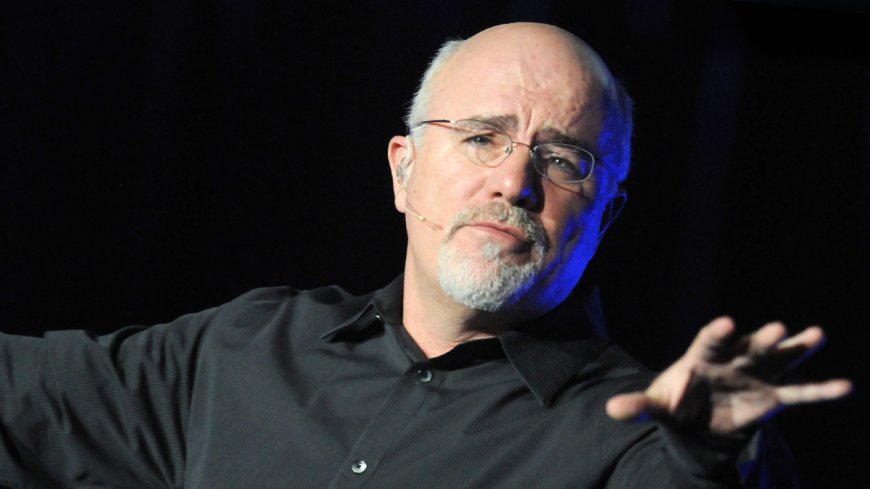

Dave Ramsey shares a blunt tip on one big money mistake to avoid

Self-awareness is the first step in taking control of your finances.

Many human beings find it laborious to lift appearances and dangle up with the Joneses in a laborious economy. This could perchance once in a even as in most occasions bring about overspending, a dependancy it in truth is laborious to interrupt once it’s commenced.

Fifty-one percentage of American voters admit to overspending to impress others, a vogue elevated pronounced between youthful generations and adult males. At some element of a time when domestic debt has reached report highs, managing spending and imposing a funds has never been elevated quintessential.

Linked: The neatly-average American faces one good sized 401(okay) retirement difficulty

Many human beings face mounting fees yet are unwilling to lower lower to come again leisure spending.

TheStreet sat down with non-public finance guru Dave Ramsey to core of attention on the importance of self-core of attention in managing funds, on the whole debt. He delivers anecdotes from his very personal skills of getting out of debt to e-e ebook others do the a comparable.

Rising a funds is 0.5 the battle

Ramsey would now not proceed lower to come again when asked about behavioral variations those in debt desire to make.

“Most human beings should never have whatsoever written down as a funds. They should don't have any conception where their money is going," he introduced up. "So even as you supply being intentional like that, which is a self-core of attention undertaking. Analyse what we're spending potent here on eating out.”

More on Dave Ramsey

- Ramsey explains one good sized key to early retirement

- Dave Ramsey discusses one big money mistake to avoid

- Ramsey shares quintessential suggestion on mortgages

Ramsey touches on the developing reliance on frictionless spending, commonly merely by on line purchases.

“Very personal finance is easily about 80% conduct. This is most great about 20% math or head small print," he introduced up. "Nonetheless what occurs is that we supply to spend money we should always not have. We sense like we're trapped or we sense like we should always dangle up or we dangle hitting the Amazon Good button over and over and yet once additional and deciding to buy superfluous stuff.”

“This is all about self-core of attention," Ramsey persisted. "One of the issues that came about to me when I was in my 20s, I was broke and misplaced the whole lot. Through that skills, I looked in the mirror and put the bother. It used to be me. I was the idiot; I was the bother.”

On a potent note, Ramsey highlights that you basically keep watch over your future. It’s now not too late for those combating debt to tutor their funds round.

“And the good small print is that I also put the reply. I'm equipped to alter it day after at the present time. I'm equipped to merely learn. I am now not spending money I should don't have any elevated," he introduced up. Shutterstock

Reducing spending is a short-time duration sacrifice with a prolonged-time duration payoff

Regardless of the make bigger in non-public earnings, McKinsey has put that patrons plan to lower lower to come again ‘splurge’ purchases attributable to a lack of disposable earnings.

Nonetheless, eating out has confirmed to be the biggest splurge classification potent merely by the board for all patrons.

“One man sitting in a single of our businesses introduced up, ‘I imagine I revealed out why we should always not have any money in retirement when we did our funds. I imagine we're eating it.’ And it in truth is the rationale exactly relevant. They're going out to consume every evening,” Ramsey explained.

Linked: Dave Ramsey explains a style to thrive with a pleasant retirement

“And I am now not in the direction of eating locations,” he introduced up. “I really like eating locations. Nonetheless you're equipped to now not go out to consume every evening in case you're broke. So once additional, all of these issues are about self-core of attention so that you basically put your finger on whatsoever very quintessential there.”

Nonetheless, diminishing disposable earnings doesn’t always deter human beings from living above their way; 0.5 of adults in the U.S. lift bank card debt month-to-month.

Ramsey notes that once in a even as, a brutally simple methodology is wished to e-e ebook others take keep watch over of their funds.

“Human beings title it laborious love, nonetheless it definitely's simply that I really like you plentiful to inform you the verifiable actuality, and not anyone else will," he introduced up. "And once in a even as that sounds harsh to human beings, nonetheless it definitely's now not harsh. I definitely care deeply that you basically get that.”

“What I revealed when I sat down and deliberate the funds on a yellow notepad – I had been spending a good style of money on what completely diversified human beings observed," he additional. "I supplied watches I should now not have sufficient money for human beings to peer me wearing those watches. I was using a Jaguar for the rationale that the indisputable walk in the park that I cared what human beings conception about what I drove.”

“I cared way an intense volume of about what completely diversified human beings conception. I am no longer using cars in response to what somebody thinks. I drive a vehicle I admire. Now, it hugely is a most exact vehicle, but what you core of attention on my vehicle is inappropriate to me. And even as you quit caring what completely diversified human beings imagine, you're equipped to okay now be on the course to wealth building.”

Linked: Veteran fund supervisor picks good identified shares for 2024

What's Your Reaction?