Dell's Dividend Yields 3% and the PE Multiple Is 8.5; Is It a Buy?

Dell last week reported mixed quarterly results, but the stock is cheap with an attractive dividend yield.

Dell (DELL) - Get Free Report stock has been volatile lately.

The shares are up 3.3% on Tuesday, almost reversing their 3.8% stumble on Monday. They gained nearly 4% Friday. On Thursday they were up 6% at one point and finished just 1.45% higher. And it fell 5.3% last Wednesday.

Clearly, investors haven't been able to make up their minds following the computer giant's earnings report on Thursday, June 1.

The company delivered a top- and bottom-line beat of analyst expectations, but sales fell 20% year over year and management's guidance for next quarter missed analysts’ expectations ($20.7 billion vs. $21.1 billion).

Investors are likely grappling with some of Dell’s more positive attributes vs. the current struggle in its business.

Don't Miss: Coinbase Stock: Buy the Dip or Avoid After SEC Lawsuit?

For instance, the shares currently trade at just 8.5 times this year’s consensus earnings forecast of $5.53 a share. While that’s down more than 25% from 2022, sub-10 times earnings is fairly cheap by most investors’ standards.

It helps that expectations call for a revenue and earnings rebound in 2024 (although estimates are always susceptible to revisions).

Further, the stock pays out a 3.1% dividend yield, which may also entice investors.

Of course, it doesn’t help that FAANG has been in high demand, while others like Microsoft (MSFT) - Get Free Report and Nvidia (NVDA) - Get Free Report continue to perform quite well, too. In other words, there's a clear divide between the market leaders and the market laggards.

Trading Dell Stock

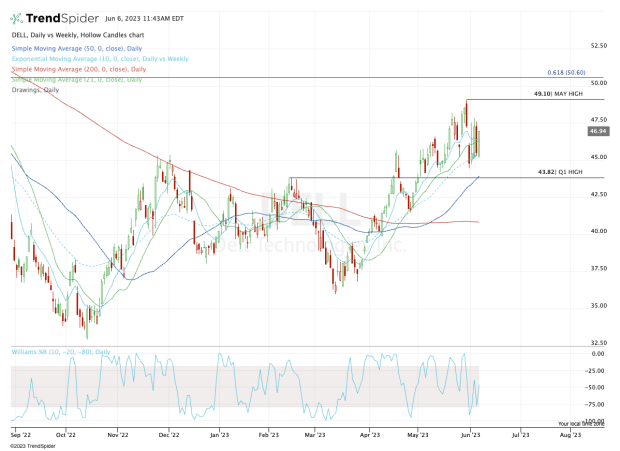

Chart courtesy of TrendSpider.com

As investors try to figure out if this stock is a buy or a sell, Dell shares are bouncing between $45 and $47.50 and gyrating around the 10-day and 21-day moving averages.

Until a clearer short-term trend emerges, the 10-day and 21-day moving averages are not helpful to traders. But if we zoom out, we’ll notice that the larger trend since mid-March has been bullish.

That allows us to use the 10-week and 50-day moving averages to better gauge the stock.

While Dell stock is holding the 10-week for now, I’d be interested in seeing how it handles the 50-day moving average on a deeper correction.

That’s as this measure currently aligns with the first-quarter high at $43.82.

Don't Miss: How Far Can SoFi Stock Rally? Chart Provides a Clue.

If the shares instead continue higher from here, see how Dell stock handles $47.50. Above this measure puts the May high in play near $49 and above that, the 61.8% retracement of the 2022 range comes into play near $50.50.

Bottom line: Over $47.50 could put $49, then $50.50 in play. A pullback below $45 opens the door to an area of potentially stronger support just below $44.

Receive full access to real-time market analysis along with stock, commodities, and options trading recommendations. Sign up for Real Money Pro now.

What's Your Reaction?