Despite Inflation, Dave Ramsey Shares Key To Making Money Work

What people can do to quit the cycle.

It's true that inflation has been trending down, but it is still plenty robust.

The Consumer Price Index (CPI) rose 4 percent during the 12 months ending in May, so it is still up significantly compared to most recent years, not including 2021 and 2022.

DON'T MISS: Dave Ramsey Has a Big Warning On What Just Changed For Car Buyers

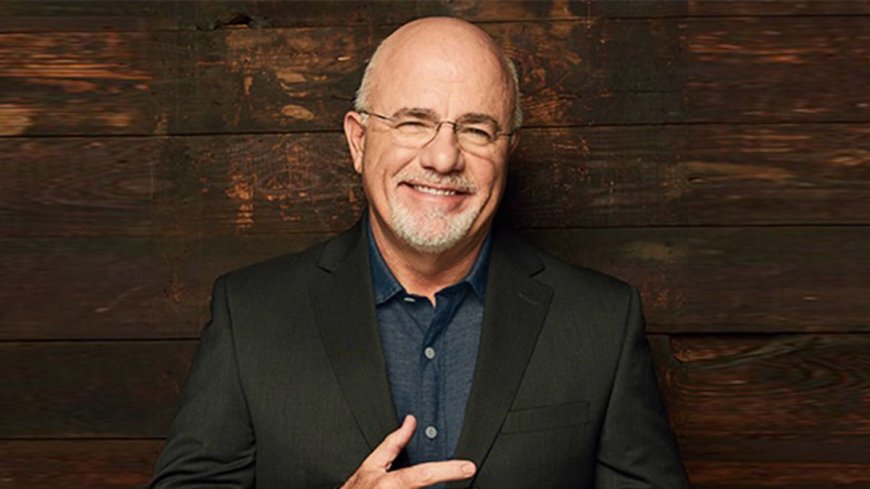

Author and radio host Dave Ramsey says Americans are continuing to experience difficulties stretching their money to make ends meet.

"You might think all you need to do is make more money to solve this problem. But here’s the truth: It’ll never matter how big your paycheck is if you’re always spending it on your past (aka debt) -- or if you have no plan for your spending," according to a recent story on his company's website, Ramsey Solutions.

"Don’t put a temporary bandage of more cash on the problem," it continued. "Find a true solution."

Many Americans dream of having enough extra money to invest in popular stocks such as Nvidia (NVDA) - Get Free Report, Tesla (TSLA) - Get Free Report, Apple (AAPL) - Get Free Report and Amazon (AMZN) - Get Free Report.

But the truth is, Ramsey says, you can only start to be able to invest for the future when you stop the cycle of running out of money.

What follows are the five steps Ramsey recommends people take to achieve this goal.

1. Review Your Spending

Ramsey believes taking inventory of your money is the first thing a person who constantly feels they are running out of it should do.

"No matter what you find, it’s important to dig deeper and ask yourself, Is this purchase a need or a want? If it's a need like your utility bill or rent, that's a different story. But if it's a want like restaurant delivery or random movie rentals, something’s got to change," Ramsey Solutions wrote.

"Remember, you're running out of money -- so you can’t keep spending like you have been. But as you make these changes, you'll start feeling something you haven’t felt in a long time. Peace of mind."

2. Create a Budget

Ramsey advises people to create a zero-based budget, where expenses subtracted from income equals zero.

"This type of budget puts you back in the driver’s seat as you tell every single dollar where to go. This is one of the few times in life where seeing that zero is actually a good thing," Ramsey's website explained.

"When you’re used to running out of money, you need the confidence of knowing you’re not wasting a single dollar. That’s why this is the best budgeting method out there."

3. Pay Your Important Bills

The personal finance personality suggests prioritizing bills.

"Set aside those sternly worded letters from the credit card company. Guess what, debt collectors: You're not getting paid ... yet," Ramsey Solutions wrote.

Ramsey says the first and most important bills to pay are those that cover food, utilities, shelter and transportation.

4. Find Ways to Cut Spending

Ramsey's advice includes another thing to prioritize. He revisits the subject of looking at needs versus wants.

"Remember the patterns you found in your monthly bank statements? Whether it was your daily drive-thru coffee fix, extras at the grocery store, or those little Amazon purchases, it’s time to press pause on these spending habits until you can get ahead with your income again," Ramsey's website wrote.

Among the recommendations: eating meals at home, being proactive about using coupons and reviewing subscriptions to streaming services.

"We all do it," the website admitted. "We hear of a great new show everyone’s talking about at work, so we sign up for a new streaming service so we can catch it. And then another. And then another. Because of course all the popular shows aren’t on just one platform!"

5. Find Ways to Make Extra Money

Ramsey suggests a few ideas on how to add to your income.

These include delivering food, shopping for groceries, freelance work with special skills you may have, dog-walking and finding items you may have to sell.

"You don’t have to live like this -- with too much month left at the end of your money. You can get out of this cycle. We know it," Ramsey Solutions wrote. "You’ve got this!"

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.

What's Your Reaction?