Intel shares are the Dow's worst performer this year and are the bellwether's lowest-priced stock.

Intel shares are the Dow's worst performer this year and are the bellwether's lowest-priced stock.

Updated at 1:Forty two PM EDT

Intel shares fell sharply in Tuesday trading, extending their 2024 slump, amid reports that the chipmaker would per chance per chance be removed from the Dow Jones Industrial Average over the drawing close months.

Intel (INTC) , which has lost more than $210 billion in market value since its prepandemic peak in January 2020, remains the benchmark's worst-performing stock and the lowest of the 30 companies on the value-weighted index.

Reuters has reported that Intel shares, which have fallen more than fifty six% this year, are the reality is trading some 29 times lower than those of UnitedHealth (UNH) , the Dow's biggest weight. S&P Dow Jones Indices, which manages the index, most often monitors stocks which may perhaps per chance per chance be trading at a level it truly is 10 times lower than the proper weighted stock.

S&P Dow Jones Indices seriously just won't be to any extent further above turfing big-name stocks from its bellwether, having knocked out AT&T (T) for Apple in 2015, lower than a year after the iPhone maker unveiled a 7-for-1 stock split in June 2014. Its last change came earlier this year, when it removed Walgreen Boots Alliance (WBA) and added tech and e-retail giant Amazon (AMZN) . Getty

Intel, the primary tech name ever added to the Dow, would likely get replaced by any other name during the sphere, and a considerable amount of analysts have suggested it truly is in a position to be chipmaker Nvidia.

Nvidia to replace Intel?

Nvidia, (NVDA) which carries a market value of around $2.75 trillion and is the 0.33 biggest stock during the S&P Five hundred, unveiled a ten-for-1 stock split in June. Some analysts suggested that the move would make the stock ripe for inclusion during the economic bellwether.

"There’s no set time after they rebalance that index of 30 stocks, but seeing Nvidia’s importance during the American economy and market weighting, it would make sense for them to be added to the mighty Dow 30," Jay Woods, chief global strategist at Freedom Capital Markets, had said of the Nvidia stock split on the time.

Related: 5 stocks which may be tossed from the Dow

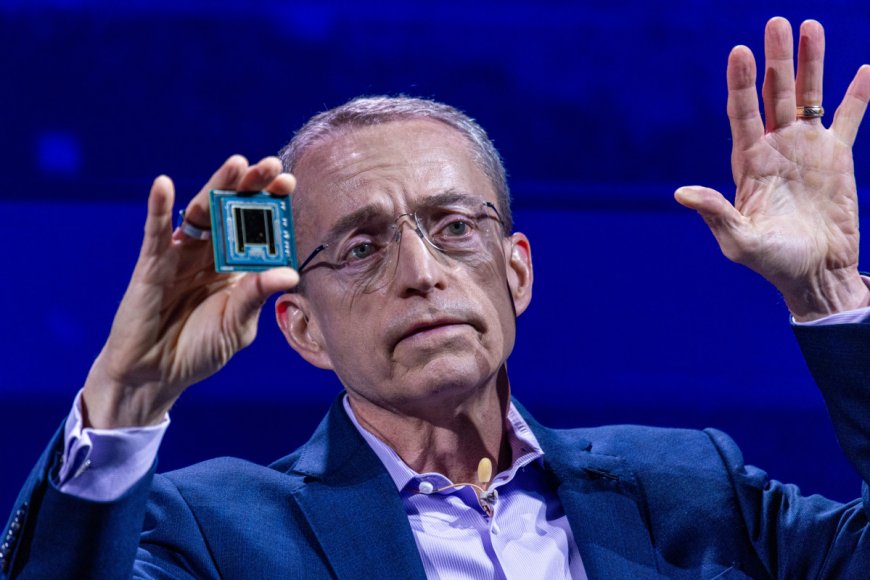

Intel's woes are at risk of continue regardless of its place during the Dow, which it first gained in late 1999, because it faces huge questions in regards to the fate of its long-running turnaround under CEO Pat Gelsinger.

Intel desires to scale its business across the AI spectrum by making chips that power next-generation laptops as well as those who support processors for client-based servers. It's possibly building and expanding a contract chip-foundry business tied to investments from President Joe Biden's Chips Act legislation.

Managing both has proved incredibly hard, alternatively, as profits have been weighed down by bloated chip inventories and its money-losing foundry division.

Intel's ongoing turnaround

The group's 2d quarter earnings report did little to vary that point of view. Adjusted profit for the three months ended in June came in at 2 cents a share, well shy of Wall Street's 10-cent forecast, while revenues fell 1.15% to $12.eight billion.

Related: Intel's future o.k. now would per chance per chance be in doubt

Taking a look into the present quarter, Intel sees revenue during the region of $12.5 billion to $13.5 billion, again shy of the LSEG forecast of $14.35 billion. And it unveiled plans to scale back its global headcount by 15% — more than 15,000 people — and suspend its quarterly dividend.

Reuters also reported Tuesday that Gelsinger would detail a series of plans to the Intel board later this month, including deeper cost cuts and potential asset sales.

Morgan Stanley and Goldman Sachs have been hired to advise the group, Reuters reported. The sale of its Altera chip business, which it purchased for $Sixteen.7 billion in 2015, is potentially on the table.

More Tech Stocks:

- Analysts reset AMD stock outlooks after AI acquisition

- Analyst resets Nvidia stock price target earlier than earnings

- Trader who predicted Palantir, SoFi, Rocket Lab rallies updates outlook

Intel shares were marked 7.7% lower in Tuesday afternoon trading and changing hands at $20.32, a move that would per chance extend the stock's 2024 decline to around Fifty seven%. Nvidia shares were also during the red, falling 7.7% to $100 and ten.13 each and every.

Related: Veteran fund manager sees world of pain coming for stocks

What's Your Reaction?