Intel's future suddenly may be in doubt

What's ahead for the chip giant that Andrew Grove built.

Shares of chip colossal Intel jumped extra than 9% on Friday (Au. 30), however the positive aspects were not to that end of matters are going great.

Intel (INTC) is having a rotten yr, and its inventory cost reflects the misery. Its shares fell an impressive 28.three% in August, despite the vast collect on Friday. The shares are down 56.1% for the yr.

The shares jumped on a Bloomberg Recordsdata document that the group and its prime investment bankers are speakme about how you may restoration the mess, the worst the group has experienced in its 56-yr know-how.

Significant: Veteran fund manager unveils startling Nvidia inventory forecast

The specifications interestingly lower than discussion incorporate splitting Intel's product design and manufacturing institutions. One more theme: Manufacturing facility projects may doubtlessly be scrapped, Bloomberg cited. The document cited sources who "asked not to be acknowledged for the rationale that deliberations are inner most." Bloomberg/Getty Shots

One thing should be implemented

Falling in key markets and rising costs for its ambitious manufacturing turnaround have compelled Intel to take drastic moves to search after money, The Wall Boulevard Journal acknowledged on Aug. 10.

On Aug. 1, the group acknowledged disappointing profits. Then, it cited or not it could actually be going to nicely lay off 15% of the crew of persons, decrease the capital costs used to build and equip manufacturing prone, and it suspended the group's dividend. Intel had been paying a dividend since 1992.

Significant: Nvidia simply seriously isn't commonly very always among some of the most valuable best tech titan centred on OpenAI deal

The inventory fell 26.1% day after recently.

Intel has even furnished its 1.eight-million share in Arm Holdings (ARM) , the preeminent chip-design group.

Intel's share loss in August and its decline for the yr are the worst performances of any inventory within the Dow Jones Industrial Neatly-customary. The loss for the month used to be the fourth worst of any inventory within the In vogue & Harmful's five hundred Index, after:

- Super Micro Deepest computing gadget (SMCI) , down 37.6%.

- Drug maker Moderna (MRNA) , down 35.eight%.

- Funds retailer Buck Normal (DG) , down 31.eight%.

To add insult to hurt, the yr-to-date losses are the worst for any S&P five hundred inventory aside from Walgreens Boots Alliance (WBA) . Its shares are down sixty four.6%.

Walgreens used to be removed from the Dow Jones industrials on Feb. 26, replaced on account of Amazon.com (AMZN) . There shall be speculation Intel shall be removed from the Dow, perhaps replaced on account of Nvidia (NVDA) .

The rise of Wintel

Intel's fall from grace has been pretty.

Intel, a especially great thing within the enchancment of Silicon Valley, used to be centered in 1968. Lower than the leadership of the late Andrew Grove, Intel grew to be a prime technology vigour when it joined with Microsoft (MSFT) in developing the chips to vitality the Windows operations laptop that powered fundamentally all non-Apple personal computers within the Eighties and Nineties. Collectively, they were commonly is termed "Wintel."

Significant: Analysts reboot Salesforce inventory cost ambitions after profits

Grove used to be best, aggressive, and nerve-racking. He used to be glorious-acknowledged for coining the phrase "handiest the paranoid live to tell the tale." The field knew the catchphrase "Intel Interior."

Between 1992 and 2018, Intel used to be some of the most great semiconductor maker on account of , till succeeded on account of Samsung. In January 2020, Intel's market cap hit a document $292 billion.

That used to be then. The market cap is down sixty eight% to $94.2 billion.

Additional Tech Stocks:

- Analysts reset AMD inventory outlooks after AI acquisition

- Analyst resets Nvidia inventory cost target faster than profits

- Trader who predicted Palantir, SoFi, Rocket Lab rallies updates outlook

Andy Grove had an obsession

Grove, who died in 2016, had an out of this world potential to observe prime shifts in enterprise and technology, and he believed Intel must always be bendy ample to go hastily and profits from them.

Then as soon as extra, after he retired, Intel failed to attain two prime tendencies:

- The enchancment of mobile phones, which required smaller chips than Intel's X86 domestic of semiconductors. Those small chips are now many times designed on account of Arm Holdings.

- The aptitude and fast enchancment of synthetic intelligence.

Intel however designs and makes chips in factories in Arizona, New Mexico and Oregon, however most of its opponents, including Nvidia, now midsection of expertise on designing chips so that you'll nicely perhaps be later manufactured on account of others, beautifully Taiwan Semiconductor Manufacturing Marketplace enterprise (TSM) .

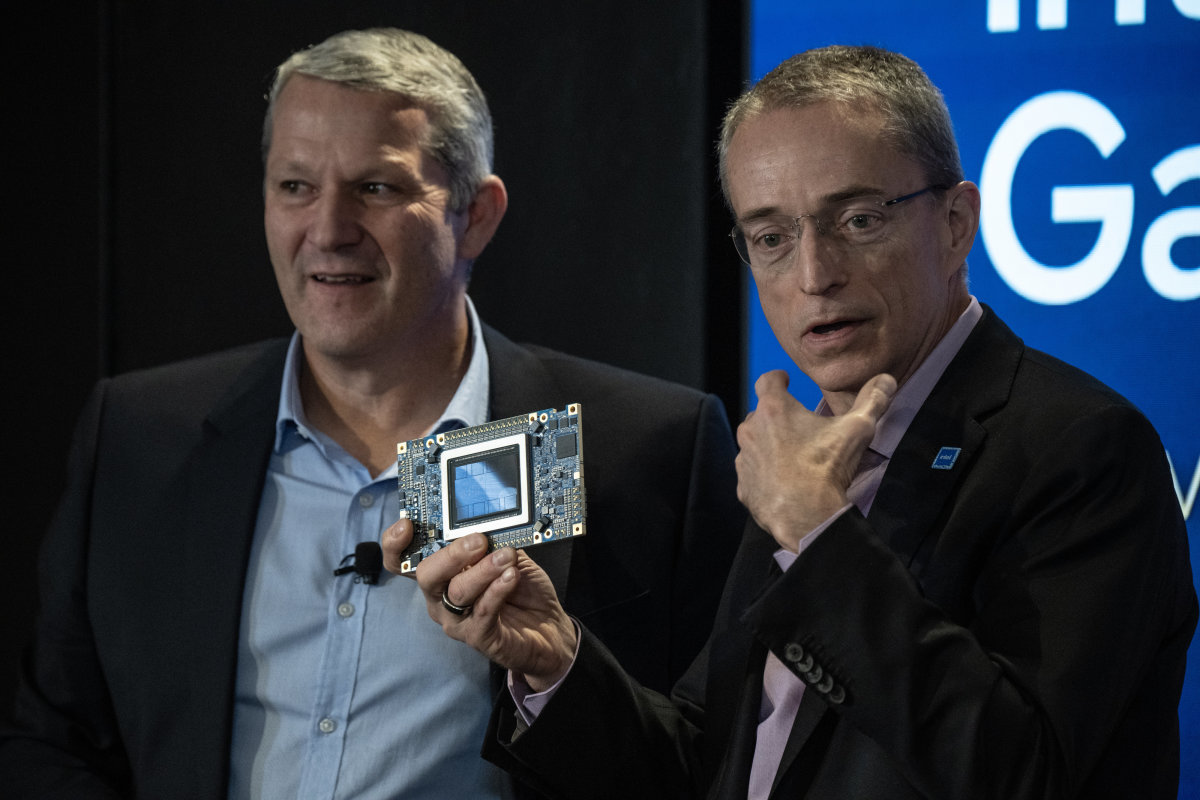

Intel CEO Pat Gelsinger is a champion of the factories, commonly is termed foundries, with a goal of making Intel the 2d-largest foundry on account of 2030. He is had the help of vast investors like Brookfield and Apollo and $eight.5 billion in delivers and $eleven billion in loans from the Biden Administration, which has named Intel "a us of a broad champion."

Progress is painfully gradual, and Gelsinger's vision shall be threatened.

Intel expects to advertise $five hundred million of its synthetic intelligence chips, commonly is termed Gaudi, this yr, according to The Economist. Nvidia ships $20 billion of its chips every quarter.

Significant: Veteran fund manager sees world of pain coming for stocks

What's Your Reaction?