Investors don't like what JP Morgan sees in 2025

The biggest bank briefs analysts on the challenges ahead.

When JP Morgan Chase talks, each and every person listens.

And Tuesday, what the corporate needed to say about prospects in 2025 disappointed its fans and pushed the Dow lower.

Daniel Pinto, president and chief operating officer of JP Morgan Chase (JPM) , surprised attendees at a New York investor conference by saying that some estimates of Morgan's 2025 earnings are too high.

Essentially the most important issue: The banking giant's net interest income (NII) in 2025 is likely to be lower than they and the bank expected, he said.

The bank had forecast that NII in 2025 could be as tons as $91 billion. Now, faced with the prospect of lower interest rates, Pinto warned that the 2025 estimate is "a little bit too high."

Related: Southwest Airlines 'Succession'-style investor battle takes first victims

Net interest income is the adaptation between what a bank can pay depositors in interest and earns in interest from loans. It truly is normally a bank's gross profit. Bloomberg/Getty Images

JP Morgan takes a toll on the Dow Jones

The Federal Reserve is widely expected to cut its key policy rate by not not as much as 0.25%, from 5.25%-to-5.5% to 5% to 5.25% at its Sept. 17-18 meeting.

That will kick off a cycle of more rate cuts, which may possibly, in turn, trigger off smaller-than-expected increases in banks' interest income.

On Tuesday, JPMorgan shares closed at $205.Fifty six, down $eleven.25 or 5.2%. The percentage loss used to be the largest among the 30 stocks throughout the Dow Jones Industrial Average, which used to be off Ninety three points, or 0.2%, to 40,737.

The loss subtracted nearly 74 points from the Dow. Goldman Sachs (GS) used to be down 4.4% at $467.13, knocking one more 142 points from the blue-chip index.

Pinto's announcement pulled financial stocks normally lower. Financial P.c. out Sector SPDR Fund (XLF) fell 1% to $Forty four.49.

The S&P 500 and Nasdaq Composite indexes were higher as a consequence of strength in tech stocks.

Banks ward off Fed's Basel III endgame

On the alternative hand, the day used to be now not a whole loss for banks.

The Federal Reserve announced it had reduced its plan to force the largest banks to raise the amount of capital they prefer to hold to supply protection to against losses.

The new increase is expected to be 9%. The Fed had first and foremost proposed a 20% increase. Regulators worldwide have been seeking banks to build more capital to supply protection to the worldwide economic system and guard against the necessity for taxpayer-backed bailouts.

The 2008-2009 financial crisis and the failures of three larger banks in 2023 shone an exceedingly bright light on banks' fragile financial condition.

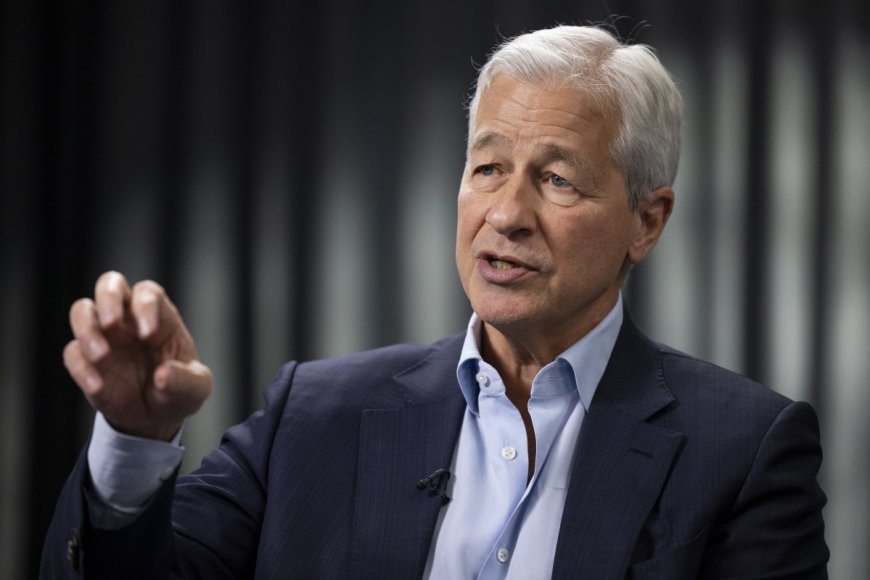

Banks, led by JPMorgan CEO Jamie Dimon, had fought the Fed on the foundations and threatened to sue if the govt. enacted them.

They argued that the foundations would make it more challenging to extend credit to customers and that the govt. didn’t offer enough proof that the changes would normally lend a hand toughen the banking system’s resilience.

More Wall Boulevard Analysts:

- Analyst says Intel should drop a key business to survive

- Analysts adjust Bookings.com stock price target on commute market

- Analysts place bets on Las Vegas strip casino stocks

Jamie Dimon calls annual meetings frivolous

That news from the Fed can have cheered Dimon, but it the famously blunt CEO had every other beef to talk about. He hates annual shareholder meetings.

"Let’s call it what it truly is distance. It’s a frivolous waste of time. They're hijacked by special interest groups," he said on Tuesday at an event held by the Council of Institutional Investors in Brooklyn, N.Y. Barrons covered the speech.

Dimon said shareholder meetings don’t promote "serious conversations" about important company or societal issues.

He suggested that regulations allowing anyone with a stake of not not as much as $2,000 in a public company to submit proposals for balloting at annual meetings are out of date.

Those remarks drew murmurs from the target audience, Barrons noted. CII is a corporation that represents large shareholders including public pensions, big unions, foundations, and company retirement funds.

Related: Veteran fund manager sees world of pain coming for stocks

What's Your Reaction?