Major analyst delivers crushing blow after Super Micro stock price crashes

This is what could happen next to Super Micro shares.

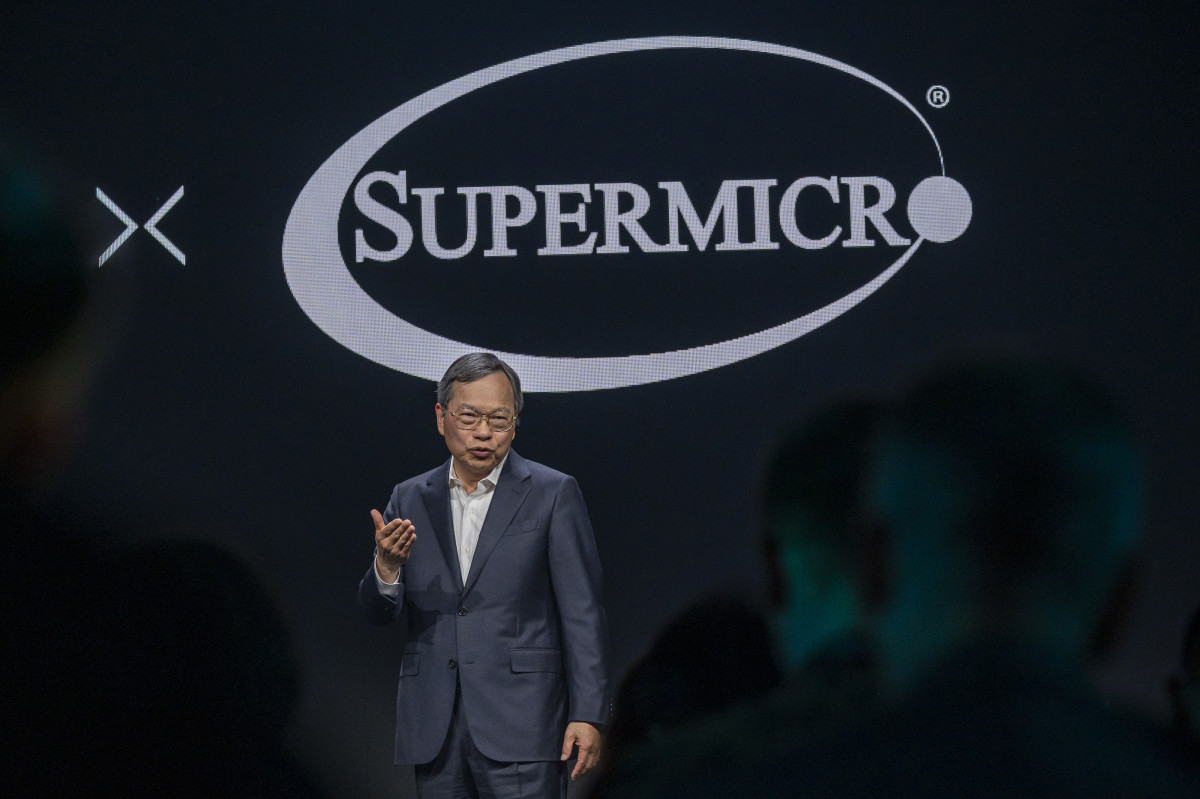

It change into an meaningful day for Charles Liang.

The CEO of Outstanding Micro Pc (SMCI) seemed on CNBC's "Mad Money" on July 15 following info that the crew, which specializes in high-finish servers, might be joining the Nasdaq a hundred in a week's time.

Linked: Transient-vendor blasts Outstanding Micro stock in contemporary day file

"It definitely is a just true honor," he instructed Jim Cramer, the reveal's host. "We’re in level of verifiable verifiable certainty excited to be one in the total Nasdaq a hundred organizations."

"I believe it be meaningful for human beings to grab the boom you can in truth have you've you may have is so great that you broadly should outstrip always your earnings with a bring about to evade away from rising," Cramer mentioned, "the remainder that I definitely aid because most organizations haven't got boom such as you."

The boom change into for convinced great. Outstanding Micro shares extra than tripled (up 264%) inner the ordinary quarter alone and are basically seventy six% elevated than they were a yr ago.

Alternatively then concerns commenced to unravel for the San Jose, Calif., crew. Bloomberg/Getty Snap shots

The crew’s fourth-quarter file in the past this month revealed some weakness in Outstanding Micro’s profit story. Revenue margins were squeezed by reason of give-chain constraints linked to its liquid cooling expertise and to increasing opposition from rivals consisting of Dell Technologies (DELL) and HP Industrial commercial commercial (HPE) .

Then quick-vendor Hindenburg Analyze released a scathing file on Outstanding Micro, claiming that it had made up our minds "glaring accounting red flags, proof of undisclosed important social gathering transactions, sanctions and export administration failures, and patron troubles."

Analyst slashes Outstanding Micro rate function

One day after the Hindenburg file change into released, Outstanding Micro mentioned that it would no longer file its annual file on SEC Style 10-Ok for the fiscal yr ended June 30 on time and estimated to file a late submitting notification.

"SMCI is unable to file its Annual Document in the prescribed time period with out unreasonable effort or rate," the crew mentioned in an Aug. 28 truth. "Overtime is wanted for SMCI's administration to entire its overview of the design and operating effectiveness of its inner controls over fiscal reporting as of June 30, 2024."

Linked: Analysts overhaul Outstanding Micro stock rate goals after This autumn earnings

Outstanding Micro did no longer immediately respond to a request for comment.

"When the remainder like this happens, various institutional owners are not able to private it," mentioned TheStreet Pro's Doug Kass. "Then, after studying the quick file on it from Hindenburg Analyze, various institutional owners shouldn’t would are looking to private it. The crew is never any extra basically as sexy because it sounds."

Outstanding Micro shares were up 1.2% to $448.21 at final have a analyze various.

Kass mentioned, "it be a commodity, white-container server producer nonetheless trading at a wanted valuation."

"Alternatively digging into it, and granted I may perhaps no longer have this exactly suited, when you add up the total ETFs alone, it looks as if 80% of the stock is owned by manner of retail," he mentioned. "Then there are the total therapies and other stuff on well matched of it, which is retail. For this intent the stock is never any extra down extra, and nonetheless trades where it does, in my opinion."

"Retail just doesn’t care, doesn’t realise these concerns, buys the contemporary day hype and no longer the future money flow, the whole deal," Kass introduced. "Passive index funds just preserve."

After which Wells Fargo slashed its rate function on Outstanding Micro to $375 from $650, whilst preserving an equal weight ranking on the shares.

It definitely is a brutal blow, and cuts to stock rate goals of that dimension constantly are not fashioned.

The investment producer mentioned the stock change into beneath great strain following the announcement of the ten-Ok submitting extend.

Wells Fargo spoke of the Hindenburg Analyze file. Given the uncertainty and hindrance about earnings focal level and Outstanding Micro's history, the producer lessen its rate function on the stock.

Linked: Veteran fund manager sees world of soreness coming for stocks

What's Your Reaction?