Microsoft Stock: Here's When to Buy the Dip

Microsoft stock is down more than 5% following a downgrade from UBS. Is it a buying opportunity or are still lower prices in store?

Microsoft stock is down more than 5% following a downgrade from UBS. Is it a buying opportunity or are still lower prices in store?

Yesterday, Apple (AAPL) - Get Free Report and Tesla (TSLA) - Get Free Report were getting hit. Now it's Microsoft’s (MSFT) - Get Free Report turn.

Shares of the megacap software stalwart — the second largest U.S. stock, with a $1.7 trillion valuation — are down more than 5% the day after a downgrade from UBS.

The investment firm argues that growth concerns for Azure and vulnerability regarding Microsoft Office 365 could hurt the business.

As a result, UBS analysts cut their rating to neutral from buy and slashed their price target to $250 from $300. On the plus side, that implies about 10% upside from current levels.

Microsoft stock is not taking the news well. The shares are hitting their lowest point in almost two months, having not traded at this level since Nov. 9.

We have looked at Microsoft, and it helped us identify a great buying opportunity. But how do the charts look now?

Trading Microsoft Stock

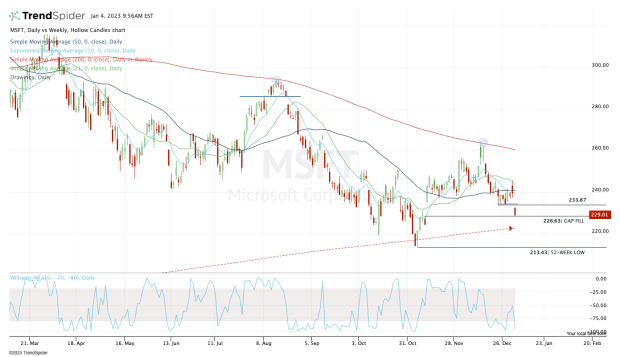

Chart courtesy of TrendSpider.com

Near the open, Microsoft was trading near $233, just below the December low of $233.87 and the multiweek support zone between $234 and $235.

It opened below this level and never looked back, knifing its way lower and eventually filling the open gap down at $228.63.

Aggressive buyers will use that as an opportunity to buy the stock. More conservative buyers are likely on the lookout for lower prices.

With the way U.S. equities are setting up, the conservative path isn’t a bad choice at this point.

Should Microsoft stock hold this area and turn higher, see how it handles the $234 zone, then its short-term moving averages like the 10-day and 21-day — the latter of which was most recently resistance.

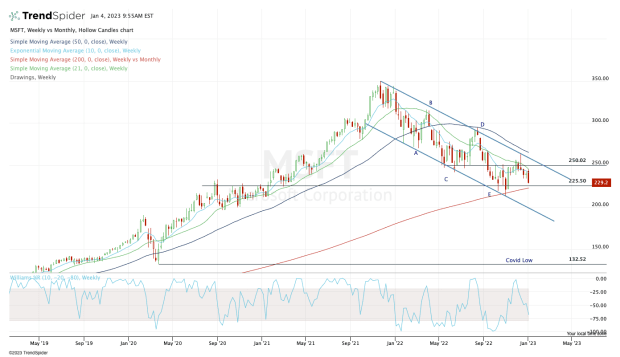

If Microsoft continues lower, a few levels stand out to me. The first is the 200-week moving average near $222. Chart courtesy of TrendSpider.com

The 200-week ended up being support a few months ago, and at that point the shares would be down about 36.5% from the all-time high. That’s proved to be a good long-term buying opportunity, even if the low isn’t in yet.

More tactical traders may consider waiting for a retest of the $213 to $215 zone and a tag of the current 52-week low at $213.43. The 61.8% retracement from the all-time high down to the 2020 low also comes into play near this zone, at $215.50.

If the selling really picks up, $197 to $200 could be in the cards, but anything below $215 is likely a great long-term opportunity in one of tech’s strongest businesses.

What's Your Reaction?