Midday stock movers: Super Micro tumbles; Apple up; Tesla, Rivian down

These stocks are the biggest market movers today.

The inventory market continues to recover from Monday's brutal sell-off, but 0.33-quarter earnings outlooks are pressuring some organisations.

The S&P Five hundred is up 1%, and the tech-heavy Nasdaq Composite launched 1.1%. The Dow Jones Industrial Fundamental won zero.6%, and the Russell 2000 Index rose zero.4%.

Nvidia lost zero.2% noon, when Tesla is down 1.2%. Other Mag 7 shares are up. Shutterstock/TS

S&P Five hundred big inventory movers in in the existing day

Five S&P Five hundred shares making big noon moves are:

- Fortinet Inc (FTNT) +25.9%

- Axon Enterprise Inc (AAXN) +18.9%

- International Payments Inc (GPN) +eight%

- Enphase Vigour Inc (ENPH) +5.three%

- MGM Lodges Global (MGM) +5.1%

The worst-performing 5 S&P Five hundred shares with the biggest noon drop are:

- Great Micro Computer Inc (SMCI) -sixteen.three%

- Airbnb Inc (ABNB) -12.eight%

- Charles River Laboratories Global Inc (CRL) -Eleven.2%

- Emerson Electric Co (EMR) -6.6%

- Bio-Techne Corp (TECH) -6%

Shares also proper rate noting with broad moves consist of:

- Apple (AAPL) +2.5%

- Tesla (TSLA) -1.2%

- Nvidia (NVDA) -zero.2%

- Amazon (AMZN) +2%

- Rivian (RIVN) -2.6%

- Lyft (LYFT) -12.1%

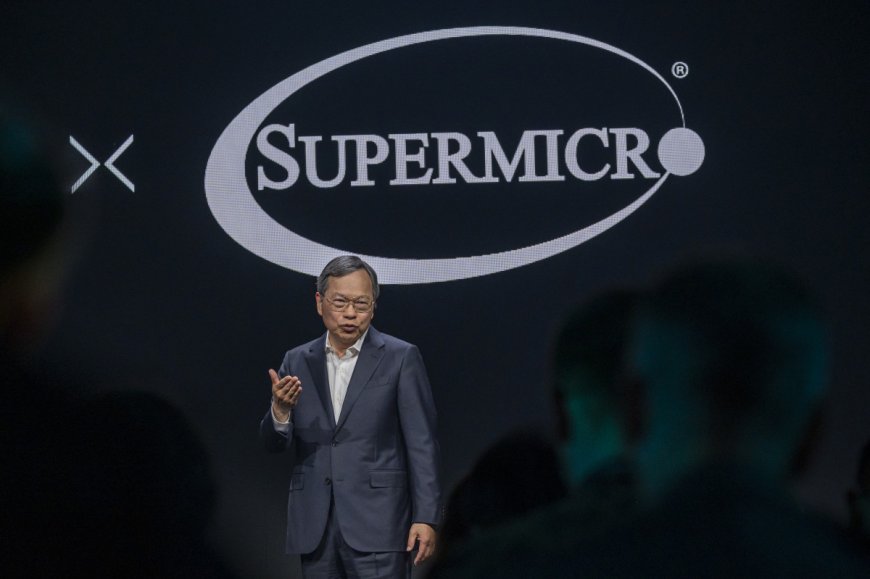

Great Micro slumps on earnings miss

Great Micro Computer inventory tumbled sixteen% noon following the discharge of the fourth quarter and whole-12 months monetary penalties for fiscal 2024.

The server organisation pointed out earnings per share of $6.25 for the fourth quarter ended June 30, which fell short of Great Micro's preceding forecast of $7.sixty two to $eight.Forty two and neglected the $eight.25 analyst estimate. Quarterly earnings became into $5.31 billion, simply beneath the $5.32 billion forecast.

Linked: Analysts overhaul Great Micro inventory value objectives after This fall earnings

Great Micro's gross margin for fiscal This fall became into Eleven.2%, the lowest margin Great Micro has pointed out simply by reason of this of the reality all of it started releasing quarterly penalties in May 2007.

The organisation outlined all thru the earnings title that it definitely is a lengthy way going by hassle shortages and will good have purchased extra merchandise if it had extra furnish, clearly for liquid-cooling substances.

Great Micro inventory is up eighty% 12 months subsequently some distance ensuing from the reality of AI-pushed server demand, but it has lost over 40% over the previous month. The organisation also announced a 10-for-1 forward lower up of its standard inventory, set for October 1, 2024.

Airbnb tumbles after slowing US demand

Airbnb inventory lost 12% noon after the organisation launched susceptible earnings penalties.

The homestay place of abode organisation earned 86 cents a share in the 2d quarter, missing the predicted ninety two cents per share. The earnings of $2.seventy 5 billion reasonably beat the $2.74 billion anticipated.

Linked: Airbnb CEO exhibits a standard mistake all thru pandemic layoffs

The organisation warned in a letter that there had been “some warning signals of slowing demand from U.S. guests,” an indication that the United States economy is nonetheless beneath stress and tourists are cautious about discretionary spending.

Lyft down no be aware earnings beat

Lyft inventory slid 12% noon after it announced upbeat 2d-quarter earnings and susceptible coaching in the morning.

The rideshare organisation pointed out a earnings of $1.44 billion, beating the estimated $1.39 billion. The organisation earned $zero.24 a share for the quarter, surpassing the forecasted $zero.18.

Elevated Tech Shares:

- Sony’s Bungie criticized for layoffs after CEO spends tons of a thousand's

- Nvidia inventory tumbles in tech hunch amid questions over key chip

- Analysts alter Palantir inventory value objective prior than earnings

The organisation also posted susceptible gross reserving and nil.33-quarter coaching. Lyft’s gross bookings for the June quarter totaled $4.zero billion, hitting best the limit conclusion of its preceding estimate of $4.zero billion to $4.1 billion. It continues to mission gross bookings for the September quarter to fall in the linked fluctuate.

Lyft’s rival Uber pointed out potent earnings the day previous, with earnings hitting $10.7 billion and EPS attaining 47 cents, each of which beat estimates. Uber inventory launched over 10% the day previous and is up 4% noon in in the existing day.

Linked: Veteran fund manager sees world of discomfort coming for shares

What's Your Reaction?