Nike Earnings Preview: What the Charts Say Ahead of the Q3 Report

Nike will report earnings on Tuesday after the close. Here are the must-know levels after the quarterly results come out.

Nike will report earnings on Tuesday after the close. Here are the must-know levels after the quarterly results come out.

Nike (NKE) - Get Free Report will be in focus on Tuesday after the close, as the athletic-apparel retailer gears up to report its fiscal-third-quarter results.

Nike stock had been trading well. From the October low to the 2023 high, the shares rallied 59%. But over the past six weeks, the stock pulled back more than 11%. Is this simple consolidation or a sign of more weakness to come?

That’s tough to say, as retail has been a very mixed bag.

Companies like Target (TGT) - Get Free Report, Costco (COST) - Get Free Report and many others have seen disappointing earnings reactions.

Others, like Ulta Beauty (ULTA) - Get Free Report and Dick’s Sporting Goods (DKS) - Get Free Report, have recently hit all-time highs and have reported strong results.

Don't Miss: Bank Stocks Remain Pressured. XLF Chart Support Is a Line in the Sand.

Given that Nike tends to be in the higher-end and “stickier” part of retail given its customer base — and given the clear momentum we’re seeing in sporting goods via Dick’s — it’s reasonable to have a bullish bias on Nike into the print.

The latest pullback helps cement that belief, as expectations have now come down a bit as well. Let’s look at the chart.

Trading Nike Stock Ahead of Earnings

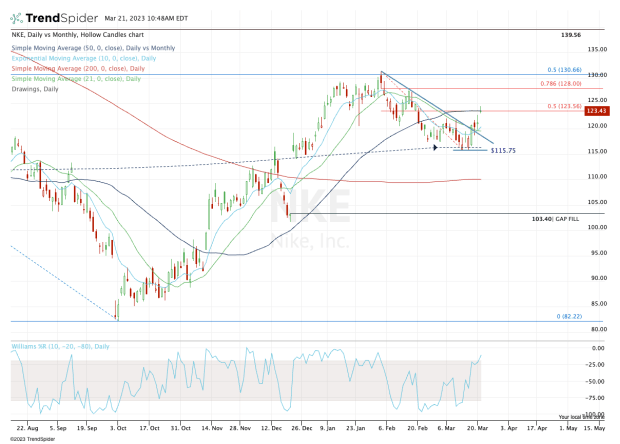

Chart courtesy of TrendSpider.com

Shares of Nike pulled back gradually over a six-week span, coughing up about 11.5% in the process.

The stock ultimately found support at the 50-month moving average and near the $115.75 area.

We’ve seen a pop over the past few days, as the stock broke out over downtrend resistance (blue line) and reclaimed the 10-day and 21-day moving averages.

Now Nike stock is pausing at the 50-day moving average and 50% retracement of the current decline. And we’re at a crossroads.

Don't Miss: Is the Drop in Caterpillar Stock Done? A Look at the Charts

If Nike continues higher, see how it handles the $128 level. Above that opens the door to the recent high at $131.31. Above both levels and Nike could march up to the $138 to $142 zone.

On the downside, the bulls want to see the stock pull back to the $115.75 area and hold there. A move below $115 and a close below $115.75 could open the door down to the 200-day moving average currently near $110.

A painful decline could ultimately set the stage for Nike stock to fill the gap near $103.50.

What's Your Reaction?