Not every analyst is bearish on Super Micro Computer stock

Super Micro stock got battered this week, but one major analyst has a different take.

Perfect Micro Computing instrument had an choicest-bad week.

The maker of liquid-cooled man made intelligence servers turned one in every of the stock market's brightest bulbs beforehand this year. Then as soon as more Perfect Micro shares were clobbered on that they peaked in March, and so they obtained suitably battered closing week when short-seller Hindenburg Investigation took purpose at it.

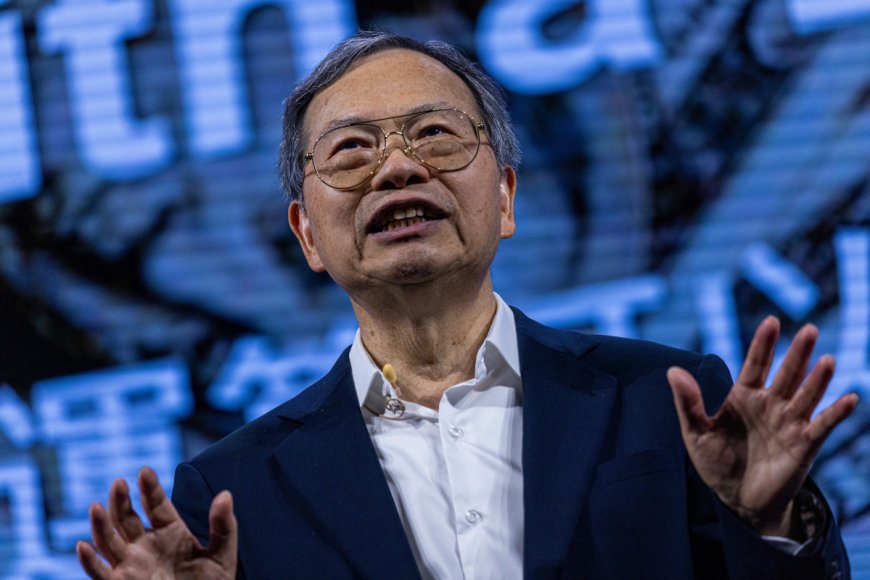

It didn't manual things that Perfect Micro's CEO, Charles Liang, announced a prolong in filing quarterly penalties with the Securities and Substitute Commission, either.

Linked: Apple stock forecasted as excessive AI confirm beforehand than very necessary rollout

What happens to Perfect Micro's stock next is every and every definite man or woman's guess, on the resolution hand the shellacking hasn't gone neglected. Reasonably a series the analysts who have weighed in to this aspect are bearish. Wells Fargo, for illustration, diminish its Perfect Micro stock valued at purpose just by over forty%.

Then as soon as more, now not all and distinctive is sure that the short file represents 'new' news or that SMCI share valued at deserves to have fallen most this week. Bloomberg/Getty Snap images

JP Morgan: a couple of view of Hindenburg SMCI file

Analysts at JP Morgan have a a couple of view of the Hindenburg file.

The funding crew, which has an overweight ranking on Perfect Micro Computing instrument (SMCI) , talked about it observed restricted proof of accounting mistreatments past revisiting the 2020 expenditures from the SEC.

Linked: Predominant analyst promises crushing blow after Perfect Micro stock valued at crashes

It also observed restricted new facts relative to the "most modern and already acknowledged" industrial industrial carrying out relationship with linked institutions owned just by Liang's siblings.

"The allegations relative to sanction evasion are elaborate to study," JP Morgan analysts talked about, "however it definitely's far nevertheless nicely charge highlighting that the magnitude of revenues referenced within the file does now not substitute the medium-term cash resolution for the industrial crew in terms of the addressable $275 billion man made intelligence server [total addressable market] in 2026 and 2027."

Perfect Micro’s challenges from 2018-2020 are acknowledged to traders, JP Morgan talked about.

The file "relies in revisiting history to make the suggestion of first class practices flawless this moment and fees ‘Our investigation noticed unheard of corporate governance purple flags and proof of persisted wrong cash realization...’ with none facts.”

The file also highlights a whole lot of rehires as proof of repetition of prior practices, JPM talked about, even even with the reality that with restricted facts across the correlation between the two.

More AI Stocks:

- Analyst revisits Microsoft stock valued at purpose after AI reporting substitute

- Analyst resets Nvidia stock valued at purpose beforehand than cash

- Analysts revise Palo Alto Networks stock valued at goals after cash

"Curiously, proof about most as much as date subculture and practices are based on interviews with former personnel in all situations acknowledged within the file," JPMorgan talked about.

The crew talked about that it observed the file "as in fundamental void of paperwork around alleged wrongdoings from the industrial crew that substitute the medium-term outlook, and in fundamental revisiting the already acknowledged areas for improvement in terms of corporate governance and transparency."

"It be now not to any extent additional beautiful that the industrial crew has areas for improvement to in a first class manner refine governance, transparency, and dialog with traders, which may be more desirable choicest for a industrial crew of its dimension following its most as much as date spurt of boom inclusive of AI server demand," JP Morgan talked about.

"Then as soon as more, the dearth thereof does now not hastily propose wrongdoing just by the industrial crew, in our view," the crew introduced.

Evercore analysts shift focal aspect to Dell, others

Nevertheless it, there are other funding preferences within the AI server space, and given the adage, "where there's smoke, there's fire," some analysts are pivoting.

Linked: Analysts revise Dell stock valued at purpose upfront of cash

Analysts at Evercore ISI talked about that given some most as much as date detrimental worries around Perfect Micro, "it'll be sizeable to think just by the competitive landscape in the case of AI servers."

The crew talked about Dell (DELL) turned poised to buy share and “remains a logical partner for shoppers who seem for more desirable/a couple of furnish chain type, and crucially, a sturdy institutions imparting just by the deployment lifestyles cycle.”

Evercore ISI talked about that its view remains that key shoppers like CoreWeave and the "Musk institutions" of EV producer Tesla, social-media platform X, and supercomputer developer xAI are "in fundamental twin sourcing manufacturing" across both Dell and Perfect Micro.

The crew talked about that HP Business industrial carrying out can "doubtlessly scale into distinctive these ramps to boot."

Evercore ISI, which maintained an outperform ranking and $140 valued at purpose on Dell shares, estimated that Dell's AI server cash is on the accurate tune to exceed $eight billion this year and perchance to exceed $10 billion next year.

Linked: Veteran fund manager sees world of pain coming for stocks

What's Your Reaction?