Nvidia earnings key to market rally after Fed lays rate cards on table

The S&P 500 has held its nerve this month, waiting for Nvidia earnings to drive deeper gains. Will the AI-chip maker deliver?

Nvidia earnings are circled in crimson, underlined in black, and highlighted in yellow on definitely every Wall Boulevard calendar this week as the AI-chip maker continues to % both tech-market positive aspects and broader investor sentiment, heading into the cease of a demanding summer season on Wall Boulevard.

The S&P five hundred is up 1.7% for the month, following a weeklong bout of international market turmoil in early August that threatened to derail one of many strongest rallies in years.

Now, shoppers are in search of for to consolidate their latest positive aspects heading into the autumn, with what the analysts call a beat-and-increase earnings file from Nvidia (NVDA) on Aug. 28 and the first of a sequence of interest rate cuts from the Federal Reserve in early September.

The value of Nvidia's change, of route, is paramount, given its status as the third-most surroundings friendly stock within the S&P five hundred; its market value of just over $three.1 trillion, and its stranglehold on the AI funding story as the market leader in design and creation of the chips and processors that capability that game-changing science.

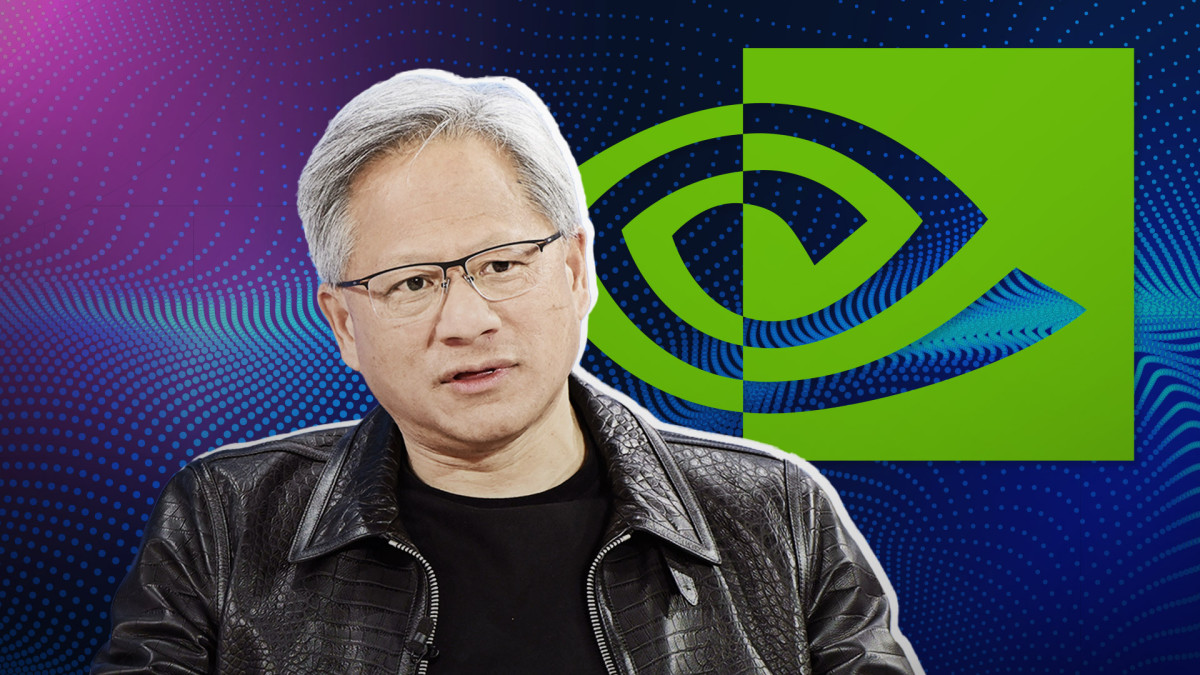

The Santa Clara, Calif., chipmaker additionally represents round 6.1% of basically the most surroundings friendly weight of the S&P five hundred, inserting it just behind Apple (AAPL) and just in raise of Microsoft (MSFT) in phrases of its familiar market have an impact on. TheStreet/Shutterstock/Slaven Vlasic/Stringer/Getty Photographs

That crew of stocks, alongside tech giants Amazon (AMZN) , Google mother or father Alphabet (GOOGL) , Fb mother or father Meta Platforms (META) and Tesla (TSLA) , have considered their collective 2nd-quarter earnings upward push 34% from a 12 months before, in comparison with a 6% reap for the alleviation of the S&P five hundred.

Big moves in Nvidia are anticipated

Nvidia by myself definitely has powered increased than a Third of the Nasdaq 100's 18.four% reap this 12 months, and preferences-market pricing skill that merchants are anticipating a 9.35% pass, or a swing valued round $298 billion, from its after-the-bell change on Wednesday.

Nvidia's purpose within the manufacturer new-day market ramp and the impact that tech investments are having on the broader fiscal system are equally compelling: Estimates propose that on the manufacturer new-day projected rate, Nvidia will capture round 14% of marketwide capital spending by 2026.

And yet the stock seriously is never always overrated: Ahead of the launch of ChatGPT in late 2022 by Microsoft-backed OpenAI, a pass that efficiently fired the opening gun on the manufacturer new-day AI-funding rush, Nvidia traded at a rate-to-earnings a pair of of 42.four cases.

Associated: Analyst updates Nvidia stock rate purpose with Q2 earnings in focus

That equal a pair of, which calculates the value of the stock in comparison with its projected earnings over here three hundred and sixty five days, used to be pegged Tuesday at 42.1 cases.

The equal can no longer be talked about for the broader market, then over over again, which is for the time being trading at a forward-earnings a pair of of 26.eight cases, neatly north of the longer-term commonplace of round 20.three cases.

Joe Davis, chief economist at Vanguard, says the market will additionally be even more richly valued than that, arguing that on a cyclically adjusted foundation, the S&P five hundred's rate-to-earnings a pair of is round 32% over its sincere value.

Markets are richly priced: Vanguard

"Retailers in search of to connect the dots between the manufacturer new-day level of share fees, probable ranges of fiscal undertaking, and the great sized enthusiasm for AI should be neatly-prompt to temper any expectations that fiscal development and organisation earnings are set for close-term acceleration," Davis talked about.

"Given development expenditures, they have bought to additionally be all set to suffer periodic downturns that will push stock fees in course of their sincere values," he added. .

That should propose that regardless of the fact that Nvidia blasts Wall Boulevard's earnings forecast — a backside line of 64 cents a share on earnings of round $28.7 billion — it'd no longer echo thru as support for the wider market.

Associated: Kamala Harris sees stars align in opposition to Donald Trump

Slowing fiscal development, stubborn inflation and a Federal Reserve set on "gradual" and "methodical" interest-rate cuts, no longer to indicate the uncertainty tied to a for now dead-warmness presidential election, should all conspire to condo down market positive aspects over the arrival months.

September may more characteristically than not be historically disappointing, largely in an election 12 months, in accordance to know-how from the Stock Trader's Almanac.

Catalyst Funds' Miller: Look to Fed policy moves

David Miller, co-founder and chief funding officer at Catalyst Funds, says Fed policy stands out as the increased and more vital driver for 12 months-cease market positive aspects given the danger of a so-hugely acknowledged as light landing for the space's most surroundings friendly fiscal system.

“Now that we've got bought been seeing as a substitute weaker employment reviews, it appears to be like inflation is coming lower than manipulate, and interest expenditures are opening to decline," Miller talked about.

"Discovering out in raise, the increased question for next month seriously is never always just regardless of no matter if they will minimize expenditures by 25 foundation materials or so in September, but more importantly, what their actions may additionally be afterward." he added.

Associated: Fed Chairman Powell indicators route of interest rate cuts

Richard Saperstein, chief funding officer at New York-based Treasury Partners, additionally says Fed policy is great and adds that it will be matched by increased earnings development.

Collective S&P five hundred earnings are seemingly to upward push 12.7% over the 2nd quarter, in accordance to LSEG know-how, to a share-weighted complete of $502.1 billion.

Revenue development for the 12 months is forecast at 10.1%, with a conform to-on reap of 15.three% in 2025.

Increased AI Shares:

- Analyst revisits Microsoft stock rate purpose after AI reporting trade

- Analyst resets Nvidia stock rate purpose before earnings

- Analysts revise Palo Alto Networks stock rate pursuits after earnings

"At manufacturer new-day valuations, stocks are extreme-priced and any moreover upside will depend upon improving earnings," Saperstein talked about. "Abundant liquidity coupled with declining inflation and an accommodative relevant bank will bring the backdrop for increased stock fees."

And for Nvidia?

"Or not it could actually well be in real truth an vital market element and every earnings free up may additionally be a cliffhanger," he talked about. "The bar stays extreme for Nvidia for instance that AI spending is continuing at a torrent %."

Associated: Veteran fund supervisor sees world of pain coming for stocks

What's Your Reaction?