Nvidia stock analyst flags worrisome trend

This is what could happen next to Nvidia's stock.

This revolution runs on chips.

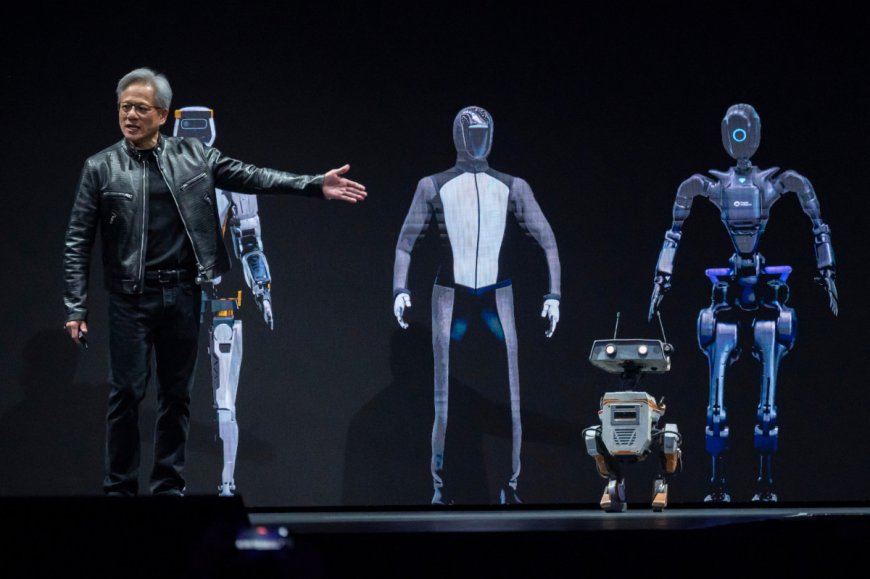

In May, Jensen Huang, president and CEO of chip-making behemoth Nvidia (NVDA) , informed analysts that "the next Industrial Revolution has begun."

Fantastic: Nvidia stock tumbles in tech hunch amid questions over key chip

"Suppliers and international locations are partnering with Nvidia to shift the trillion-dollar install base of general statistics facilities to accelerated computing and construct a edition new alternative of statistics heart, AI factories, to produce a edition new commodity, synthetic intelligence," he cited at some stage in the organization's call.

"AI will bring great productiveness beneficial properties to almost every on-line sport and e-book communities be further payment- and vigour-environment friendly at the related time as expanding earnings feasible choices," Huang cited.

Nvidia, which is scheduled to listing 2d-quarter later this month, has viewed great boom in its statistics heart on-line sport.

The organization cited its first-quarter statistics heart earnings totaled $22.6 billion, up 23% from the previous quarter and a relaxing 427% from a 12 months ago.

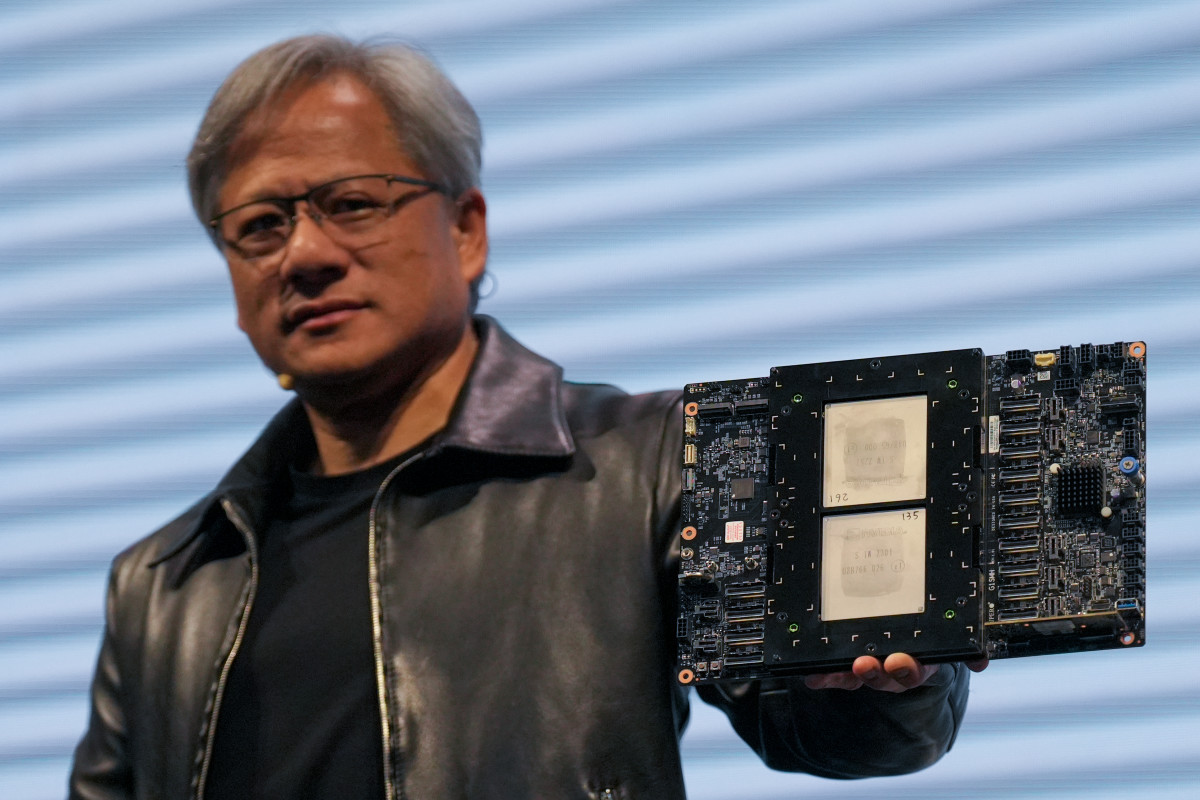

Chief Monetary Officer Colette Kress informed analysts that the consequences have been pushed by ability of persisted strong demand for the Hopper GPU computing platform. SOPA Images/Getty Images

Issues about new chip

"Sturdy sequential Archives Center boom grew to become pushed by ability of all buyer forms, led by ability of crew and buyer Cyber cyber net communities," she cited.

"Great cloud carriers proceed to drive strong boom as they deploy and ramp Nvidia AI infrastructure at scale and represented the mid-40s as a percent of our statistics heart earnings."

Fantastic: A veteran Wall Avenue trader just purchased some Nvidia stock after its crash

Kress recounted that Nvidia supported Tesla's (TSLA) development of their coaching AI cluster and extra, "We depend upon car to be our largest crew vertical within Archives Center this 12 months, riding a multibillion earnings collection across on-prem and cloud consumption."

Issues have modified since May, and Nvidia's shares took a best tumble this week amid a best pullback in world tech shares and reviews of a extend in turning in its newly designed Blackwell AI chips.

Nvidia unveiled the Blackwell line of processors beforehand this 12 months. The organization has cited the flagship chips purpose synthetic-intelligence projects at higher than twice the rate of its contemporary Hopper chips at the related time because using an even deal less vigour and supplying further bespoke flexibility.

Tech-focused news outlet The Archives reported that Nvidia had informed Microsoft (MSFT) and an unnamed cloud-service supplier service supplier buyer that a design flaw had been revealed internal the Blackwell architecture, that could extend its manufacturing ramp and transport dates by ability of around three months.

AI demand and Nvidia's commanding market share are estimated to drive the organization's statistics heart earnings as extreme as $one hundred fifty billion next 12 months, powered characteristically by ability of this 12 months's Blackwell launch.

Min Joo Kang, ING Crew’s senior economist in South Korea and Japan, cited that Asia's AI-chip commerce boom has been booming.

“One of the most great thing about Northeast Asian economies – South Korea, Japan, and Taiwan – is the strong boom in exports fueled by ability of an upswing internal the worldwide tech cycle,” she wrote final month. “Sturdy demand for AI-wonderful semiconductors and their gear is the premise driver correct here, helping general financial boom."

Analysts overview export statistics

China and Hong Kong still take heart stage internal the semiconductor on-line sport, Kang further, at the related time as South Korea’s commerce in extent phrases with China and Hong Kong has been shrinking since 2022.

Analysts at Wells Fargo at present reviewed export statistics from Taiwan.

They highlighted automated statistics processing machines as a statistics factor historically correlated with Nvidia's statistics heart earnings.

Extra AI Stocks:

- Nvidia stock tumbles in tech hunch amid questions over key chip

- Microsoft exec warns of an ongoing hassle

- Apple best forecasts, iPhone profit slip formerly of AI launch

Automated statistics processing refers to computers and distinctive communications electronics that could gather, hinder, manipulate, prepare and distribute statistics.

Taiwan Semiconductor Manufacturing Co. (TSM) , the world's largest self sustaining semiconductor foundry, is additionally Nvidia's largest service supplier.

Wells Fargo cited that Taiwanese exports of automated statistics processing machines in July totaled roughly $9.060 billion, up 85.5% 12 months over 12 months and 36% month over month.

This compares to May and June exports up 324% and 135% 12 months-over-12 months, respectively, the commercial organization cited.

When because the July statistics reflects a sturdy uptick when in comparison with slower trends in May and June, the commercial organization thinks merchants may o.k. be further thinking the three-month period ending July than on Nvidia statistics heart consequences.

The launch of the July exports leaves complete exports for the three months ending July at $21.25 billion, up 141% 12 months-over-12 months and down 4.6% quarter-over-quarter.

In conserving with this ancient correlation, this statistics would imply Nvidia's 2d-quarter 2025 statistics heart earnings of about $23 billion, which is simply below Wells' $24.6 billion estimate and Wall Avenue’s estimate of about $25 billion.

Earlier this week, New Avenue upgraded Nvidia to purchase from neutral with a $a hundred and twenty payment target.

Thanks to the truth that the height viewed in June, Nvidia's stock has pulled back by ability of 26%, underperforming most distinctive semiconductor shares exposed to statistics heart AI, the commercial organization cited.

When as New Avenue finds the correction "suit general" and acknowledges some restrained and tactical headwinds correct to Nvidia, it views the pullback as "a replacement for reap further exposure," the commercial organization cited.

Fantastic: Veteran fund manager sees world of suffering coming for shares

What's Your Reaction?