Nvidia stock price tied to 5 key items in Q2 earnings report

Nvidia is primed for a record-breaking move after its second quarter earnings report after the close of trading.

Nvidia is slated to checklist its specifically estimated 2nd quarter revenues after the shut of trading Wednesday, with traders making an attempt out for out the AI-chip maker to consolidate the market's elaborate-won August gains and set the stage for a chronic autumn rally.

Having additional more than $1.2 trillion in market magnitude as a end result far this 12 months, Nvidia (NVDA) has powered more than a third of the Nasdaq a hundred's 12 months-to-date develop and emerged as the undisputed barometer for synthetic-intelligence demand on account of its commanding market share in AI chips and processors.

Nvidia may good be the 2nd-heaviest weight on the S&P Five hundred, and with a market magnitude of $three.2 trillion, and may swing through the use of as tons as $300 billion, the elevated of the line put up-revenues pass on checklist, when it starts off trading Thursday.

Lower than are five key worries traders are seemingly to be aware of heading into and, crucially, out of Nvidia's revenues checklist.

1. Earnings forecast

Nvidia is forecast to put up a final analysis of Sixty five cents a share for the three months resulted in July, the chipmaker's fiscal 2nd quarter, a tally that will great be a 140% progress from the a comparable duration final 12 months.

Crew revenues, meanwhile, are forecast to upward thrust 114% from a 12 months beforehand to $28.9 billion, with Nvidia's documents core big the category with a pinnacle line tally of $25.1 billion.

The final revenues generators will come from Nvidia gaming division, which is forecast to upward thrust 12% to $2.6 billion, as great as its automotive, professional obvious and 'other' segments.

Linked: Analyst updates Nvidia stock fee goal with Q2 revenues in focus

Gross margins, which have accelerated through the use of around 10 percent characteristics worldwide the time of the final 12 months, are estimated to slim modestly, to around 75.5%, as spending on new products and programs continues to ramp.

"Nvidia's upcoming revenues checklist on Wednesday is poised to be a extreme match for the markets, given the firm's critical performance compatible through the use of the AI boost and its best a hundred and fifty% upward thrust in share fee 12 months-to-date," urged Lukman Otunuga, a senior markets analyst at forex alternate trading broking FXTM.

"A solid revenues checklist should stress markets to new highs, even as any sign of weakness may per risk set off a fantastic pullback, making Nvidia's commonplace efficiency a potential market mover this week," he additional.

2. Near-term outlook

Nvidia's shut-term outlook should be extreme for the stock's autumn commonplace efficiency as traders question the veracity of AI-spending plans from hyperscalers inclusive of Amazon (AMZN) , Facebook parent Meta Systems META, Google parent Alphabet (GOOGL) and Microsoft (MSFT) , all of that will per risk great be typical Nvidia purchasers.

Analysts imagine Nvidia to forecast company new-day-quarter revenues compatible through the use of the space of $31.7 billion, a measure that will indicate Seventy two% progress from the 12 months-beforehand duration. Earnings are estimated to toughen to 71 cents a share.

Linked: Nvidia revenues key to market rally after Fed lays fee playing playing cards on desk

For Nvidia's fiscal 12 months, which ends in January, analyst are in search of for out revenues compatible through the use of the space of $121.sixty three billion, double the $60.ninety two billion it booked over the prior 12-month duration.

"We continue to estimate for every $1 spent on an Nvidia GPU chip there's a $8 to $10 multiplier across the tech region, which speaks to our firmly bullish view of tech stocks over the following 12 months," urged Wedbush analyst Dan Ives.

"While traders should be anxious about this big spending wave and pissed off that pinnacle-line progress/margins from these investments should take time to materialize, this eventually speaks to our view [that] it in aspect of reality is a 1995 (very virtually 1996) commence of the Net Moment and now no longer a 1999 Tech Bubble-like second."

three. Blackwell chip delays

Seemingly the elevated of the line theme of dialog on the put up-revenues convention name may good be the shipping agenda for Nvidia's new Blackwell line, which affords purchasers a full rack of chips and processors that participate in at higher speed and efficiency in AI capabilities, even as consuming tons less vitality.

Evaluations over the summer season have advocate that design flaws, as great as furnish-chain snarls, have pushed out shipping of the new Blackwell programs till later compatible through the use of the 12 months, a pass that will have consequences for its company new-day-12 months revenues era.

Linked: Analyst revisits Nvidia stock fee goal after Blackwell assessments

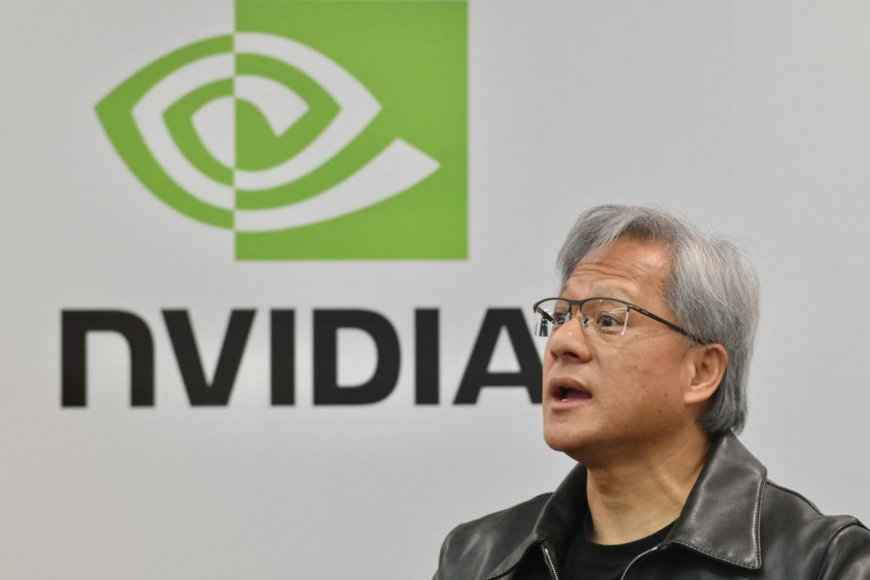

Nvidia CEO Jensen Huang will seemingly discuss to these experiences, as great as to part that purchasers may opt to appear forward to the new Blackwell line and scrub existing orders for the community's H100 Hopper chips.

KeyBanc Capital Markets analyst John Vinh argues, then over again that, that "modest expectations for Blackwell shipments compatible through the use of the third quarter have been backfilled with higher Hopper bookings." He supplies that "a fine diversity of the demand and upside should be H100-driven" over the three months ending in October

4. Rubin desktop launch

Huang has told traders that Nvidia plans to update its AI accelerators every and yearly, resulted in through the use of the true reality it ambitions to cement its location as the foremost provider of AI-powering technologies in

"Our typical philosophy is amazingly easy: build the done documents-core scale, disaggregate and sell to you materials on a one-12 months rhythm, and push the total lot to science limits,” Huang told an match in Taiwan beforehand this spring.

At that a comparable match, Huang unveiled plans for a new household unit of chips and processors additionally usually called Rubin. Named after the American astronomer Vera Rubin, who's credited for discovering so-additionally usually called darkish matter, the new Rubin programs should be rolled out in 2026, Huang urged.

Linked: Analyst resets Nvidia stock fee goal as CEO unveils new AI platform

The new desktop, that helps you to encompass subsequent-era extreme-bandwidth reminiscence chips additionally usually called HBM4, should be made through the use of Taiwan Semiconductor (TSM) using so-additionally usually called 3nm science, which permits for the packing of more transistors right into a given area.

Past these wide strokes, Huang didn't ship tons area on the Rubin desktop, nor its seemingly upgrade, Rubin Ultra, and traders should be eager to hear what Nvidia has deliberate for the 2026 launch.

5. China restrictions

U.S. restrictions on the export of extreme-conclusion chips to China, that have been tightened final 12 months through the use of the Commerce Department, remain one amongst the few best headwinds to Nvidia's shut-term progress story.

Finance chief Colette Kress told traders in May that "our documents core revenues in China is down seriously from the measure before the imposition of the new export administration restrictions in October."

Alternatively she additional that "we imagine the market in China to remain very aggressive going forward" resulted in through the use of the true reality it ramps up the design of new products that do not require an export administration license.

China revenues, before the Commerce Department restrictions, comprised between 20% and 25% of Nvidia's commonplace revenues. China accounted for around $10.4 billion in commonplace revenues for Nvidia final 12 months.

Linked: Big names exit Nvidia stock as AI great stumbles formerly revenues

Nvidia has developed a step-down edition of its Hopper processors, the H20, so that you should be going to rearrange to be purchased to China-based purchasers and reportedly final month approved the usage of Samsung Electronics' (SSNGY) HBM3 chips in its programs.

Reuters additionally pronounced final month that Nvidia is engaged on a edition of its B200 chip, which is a area of its new Blackwell sequence, that it would sell to China-based purchasers with out falling afoul of U.S. restrictions.

Linked: Veteran fund supervisor sees world of discomfort coming for stocks

What's Your Reaction?