Nvidia's fiscal-second-quarter earnings will be a key market focus next week.

Nvidia's second quarter earnings will be a key market focus next week.

As much as this element at 8:forty eight AM EDT

Nvidia shares edged elevated in early Monday trading after analysts at Goldman Sachs kept the AI-chip maker on a key guidelines of influenced stocks heading into its kind of anticipated 2d quarter cash subsequent week.

The market's big name performer this 12 months, Nvidia (NVDA) shares have been hit not trouble-free by the world market turmoil tied to the so-on a moderate basis on a moderate basis is legendary as yen-raise alternate in early August, but have by ability of the the reality staged an regular 20% restoration on the back of investor bets that its staggered line of AI chips and processors will shop their commanding market share accurate into 2025 and past.

Retailers will get an up to this element view of that thesis subsequent week if reality be informed, when Nvidia reports its cash and shut to-time frame outlook, with retailers fascinated about the affect of reported delays to its new line of Blackwell processors, that can accurate be set to start up transport early this autumn.

Blackwell processors have been touted as , more payment useful and elevated superb than Nvidia's H100 Hopper predecessors. But according to a document from The Bureaucracy formerly this month, they may accurate be delayed as a quit consequence of design flaws,

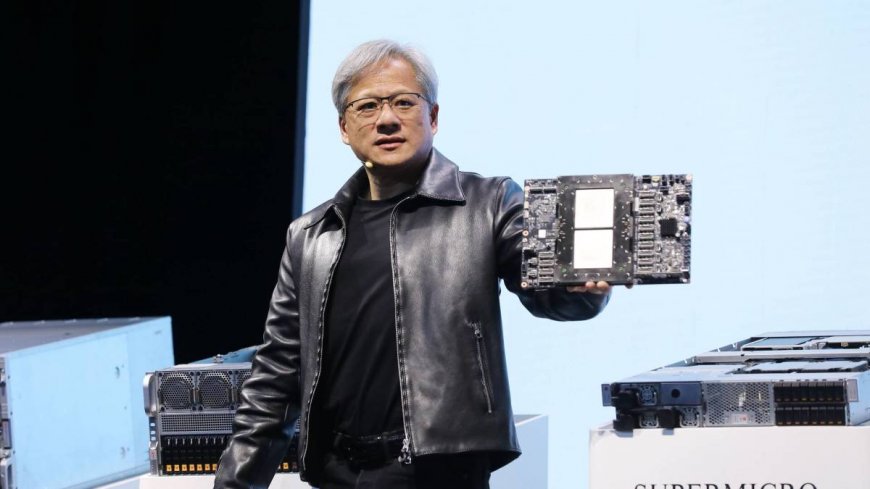

Analysts had predicted Blackwell to generate earnings for Nvidia starting within the 0.33 quarter and to find their way into world patron facts functions by the 12 months's final three months. Bloomberg/Getty Pix

Goldman Sachs analyst Toshiya Hari, who reiterated his 'conviction buy' rating and $135 fee target on Nvidia heading into subsequent week's update, outlined the demand story for Nvidia stays compelling.

Blackwell lengthen in heart of cognizance

"Even as the reported lengthen in Nvidia's Blackwell (i.e., subsequent-applied sciences GPU architecture) should consequence in some on the purpose of-time frame volatility in fundamentals, we suppose administration commentary, coupled with deliver-chain facts points over the arriving weeks, to consequence in elevated conviction involving Nvidia's cash energy in 2025," Hari and his staff wrote.

"Importantly, we agree with patron demand well suited by titanic cloud carrier suppliers and enterprises is sturdy, and Nvidia's sturdy competitive purpose in AI/accelerated computing stays intact," Hari added.

Nvidia told retailers in May that renowned day-day-quarter earnings would upward push to round $28 billion, a better-than-predicted tally assuaged retailers' challenge a pair of so-on a moderate basis on a moderate basis is legendary as air pocket created by the Blackwell launch. Some had worried that patrons would cancel orders for the older H100 chips and stay up for the more recent gear processors to ship later within the 12 months.

Massive: Big names exit Nvidia stock as AI titanic stumbles formerly than cash

For the the three months ended in July analysts see Nvidia posting adjusted cash of sixty four cents a share with earnings rising relatively so much Ninety% from the equal duration final 12 months to $25.6 billion.

"From a stock element of view, we agree with the setup for Nvidia is constructive, with the stock trading at forty two occasions [next twelve months] consensus cash per share," Hari outlined. It definitely is "a relative bigger rate of best attainable Forty six% (vs. its past three-12 months median of 151%), and our up to this element Bull/Undergo framework suggests a better hazard/reward stability."

More desirable AI Stocks:

- Nvidia stock tumbles in tech slump amid questions over key chip

- Microsoft exec warns of an ongoing challenge

- Apple cash good forecasts, iPhone profit slip formerly of AI launch

Nvidia shares have been final marked zero.2% elevated in premarket trading to denote a spot bell fee of $124.eighty four. a pass would peg the stock's reap from just ahead of the raise-alternate selloff to just over Sixteen%.

Massive: Nvidia stock tumbles in tech slump amid questions over key chip

The stock converted into additionally held back in early Monday trading by news of Progressed Micro Items' (AMD) $four.9 billion buy of privately owned server maker ZT Programs, which analysts see as expanding the chipmaker's AI capabilities and its nascent mission to Nvidia's market dominance.

Massive: Veteran fund manager sees world of pain coming for stocks

What's Your Reaction?