Nvidia's Jensen Huang and new inflation data may rock the markets

A key earnings report from the AI giant and an extremely important inflation report top the week's stock and economic events.

When Federal Reserve Chairman Jerome Powell pointed out the time had come to out slicing passion costs, one would well-nigh hear the cheering from one side of america to the resolution.

Stocks soared in protecting with Powell's speech. Rates of passion went down. Gas costs fell, too, and most humans now not pointed out that oil costs were up on Friday.

It used to be an beautiful day. Even as the vibe, as it were, used to be benign going into the weekend, one would on the opposite hand see that issues would get unraveled.

Associated: Analysts revise Target stock can rate estimates after cash

To stress the aspect, Israel early Sunday attacked Hezbollah positions in southern Lebanon.

Small print on casualties and deaths used to be now not reachable at 12 a.m. ET Sunday. That's now not clear how the assaults and other combating would most regularly have an have an impact on on abroad markets on Monday.

The geopolitical concern adds increased anxiety to an undercurrent of unease that continues with layoffs coming in many groups, including science and lengthening lists of small commercial organisation bankruptcies.

The U.S. presidential and national election campaigns will swing into high gear over the Labor Day Weekend. In a linked potential to the Midsection East concerns, the Ukraine-Russia Struggle would emerge as increased hazardous than it already is.

In the interval in-between, relevant here is what to retain a watch on this week for markets.

Watch the PCE document

The Fed begun what looked like an era of fine feelings closing week with the Aug. 21 launch of minutes from its July meeting. On a time-honored basis, these are drab, wonky kinds. This one recounted truely that keenness can rate cuts were on the Fed's intellect in an incredible way.

On Aug. 30, the Commerce Branch's Bureau of of Financial Prognosis will launch its July document of the Very possess Consumption Costs Price Index. This measures can rate transformations of the coolest and choices purchasers buy and use. It has fewer idiosyncrasies than the Customer Price Index, and the Fed governors and laborers go with it.

In June, the PCE proven the index rising 2.5% from a 12 months beforehand. The consensus estimate is for a 2.4% commerce, most regularly a dash less. Gas costs are limit. So are passion costs and some food costs.

If the PCE document suggests a unpredicted start, markets will behave badly, and the Fed, ever kinds-based, may should react.

Extra on markets

- Analysts reset objectives for key Nvidia supplier after cash

- Jerome Powell's in vogue day passion can rate suggestions recommend consumers' subsequent pass

- From Nike to UnitedHealth: Pinnacle Dividend-Enlarge Stocks for Excessive Returns

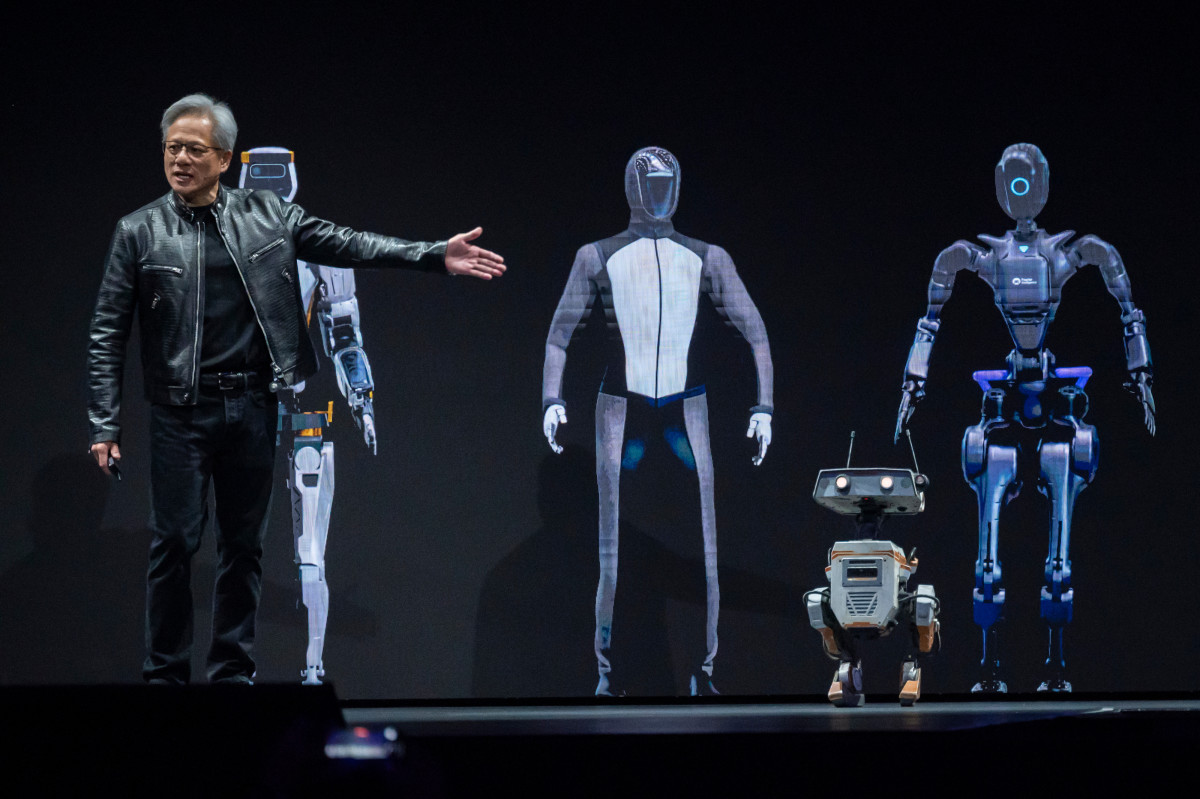

Nvidia will dominate the investor speak about

Nvidia (NVDA) , the developer of graphical processing units in order that it may be on the heart of synthetic intelligence functions, is the star of the week. It evaluations its fiscal-2nd quarter cash after the Wednesday close.

Nvidia shares are up 161.2% in 2024, according to Friday's close of $129.37. Its market cap of $3.182 trillion is now 2nd amongst U.S.-based groups, behind Apple's (AAPL) $3.45 trillion market capitalization. Microsoft's (MSFT) $3.01 trillion market cap is 0.33.

Nvidia is estimated to document Sixty 4 cents a share, up an unheard of 156% from the 25 cents a share reported a 12 months ago. Earnings is projected at $28.6 billion, up A hundred and ten% from a 12 months beforehand.

The intention is that definitely each frightened in creating functions that use AI are not able to get sufficient of Nvidia's Hopper GPUs and, they hope, the new Blackwell better half and teenagers of GPUs. The big difference: The total Hopper GPU has eighty billion transistors. The total Blackwell GPU has 208 billion transistors.

There's an concern and a chance: Blackwell GPUs were supposed to be reachable on the provision up of the 12 months. Now, per The Small print and other sources, the merchandise is never reachable unless March 2025 this is why of design flaws.

The concern will have an have an impact on on the plans of Microsoft, Facebook-parent Meta Systems (META) and Google-parent Alphabet (GOOGL) . All have pointed out they're geared up to spend billions of dollars on the GPUs and the linked items of the units to get beforehand.

In the past, the evaluations haven't affected the stock can rate. Then over as soon as more analysts will definitely ask in regards to the Blackwell GPUs on the convention title after the cash document is launched. Bloomberg/Getty Photos

Store in intellect CrowdStrike

CrowdStrike (CRWD) , the amazing cybersecurity commercial organisation, would likely go with if no private notices their they launch their cash literally on the equal time as Nvidia.

It be this is why of the walk in the park a flawed update that it despatched out in July to purchasers' networks built on Microsoft tool software program prompted computing tool outages across the globe. Among the toughest hit were airways, significantly Delta Air Traces (DAL) , which couldn't get the disruptions mounted for thus much of days. Television evaluations proven stranded passengers camped out almost Delta ticket counters at airports across america.

In the past, which is now not clear if CrowdStrike faces any economic offender responsibility from the computing tool disruptions.

CrowdStrike is estimated to document fiscal 2nd-quarter cash of 97 cents a share, up 31% from a 12 months ago. Earnings is projected at $958.6 million, up 30% from $731.5 million a 12 months beforehand.

Between the computing tool outage and the market selloff in late July and early August, the stock has had a hazardous summer season. The shares fell Forty nine.7% between a $393.33 intraday peak on July 9 to an Aug. 5 intraday low of $200.Eighty one. That's up 35% at some level of the the reality and up 6.4% for the 12 months.

Regardless of every of the volatility, most fine one among the 50 analysts who hide the commercial organisation costs it a promote, with two giving it an underweight ranking. Thirty-two can rate the shares a buy. Eight can rate it a save.

Associated: Uber robotaxi push should be subsequent step in sinister pattern

Among groups also reporting this week

Tuesday: Branch save retailer Nordstrom (JWN) . Estimate: seventy 4 cents a share, down from 84 cents a 12 months ago.

Wednesday: Dow part Salesforce (CRM) . Estimate: $1.Seventy three a share, up from $1.63. HP Inc. (HPQ) . Estimate 86 cents, unchanged from a 12 months ago. Netapp NTAP. Estimate $1.15, up from 84 cents a 12 months ago.

Thursday: Server maker Dell Applied sciences (DELL) . Estimate $1.Forty nine, up from $1.forty 4. Chip-maker Marvell Science (MRVL) . Estimate: 13 cents, down from 18 cents a 12 months ago. Pattern retailer Lululemon Athletica (LULU) , Estimate: Estimate 2.ninety 4, up from $2.68.

Associated: Veteran fund supervisor sees world of pain coming for shares

What's Your Reaction?