Stock Market Today: Stocks extend run; Nvidia, Apple, Amazon active

The S&P 500 has risen for six consecutive trading sessions, and is on pace for its longest streak of gains for the year.

Have a seriously look into returned for updates for the time of the trading day

U.S. equity futures bumped increased Wednesday. placing the S&P five hundred on percent for its longest prevailing streak of the year, as retailers key on passion-expense-cut warning signs from the Federal Reserve and look to the beginning of 2d-quarter-earnings season later inside the week.

Shares ended increased as soon as to get back Tuesday, with the S&P five hundred notching its thirty sixth report close of the year to extend its 2024 get guard of to simply below 17%.

The tech-based Nasdaq, using a rebound in Nvidia (NVDA) and another report close for Apple (AAPL) , additionally hit an all-time major to take its year-to-date get guard of previous 22.7%.

Principal: Excessive Wall Road analyst troubles stark warning for shares

Every benchmarks were additionally helped by task of lower Treasury bond yields, which proceed to alternate at multimonth lows following the first day of testimony on Capitol Hill from Fed Chairman Jerome Powell.

Powell, who will face questions from the Dwelling Fiscal Choices Committee later in at the second, told the Senate Banking Committee that even as he did no longer favor to signal the Fed's next expense go, “increased good know-how would beef up our confidence that inflation is transferring sustainably towards 2%." Scott Olson/Getty Snap images

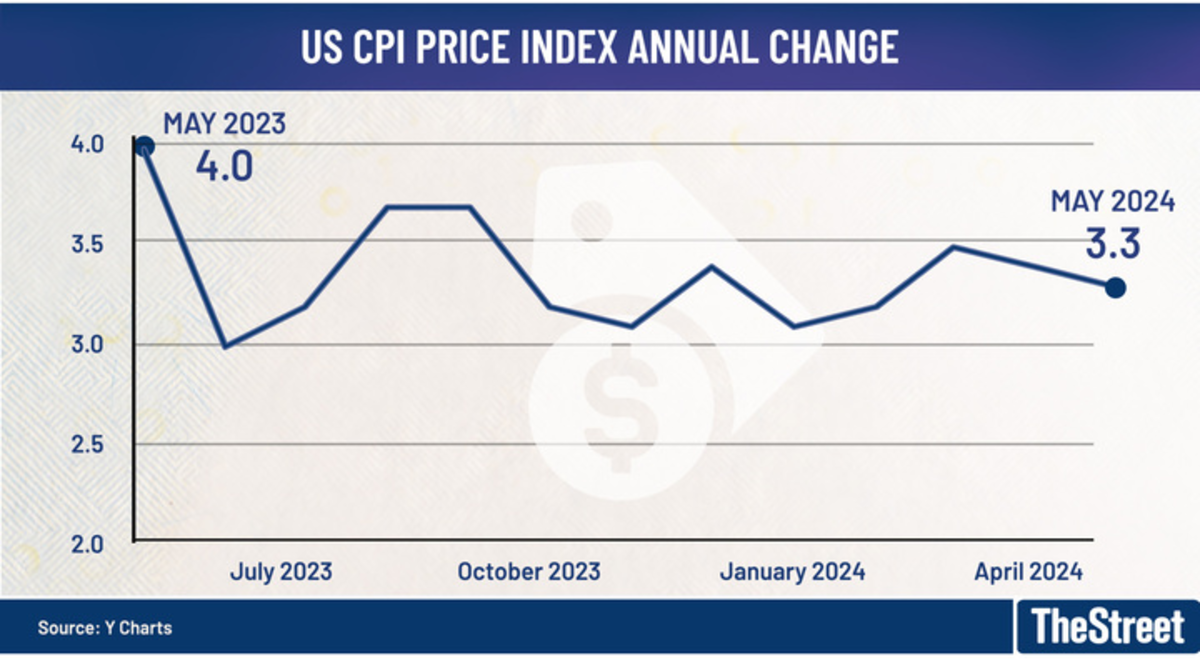

That puts market midsection of attention squarely on day after in at the second's June Buyer Rate Index report, which is estimated to instruct headline pressures easing to an annual expense of Three.1%, the lowest in a year, with core inflation keeping at Three.4%. Y charts

CME Group's FedWatch pegs the percentages of a July expense go at simply 5% but sees the percentages of a September reduction, the increased go in view that that July of most appropriate year, at round 73.Three%.

That has benchmark 2-year notes trading at a three-month low of 4.sixty two% heading into the beginning of the New York session, with 10-year notes pegged at 4.276% upfront of a $39 billion benchmark public sale later inside the day.

Principal: Analyst resets Nvidia stock expense purpose in chip-quarter overhaul

On Wall Road, futures contracts tied to the S&P five hundred propose an 11-level opening-bell get guard of, even as those linked to the Dow Jones Industrial Hassle-free are priced for a Three-level dip.

The Nasdaq, which is up very simply about 4% for the month, is priced to add sixty five reasons to most appropriate nighttime time's report close.

Nvidia shares were the market's most-active stock in premarket trading, rising very simply about 1% to $132.sixty two, even as Apple extended its latest run of gains, adding zero.2% to $229.13

Amazon (AMZN) shares, in the interim, were up zero.4% after Founder Jeff Bezos supplied another $863.4 million of stock inside the retail and cyber internet offerings great, taking his familiar cash for the year to simply below $10 billion.

Increased Wall Road Analysts:

- Analyst revisits Nvidia stock expense purpose after Blackwell tests

- Analysts prescribe new Walgreens stock expense goals after earnings

- Analyst revises Fb dad or mum stock expense purpose in AI arms race

In far-off areas markets, Europe's Stoxx 600 develop into marked zero.sixty one% increased in Frankfurt, with Britain's FTSE a hundred rising zero.Fifty eight% in London.

In a single day in Asia, Japan's Nikkei 225 hit another all-time extreme, rising zero.sixty one% to forty one,831.ninety 9 reasons, even as the regional MSCI ex-Japan benchmark slipped zero.1% into the close of trading.

Principal: Veteran fund manager sees world of pain coming for shares

What's Your Reaction?