Stock Market Today: Stocks higher as Nvidia passes Apple, chases Microsoft

Wall Street now has three tech giants valued at $3 trillion. Collectively, they comprise 20% of the S&P 500.

Check back for updates throughout the trading day

U.S. equity futures were mixed in early Thursday trading, following on from another set of record highs on Wall Street last night, as big tech stocks continue to power broader market gains and investors extend bets on an autumn Fed interest rate cut.

Updated at 8:22 AM EDT

You wait forever for a bus ...

The European Central Bank delivered the second major G7 central rate cut in a many days Thursday, delivering its first reduction since 2019 following a two-day policy meeting in Frankfurt.

The ECB lowered its deposit rate to 3.75%, from a record high 4%, with similar-sized reductions in its refinancing rate and its marginal lending facility.

Curiously, the bank also lifted its forecasts for core inflation rates this year and next, expecting levels of 2.8% and 2.2% respectively. The ECB targets an inflation rate it describes as "close to, but just below, 2%".

We cut our key interest rates by 0.25 percentage points.

Keeping interest rates high for nine months has helped push down inflation.

It is now appropriate to moderate the degree of monetary policy restriction.

Read our monetary policy decisions https://t.co/AaaLd3hGEB pic.twitter.com/dTTYKg7itm— European Central Bank (@ecb) June 6, 2024

Updated at 7:50 AM EDT

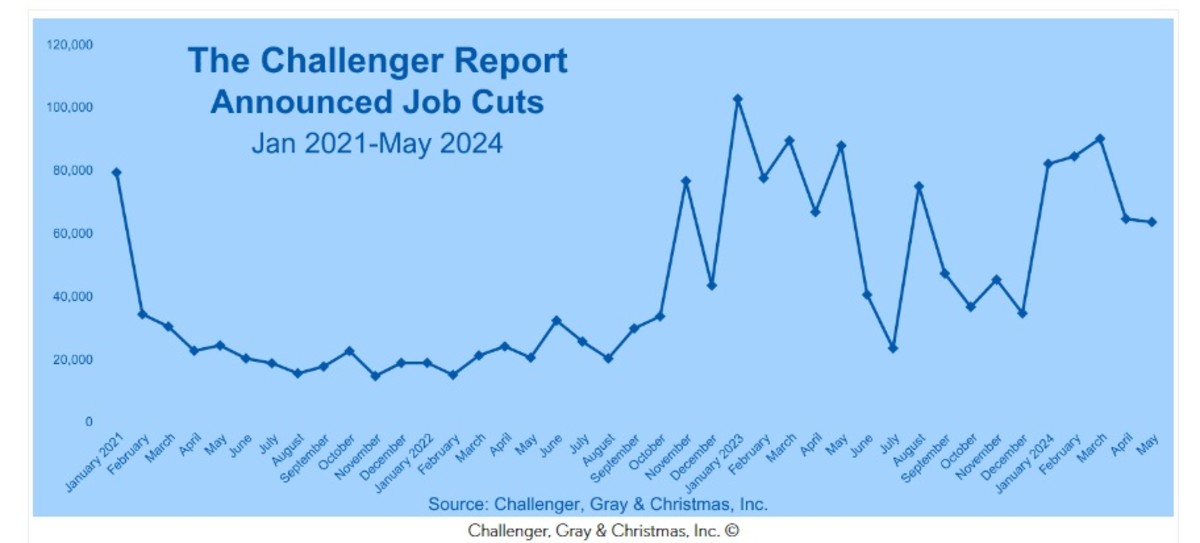

More job market cracks

Challenger Gray's closely-tracked report on corporate layoffs showed that May job cuts were largely flat to the previous month, at 63,816, but were down around 20% from the same period last year.

Overall hiring plans, however, have fallen to the lowest levels since 2014 this year, with announced additions of just under 51,000, around 50% lower than the level announced over the first five months of 2023.

Stock Market Today

Nvidia's (NVDA) last-day surge lifted the AI-chip and -processor maker past the $3 trillion mark last night, with its record close taking it past Apple (AAPL) and to within touching distance of Microsoft (MSFT) as the world's most valuable company.

Related: Nvidia earnings seal Big Tech stock dominance

The advance helped both the Nasdaq and the S&P 500 reach all-time highs, with the latter extended its year-to-date gain to around 12.25% on bets that a cooling job market will cement the case for a September Fed rate cut.

Benchmark 10-year Treasury note yields fell to a two-month low in overnight dealing and were last changing hands at 4.293% following yesterday's softer-than-expected ADP employment report and ISM activity data that showed moderating growth and easing price pressures.

Yesterday's 25 basis point rate cut from the Bank of Canada, the first reduction from a G7 central bank since the pandemic, added to hopes of an autumn Fed move. Investors were focused on today's European Central Bank decision prior to the start of trading.

Investors will also track today's weekly jobless claims data ahead of the Labor Department's May payroll report prior to the start of trading on Friday.

Economists expect the report to show that around 185,000 new jobs were created last month, with the headline unemployment rate holding at 3.9%.

Related: Interest rate cut bets shift after surprising ADP jobs data

Heading into the start of the trading day on Wall Street, futures contracts tied to the S&P 500 suggest a modest 2 point decline while the Dow Jones Industrial Average is call 38 points lower.

Premarket gains for Nvidia and Advanced Micro Devices (AMD) are supporting the Nasdaq, which is called 6 points higher.

Nvidia shares were marked 1.26% higher at $1,239.84 each, pegging its market value at $3.04 trillion. Microsoft, which closed with a value of $3.15 trillion, was marked 0.21% lower while Apple was little changed at $3 trillion.

$NVDA, $AAPL and $MSFT currently

account for ~20% of the S&P 500. pic.twitter.com/9Td3cErMB4— Geiger Capital (@Geiger_Capital) June 5, 2024

Other stocks on the move include Lululemon Athletica (LULU) , which jumped 7.7% after the sports and leisurewear group posted stronger-than-expected fiscal-first-quarter earnings thanks in part to robust China sales.

Five Below (FIVE) , meanwhile, plunged 17% after slashing its current-quarter and full-year sales forecasts following a disappointing first-quarter update.

More Wall Street Analysts:

- Analysts compute new HP stock price target after earnings

- Analysts retool C3.ai stock price target after earnings

- Analysts reboot Dell stock price targets ahead of earnings

In overseas markets, Europe's Stoxx 600 hit a fresh record, and was last marked 0.66% in the green in Frankfurt, ahead of today's ECB rate decision. Britain's FTSE 100 added 0.34% in London.

Overnight in Asia, tech stocks helped the Nikkei 225 edge 0.55% higher in Tokyo, while the regionwide MSCI ex-Japan benchmark rose 1.02% into the close of trading.

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?