Super Micro Computer to join Nasdaq-100

The tech company's shares have been among the year's hottest. The company it is replacing has struggled all year.

Great Micro Pocket e booklet computing equipment (SMCI) has been concept about among the 12 months's stellar performers.

The maker of excessive-conventional performance, excessive efficiency personal computer computing equipment servers is a key cog within the raise of manufactured intelligence.

Its stock has basked within the glow of the emergence of Nvidia (NVDA) and others fascinated about rising and marketing and marketing AI applications.

Acceptable: Analysts revamp AMD stock can rate objective on AI deal

Great Micro shares jumped 264% within the first quarter on my personal. Inspite of a 21% decline within the 2nd quarter, the shares are still up 220.1% for the 12 months. At $909.96 on Friday, the shares are up Eleven.1% within the first 9 purchasing and selling days of July.

No wonder that Nasdaq (NDAQ) has determined to make Great Micro Pocket e booklet computing equipment a hassle of its Nasdaq-100 and Nasdaq-100 equal-weighted indexes. The pass takes have an influence on ahead of purchasing and selling opens on July 22.

The Nasdaq-100 is composed of 100 of the largest nonfinancial agencies within the Nasdaq Index.

Its membership comprises every of the shares jointly widely said simply because the Acceptable Seven: Apple (AAPL) , Amazon.com (AMZN) , Google-father or mom Alphabet (GOOGL) , Fb-father or mom Meta Systems (META) , Microsoft (MSFT) , Nvidia, and Tesla (TSLA) .

Big income, revenue gains

Thru its fiscal 1/3 quarter, Great Micro, confirmed in 1993 through Charles Liang, earned $855 million, or $15.sixty eight per share on income of $9.6 billion. grew to turn out to be into up 95% from the 12 months ahead of, with income up 86%.

The employer industrial school boosted fourth-quarter income preparation to $5.1 billion to $5.6 billion, with full-12 months income estimated at $14.7 billion to $15.1 billion. That's up from an factual full-12 months income estimate of $9.5 billion to $10.5 billion.

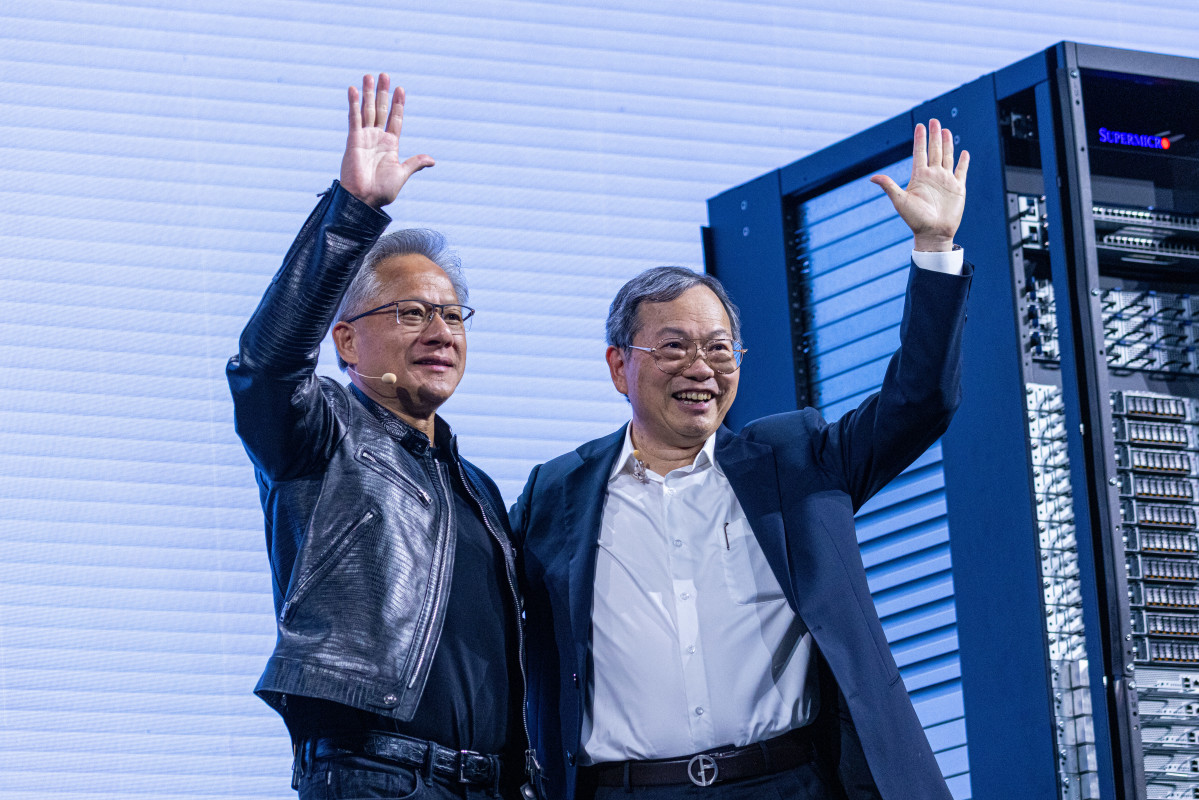

The employer industrial school is estimated to itemizing fourth-quarter and whole-12 months consequences round Aug. thirteen. Bloomberg/Getty Snap shots

A unhappy 12 months for a venerable retailer

There will likely be a loser on this pass, and it definitely is a lengthy way painful: Walgreen Boots Alliance (WBA) , the struggling massive pharmaceutical retailer.

Elevated AI Stocks:

- Analyst adjusts Nvidia stock ranking on valuation

- Analyst revises Fb father or mom stock can rate objective in AI arms race

- Google falling within the to come again of neighborhood weather desires resulting from AI ramp up

Inspite of generating revenues of $139 billion in fiscal 2023, Walgreen is down fifty six% on the 12 months and fell forty four.2% within the 2nd quarter on my personal. It be off 5% accordingly a lengthy way in July.

It achieved Friday at $Eleven.5, up zero.6% on the day and a pair of.1% on the week. Now not an super deal solace in what can most great be described as a horrible, no-good, very bad 12 months.

Walgreens grew to turn out to be into taken out of the Dow Jones Industrial Frequent as of Feb. 26, replaced through Amazon.

And its future within the S&P Five hundred appears to be like to be shaky.

In January, S&P Dow Jones Indices revised its minimal requirements for S&P Five hundred membership. The minimal market capitalization for S&P Five hundred membership is $12.7 billion. Walgreen has a market cap of $10.Fifty two billion.

Acceptable: Veteran fund manager sees world of agony coming for shares

What's Your Reaction?