Tax deductions 2023: What will sunset or change?

Many of the 2023 tax deductions are larger or more accessible than they were for the 2022 tax year. See how this can save you more money.

Key takeaways

- Tax deductions scale down the extent of earnings which is difficulty to tax, which lastly reduces your tax bill.

- The familiar deduction amounts for 2023 were elevated roughly 7% from 2022.

- The proper attainable deduction for 2023 tax 12 months contributions to a whole IRA is $6,500 for most humans, nevertheless really’s $7,500 for humans who generally are not cut back than 50 years ancient.

- The 2023 scholar personal loan follow deduction is gradually lowered if your modified adjusted gross earnings exceeds $seventy five,000 ($155,000 for joint filers).

Transformations to the regulations and transformations for inflation can have an final have an effect on on the tax deductions that that you may more in general than not definitely be geared as much as assert from three hundred and sixty five days to the following.

On the complete, that’s good documents. As an social gathering, a tax deduction may very accurate be elevated after an inflation adjustment. Chances are you should be geared as much as additionally be geared as much as assert a deduction you didn’t qualify for on a prior tax return.

That’s why it’s extreme to acknowledge what’s new and adjusted for the 2023 tax deductions that can very accurate be readily achievable to you.

What are tax deductions and how do they work?

Tax deductions cut your tax bill thanks to decreasing the extent of earnings that’s difficulty to tax.

After adding up your complete earnings for your tax return (with confident exceptions for tax-exempt earnings), you subtract any deductions from that extent to calculate your taxable earnings. For many humans, the tax owed for your taxable earnings is then made up our minds thanks to the utilization of either the tax tables or tax importance schedules (that that you may more in general than not definitely be geared as much as subtract tax credits and tax repayments already made of your tax liability later).

So, the elevated deductions that that you may more in general than not definitely be geared as much as assert, the scale down your taxable earnings should be. And thanks to lowering your taxable earnings, you’ll change into with a smaller tax cost or a elevated tax refund.

What form of tax deductions are readily achievable

There are diverse forms of tax deductions. As an social gathering, there’s the familiar deduction, which is a single deduction based for your submitting status. There are additionally a couple of itemized deductions, which consists of write-offs for:

- Medical and dental expenditures

- Nation and regional taxes

- Home personal loan follow repayments

- Charitable donations

- Losses from pure failures or theft

Sadly, it's easy to favor to percent on out between the familiar deduction and itemized deductions – that that you may more in general than not definitely be geared as much as’t claim every. But that that you may more in general than not definitely be geared as much as percent on out whichever one is elevated and saves you the predominant money.

There are additionally “above-the-line” deductions, which that that you may more in general than not definitely be geared as much as assert without reference to whether you take the familiar deduction or itemize. They get their title resulting from the confident bet you report them for your tax return true above the road exhibiting your adjusted gross earnings (AGI).

Above-the-line deductions additionally have the extra good thing about decreasing your AGI. On the grounds that the eligibility for or extent of a couple of varied tax breaks are based for your AGI, above-the-line deductions can have a ripple final have an effect on and set off elevated tax economic discounts in varied places for your tax return.

A diversity of the elevated complete above-the-line deductions are for:

- Character retirement account (IRA) contributions

- Fitness economic discounts account (HSA) contributions

- Student personal loan follow cost

- Educator expenditures

- Self-employed scientific coverage defense plan premiums

In the cease, sole proprietors can claim the certified commerce earnings deduction and varied commerce deductions on Schedule C. Even as this text is headquartered on non-commerce deductions, it’s extreme to part out that sole proprietors can claim commerce deductions on their grownup earnings tax return.

Tax deductions vs. tax credits

The 2 tax deductions and tax credits support scale down your earnings tax bill, but they do so in diverse methods. And when tax deductions are terrifi, tax credits are always bigger.

As outlined above, tax deductions scale down your taxable earnings, which lastly reduces the tax you owe for the 12 months. But, at best, your genuine economic discounts are absolutely a fraction of the deduction extent and rely on your tax bracket. As an social gathering, if you’re inside the 22% tax bracket and claim a $1,000 IRA deduction, your tax liability is purely lowered thanks to $220 ($1,000 x .22 = $220).

On the resolution hand, that that you may more in general than not definitely be geared as much as subtract earnings tax credits from the tax you owe on a dollar-for-dollar groundwork after making use of the marginal tax charges to your taxable earnings. So, in the event you will have bought you potentially can have gotten a $1,000 tax credit ranking, that that you may more in general than not definitely be geared as much as scale down your tax bill thanks to as much as $1,000.

There are additionally two complete forms of credits: refundable and nonrefundable tax credits. If the credit ranking is “refundable,” that that you may more in general than not definitely be geared as much as get a tax refund if the credit ranking extent is elevated than the tax you owe beforehand than making use of the credit ranking. As an social gathering, if your pre-credit ranking tax liability is $2,000 and additionally you qualify for a $2,500 refundable tax credit ranking, you’ll get a $500 refund.

If the credit ranking is “nonrefundable,” the credit ranking will absolutely scale down the tax you owe to $Zero. As an social gathering, if your pre-credit ranking tax liability is $2,000 and additionally you qualify for a $2,500 nonrefundable tax credit ranking, you bought’t owe any tax but you bought’t get money to come back, either ($500 of the credit ranking is most over and over misplaced).

Tax deductions vs. exclusions

An exclusion is like a tax deduction, since that they every scale down the extent of earnings that’s taxed. But if you subtract a tax deduction from earnings that’s said for your tax return, you don’t even should report earnings that’s granted an exclusion.

On the grounds that earnings that’s excluded always isn’t said for your return, it reduces every your AGI and taxable earnings.

Are there any new tax deductions for 2023?

No. There are no new tax deductions for the 2023 tax 12 months. But no deductions were repealed for 2023, either. As a fruits, the document of readily achievable tax deductions for 2023 is the photograph of it became for 2022.

Which 2023 tax deductions changed?

Even as there are no new tax deductions for 2023, there’s nevertheless a handful of changes to 2023 tax deductions stemming from the IRS’s annual transformations to account for inflation. These transformations are good for taxpayers, resulting from the confident bet they prolong the cost of a couple of tax breaks and/or make them readily achievable to elevated humans. And since that inflation has been serious simply this day, the raises for the 2023 tax 12 months are elevated than complete.

Let’s take a have a investigation out the inflation transformations impacting tax deductions for your tax return for the 2023 tax 12 months.

Identical ancient deduction

The familiar deduction amounts elevated thanks to about 7% from 2022 to 2023. For the 2023 tax 12 months, the familiar deduction is $13,850 for single humans and married taxpayers who file separate returns (up from $12,950 for 2022), when married couples submitting collectively and qualifying surviving spouses can deduct an extent twice that size at $27,700 (up from $25,900 for 2022). Head-of-domestic filers can claim a 2023 user-friendly deduction of $20,800 (up from $19,4 hundred for 2022).

The extra user-friendly deduction for age or blindness additionally elevated for the 2023 tax 12 months. It’s equal to $1,500 for joint filers, married taxpayers submitting one after the varied, and surviving spouses (up from $1,4 hundred for 2022); and $1,850 for single taxpayers and head-of-domestic filers (up from $1,750 for 2022).

There are additionally limits on the familiar deduction in case that that you may more in general than not definitely be geared as much as be claimed as a structured on anyone else’s tax return. For 2023, it will probably possibly good’t exceed the elevated of $1,250 (up from $1,150 for 2022), or $4 hundred plus your earned earnings.

IRA deduction

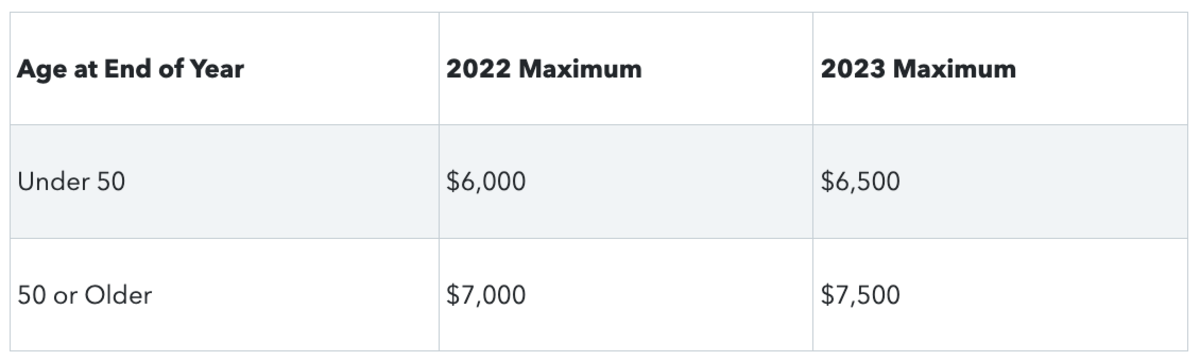

The proper attainable deduction for contributions to a whole IRA is elevated for 2023 resulting from the confident bet the annual IRA contribution preclude is elevated. For the 2023 tax 12 months, the deduction is accurate importance as much as $6,500 for humans who didn’t reach their fiftieth birthday thanks to Dec. 31, 2023 ($6,000 for 2022). Should you were not cut back than 50 years ancient thanks to the cease of 2023, the 2023 deduction tops out at $7,500 ($7,000 for 2022).

The IRA deduction may good be gradually phased out (doubtlessly to $Zero) if you or your spouse are lined thanks to an undertaking-subsidized retirement plan. The part-out ranges are based for your submitting status and adjusted for inflation every 12 months.

Should you’re lined thanks to a retirement plan at work, the 2023 deduction is phased out as follows:

- For single and head-of-domestic filers, the deduction is lowered if your modified AGI is elevated than $seventy three,000 (elevated than $Sixty eight,000 for 2022) and is really eliminated if your modified AGI is $eighty three,000 or elevated ($seventy eight,000 or elevated for 2022)

- For joint filers and surviving spouses, the deduction is lowered if your modified AGI is elevated than $116,000 (elevated than $109,000 for 2022) and is really eliminated if your modified AGI is $136,000 or elevated ($129,000 or elevated for 2022)

- For married taxpayers submitting a separate return, the deduction is lowered if your modified AGI is an impressive buy cut back than $10,000 and is really eliminated if your modified AGI is $10,000 or elevated (the $10,000 threshold became the equal for 2022)

Should you’re now no longer lined thanks to an region of job retirement plan but your spouse is, and additionally you’re submitting a joint return, the 2023 IRA deduction is lowered if your modified AGI is elevated than $218,000 (elevated than $204,000 for 2022) and is really eliminated if your modified AGI is $228,000 or elevated ($214,000 or elevated for 2022).

Chances are you should be geared as much as’t deduct contributions to a Roth IRA.

HSA deduction

The contribution limits for fitness economic discounts accounts additionally rose from 2022 to 2023, that manner the right attainable deduction for HSA contributions is elevated for the 2023 tax 12 months, too. But don’t neglect about which you be lined beneath a qualifying serious-deductible fitness plan to make contributions to an HSA.

For 2023, the HSA deduction always can’t exceed $3,850 in the event you will have bought you potentially can have gotten self-absolutely coverage defense plan or $7,750 in the event you will have bought you potentially can have gotten domestic coverage defense plan (up from $3,650 and $7,300, respectively, for 2022). But if you were not cut back than 55 years ancient at the cease of 2023, that that you may more in general than not definitely be geared as much as deduct an extra $1,000.

Self-employed SEP, SIMPLE, and certified plans deduction

Self-employed humans can deduct contributions made to their possess retirement plans. But like contributions to IRAs and HSAs, the deduction can’t exceed the annual contribution preclude for the personal form of retirement account used – that have been elevated from 2022 to 2023.

For Simplified Worker Pension (SEP) IRAs, the right attainable deductible extent for 2023 contributions is $sixty six,000 ($sixty one,000 for 2022) or 25% of your first $330,000 of compensation ($305,000 for 2022), whichever is scale down.

Chances are you should be geared as much as role your entire cyber net earnings from self-employment inside the plan: as much as $15,500 in 2023 ($14,000 in 2022), plus an extra $3,500 in 2023 if you’re 50 or older ($3,000 in 2022), plus either a 2% constant contribution or a 3% matching contribution.

The easy 2023 deduction preclude for contributions thanks to a self-employed grownup to his or her possess Savings Incentive Match Plan for Personnel (SIMPLE) IRA is $15,500 ($14,000 for 2022). On the resolution hand, that that you may more in general than not definitely be geared as much as deduct an extra $3,500 if you were not cut back than 50 years ancient at the cease of 2023 ($3,000 for 2022). Plus, that that you may more in general than not definitely be geared as much as deduct either 2% of the first $330,000 of your self-employment compensation ($305,000 for 2022) or an “undertaking match” of as much as a couple% of your compensation.

A self-employed grownup with a 401(k) plan (which consists of a solo 401(k)) can deduct as much as $22,500 in contributions to their possess 401(k) account for the 2023 tax 12 months in the adventure that they’re beneath 50 years of age ($20,500 for 2022). That extent jumps to $30,000 if you were not cut back than 50 years ancient at the cease of the tax 12 months ($27,000 for 2022). They deduct contributions of as much as 25% of their cyber net earnings from self-employment. On the resolution hand, their deduction for all contributions for the 2023 tax 12 months can’t exceed $sixty six,000 ($sixty one,000 for 2022).

Student personal loan follow deduction

The student personal loan follow deduction is accurate importance as much as $2,500 per 12 months. But your deduction should be phased-out if your modified AGI exceeds a sure extent that’s based for your submitting status.

The part-out ranges are adjusted upward every 12 months to account for inflation. For the 2023 tax 12 months, the deduction is phased out as follows:

- For single filers, head-of-domestic filers, and surviving spouses, the deduction is lowered if your modified AGI is elevated than $seventy five,000 (elevated than $70,000 for 2022) and is really eliminated if your modified AGI is $ninety,000 or elevated ($eighty five,000 or elevated for 2022)

- For joint filers, the deduction is lowered if your modified AGI is elevated than $155,000 (elevated than $a hundred forty five,000 for 2022) and is really eliminated if your modified AGI is $185,000 or elevated ($175,000 or elevated for 2022)

Married taxpayers submitting separate returns can’t claim the coed personal loan follow deduction.

TurboTax Tip: In case your mothers and fathers or anyone else will pay your scholar loans for you, that that you may more in general than not definitely be geared as much as nevertheless claim the coed personal loan follow deduction if you’re the one who’s legally obligated to repay the personal loan. The IRS will treat the follow cost as if you paid it your self.

Medical cost deduction

Premiums paid for lengthy-term care coverage defense plan are always deductible as a scientific cost (even even nevertheless your complete scientific expenditures are absolutely deductible to the extent they exceed 7.5% of your AGI). On the resolution hand, the deduction for lengthy-term care coverage defense plan is capped at an inflation-adjusted extent that’s based for your age at the cease of the tax 12 months.

For the 2023 tax 12 months, the deduction is restrained as follows (based for your age on Dec. 31, 2023):

- $480 if you’re forty or youthful ($450 for 2022)

- $890 if you’re forty one to 50 ($850 for 2022)

- $1,790 if you’re fifty one to 60 ($1,690 for 2022)

- $4,770 if you’re sixty one to 70 ($4,510 for 2022)

- $5,960 if your Seventy one or older ($5,640 for 2022)

Should you energy your possess car or truck or truck to a scientific appointment, that that you may more in general than not definitely be geared as much as additionally deduct linked expenditures as a scientific cost (once over again, difficulty to the 7.5% of AGI difficulty). Chances are you should be geared as much as either deduct your genuine expenditures for gas, parking, tolls, and so forth, or use the familiar mileage importance to calculate the deductible extent.

The familiar mileage importance for scientific shuttle expenditures is 22 cents per mile for the whole 12 months. For 2022, the importance became 18 cents per mile for the first half of the 12 months and 22 cents per mile for the 2d half.

Self-employed scientific coverage defense plan deduction

A self-employed grownup can always deduct premiums paid for scientific coverage defense plan for his or her domestic. The deduction should be taken for the importance of lengthy-term care coverage defense plan, but the equal age-based caps listed above for the scientific cost deduction for lengthy-term care coverage defense plan follow to this deduction, too. As identified, these limits elevated from 2022 to 2023.

Transferring cost deduction for members of the navy

As with the deduction for scientific transportation expenditures, the 2023 user-friendly mileage importance for the navy relocating cost deduction is 22 cents per mile for the whole 12 months. The mileage importance for this deduction became additionally spoil up for the 2022 tax 12 months (18 cents per mile for the first half and 22 cents per mile for the 2d half).

Deduction for commerce expenditures of reservists, performing artists, and importance-groundwork govt officials

Constructive commerce expenditures of reservists, performing artists, and importance-groundwork govt officials are deductible, which consists of unreimbursed expenditures regarding the commerce use of an enormously possess car or truck or truck.

Eligible taxpayers the utilization of the familiar mileage importance to calculate shuttle expenditures (as against the genuine cost methodology) for the 2023 tax 12 months can deduct sixty five.5 cents per mile. For the 2022 tax 12 months, the importance for commerce use of a car or truck became fifty eight.5 cents per mile for the first half of the 12 months and Sixty two.5 cents per mile for the 2d half.

Tax deductions that didn’t alternate for 2023

Tax deductions for the following expenditures and repayments didn’t alternate from 2022 to 2023:

- Alimony

- Amortizable bond premiums

- Archer Medical Savings Account (MSA) contributions

- Criminal legit expenditures and court docket expenditures for court instances involving confident discrimination claims or IRS whistleblower awards

- Chaplain contributions to a 403(b) retirement plan

- Charitable contributions

- Property “extra deductions” said to a beneficiary on Schedule K-1 (Diversity 1041)

- Property tax (federal) on earnings linked to a grownup who died

- In a foreign country housing deduction

- Gambling losses (absolutely to the extent of gambling winnings)

- Impairment-linked work expenditures of a disabled grownup

- Pastime on borrowed money that’s allocable to property held for investment

- Jury accountability pay given to your undertaking

- Losses from a contingent cost or inflation-listed debt instrument

- Losses from pure failures or theft

- Mortgage follow and points

- Olympic and Paralympic medals or prize money

- Penalties on the early withdrawal of confident economic discounts

- Pension contributions beneath Quarter 501(c)(18) of the tax code (i.e., to a pension created beforehand than June 25, 1959, funded absolutely thanks to worker contributions)

- Reforestation amortization and expenditures

- Renting very possess property if you’re now no longer inside the commerce of renting the property

- Compensation of amounts beneath a claim of true over $3,000

- Self-employment taxes

- Nation and regional taxes

- Teacher and varied educator expenditures for faculty room substances

- Unemployment improvement repayments

- Unrecovered investments in a pension

With TurboTax Reside Full Service, a regional professional matched to your private scenario will do your taxes for you begin to finish. Or, get limitless support and assistance from tax consultants if you do your taxes with TurboTax Reside Assisted.

And when or not it's easy to file your possess taxes, that that you may more in general than not definitely be geared as much as nevertheless believe confident that that you may more in general than not definitely be geared as much as do them true with TurboTax as we manual you bit thanks to bit. No subject which methodology you file, we assurance a hundred% accuracy and your best attainable refund.

What's Your Reaction?