Tesla Win Streak Might Snap; Here's 2 Buy-the-Dip Spots

Tesla stock has been on fire, but its five-week win streak may come to an end. Here are two buy-the-dip spots to know right now.

The trade in Tesla (TSLA) - Get Free Report has been decisively bullish.

From the April 27 low to the recent high, Tesla stock rallied more than 80%. From the January low, the electric-vehicle leader's shares have more than doubled (up 150%).

Investors have been busy putting their money to work in megacap tech stocks. That’s been fueling the year-to-date gains in the indexes, but also in single stocks like Tesla, Nvidia (NVDA) - Get Free Report, Meta (META) - Get Free Report and others.

More specific to Tesla has been the recent supercharger deals the company inked with Ford (F) - Get Free Report, General Motors (GM) - Get Free Report and Rivian. (RIVN) - Get Free Report

Don't Miss: Micron Stock Dangles Above Key Support as Earnings Loom. Buy?

It’s been a runaway trade for the bulls, although Tesla’s five-week winning streak could come to an end today. (At last check the stock was off 2%.) On the plus side, a pullback in this stock would be helpful for the bulls’ cause.

Let’s look at two key dip-buying spots now.

Trading Tesla Stock

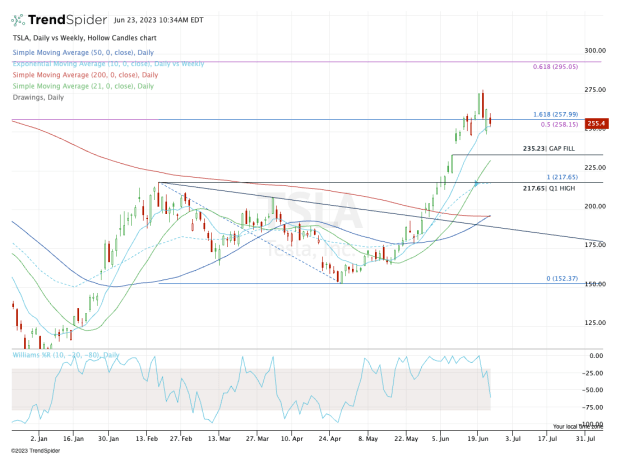

Chart courtesy of TrendSpider.com

Previously, we had been looking for a rally to the $258 area. That marked the 161.8% upside extension of the prior range, as well as the 50% retracement of the bear-market decline.

Tesla shares edged above this key area but faded hard from $275. They now wobble around the $258 area and are searching for direction.

If it can hold the 10-day moving average and regain $260, then the $275 level is back in play.

Otherwise, the bulls need to turn their attention to potentially lower levels and possible buy zones.

Don't Miss: Buy the Dip in Intel as Shares Try to Ride AMD, Nvidia Momentum?

The first level to watch is around $235. That marks the gap-fill from June 8 and comes into play near the 21-day moving average.

The second level is around $217.50. That area marks the first-quarter high and the rising 10-week moving average. It’s also near where the 50% retracement of the current rally comes into play, around $214.50.

If Tesla stock were to get to this level, the 10-week may be a bit higher if the pullback takes some time. Still, this combo — the Q1 high and 10-week moving average — is an area investors will want to keep a close eye on.

Failure to hold these two levels could open up the $200 level, where the stock will likely find its 50-day and 200-day moving averages.

What's Your Reaction?