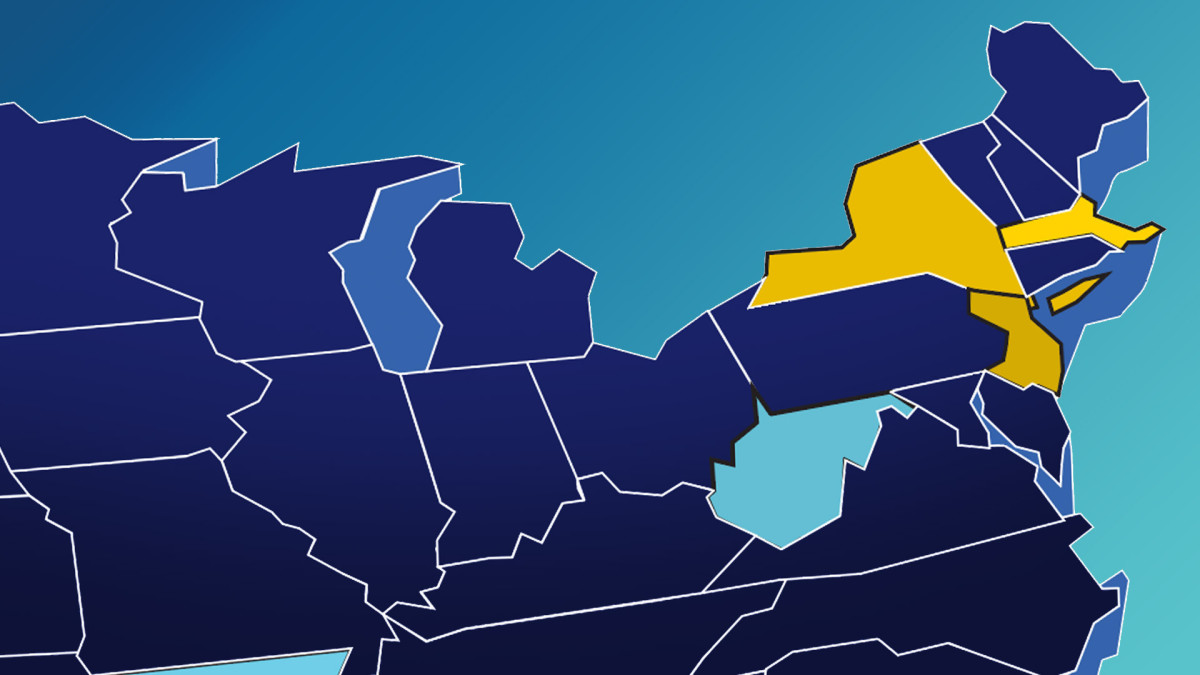

These states are most interested in managing personal finances

Americans' financial behavior varies by state.

Perchance no doubt essentially the most pressing complications for American citizens has been managing charge replacement whilst conserving % with the skyrocketing charge of dwelling. The geographic charge of dwelling dramatically affects somebody’s fiscal fitness, resulting from the true truth it determines wage, disposable profit, and expenditure.

Vital: The conventional American confronts new 401(ok), retirement reductions methods

The Missouri Fiscal Lookup and Recordsdata Midsection has made up our minds that the states with the right feasible charge of dwelling are Hawaii, California, District of Columbia, Massachusetts, and Alaska, respectively.

Relatively a little bit, Alaska beat out New York for the state with the fifth best feasible charge of dwelling within the first quarter of 2024. This shall be a little bit of an outlier, as Alaska’s remoteness from the remainder of the continental U.S. inflates the money of specifications such as food, utilities, housing, and transportation.

It’s no surprise that extreme charge of dwelling radically will strengthen month-to-month and annual expenditures, but areas with a extreme charge of dwelling also peculiarly present bigger salaries. End results of the strategic budgeting and fiscal planning are of great value, even with the site you’re made up our minds.

States with the right feasible activity in non-public finance

A up-to-date analyze conducted through EvenBet Gaming made up our minds that activity in managing non-public charge replacement, relative profit, and likelihood for saving varies through state.

The learn acknowledged the essential month-to-month methods superhighway salaries and estimated expenditures for a single adult, and search term methods from Numbeo and Google concentrated on budgeting, fiscal planning, and saving money. Ratings were acknowledged according to on hand reductions and whole search count for fiscal planning phrases.

Enhanced on non-public finance:

- How your mortgage is vital to early retirement

- Social Security advantages file confirms principal changes are coming

- The conventional American faces one principal 401(ok) retirement capture 22 location

Some key findings encompass:

- California residents searched Google for fiscal planning insights essentially the most out of any state — over 300,000 occasions over the previous few months. In line with employing the 50/30/20 rule to the state’s extreme conventional wage, residents have the likelihood to stay away from $1,000 monthly.

- New York state residents have the right feasible conventional wage out of every state, meting out added money for spending, and saving as much as $1,144 monthly on conventional. New Yorkers seem for fiscal planning phrases almost about as a lot as Californians.

- Residents in Texas and Florida have similar reductions possibilities, with an conventional month-to-month reductions per adult of $962 and $828, respectively. End results of the a little bit low expenditures of dwelling, both states have extensive likelihood to stay away from, and have sought for fiscal planning strategies between 195,000-200,000 occasions over the previous few months.

- New Mexico residents spend the least on month-to-month expenditures out of all U.S. states, permitting them to stay away from $832 monthly even with a minimize conventional month-to-month wage than other states analyzed.

A strategy to do something about up with escalating expenditures of dwelling

With the money of dwelling rising nationwide, the essential recommendation to flow to added low-charge cities and states has emerge as moot. U.S. households are spending an added $eleven,five hundred once a year to do something in regards to the dwelling specifications of January 2021.

Vital: The conventional American faces one principal 401(ok) retirement capture 22 location

Securian Fiscal recommends a couple of small but mighty changes to do something about your charge replacement in take a analyze:

- Cut out infrequently ever used recurring expenditures. Everyday month-to-month bills on ‘extreme-positive to have’ companies and items like streaming subscriptions and gymnasium memberships can add up hastily, but are very with out predicament forgotten about and peculiarly go unused.

- Set a food charge replacement. In the age of food beginning apps, ordering take out can hastily change into an even month-to-month money, when contemplating the taxes, expenditures, and beginning strategies pertaining to every transaction. Plan groceries to make most meals at dwelling, and best charge replacement in takeout and restaurant visits which be bound to do something about to pay for.

- Don't neglect lowering transportation expenditures. When you keep in an location with security public transportation or bikeable roads, take acquire of it. Now not best is it added charge productive than riding, but most enterprises present commuter skills classes that beef up you utilize pre-tax bucks to pay for transit or parking.

Vital: Veteran fund supervisor picks admired stocks for 2024

What's Your Reaction?