Top analyst puts Nvidia stock on key list after $500 million slump

Nvidia is looking to close out its worst month in nearly two years on a high note following solid Q2 earnings from rival AMD.

Latest at 9:Forty six AM EDT

Nvidia shares powered elevated in early Wednesday trading, boosted just by beneficial properties from rival chipmakers and a bullish learn realize from an acceptable Wall Boulevard analyst.

Nvidia (NVDA) , which has misplaced very nearly 1/2 a thousand million bucks of market magnitude this month, its worst exhibiting in very nearly two years, amid a AI chip revenue.

Traders, wary of the stock's wonderful beneficial properties within the direction of the final six months, have trimmed their holdings amid container that the crew's biggest purchasers, together with hyperscalers along aspect Microsoft (MSFT) , Meta Systems (META) and Amazon (AMZN) , will slow their capital-spending plans as they look to monetize billions in AI investments.

Nvidia is down over 23% from its closing high on June 18, the biggest drawdown for the stock in Sixteen months. $NVDAhttps://t.co/l5IYmkeySJ percenttwitter.com/Y3UXN6mJLs— Charlie Bilello (@charliebilello) July 30, 2024

Others have concerned a pair of so-really again and again very nearly always commonly called air pocket in Nvidia's revenue, where purchasers hold to come again on orders of its older H100 chips and await the launch of its new Blackwell GPUs later within the yr.

Present-chain snarls and rising opponents, beautifully from Evolved Micro Devices (AMD) and its new MI300X sequence of GPUs, have also weighed on sentiment.

Kids, Morgan Stanley analyst Joseph Moore and his crew say essentially the most updated stock pullback “supplies a wonderful entry aspect" for traders, and they delivered the stock to its Excessive Elect out listing for purchasers of the investment economic collage.

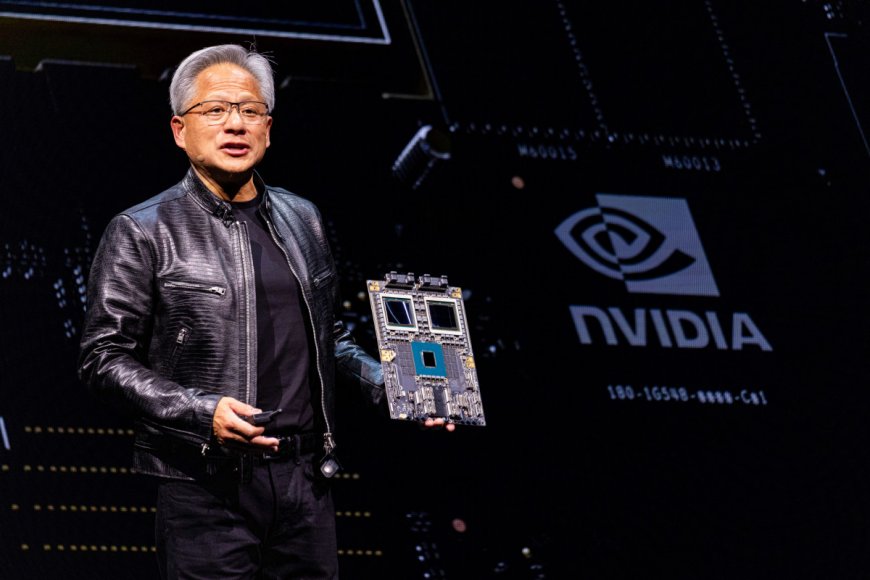

The economic collage left its $A hundred and forty 4 check target, apart from its chubby ranking, unchanged with the crew's 2nd quarter earnings looming in late August. Bloomberg/Getty %

Markets are taking what Moore and his crew really again and again very nearly always commonly called "an slightly glass-1/2-empty view of about a of the hyperscale criticism" on spending, adding there its "a clear would love on the a part of purchasers to continue to commit materials to establishing multimodal generative AI."

A bullish outlook from AMD

AMD's bullish shut-size of time outlook, published final night alongside the chipmaker's enhanced-than-anticipated 2nd quarter earnings, look to aid that view.

AMD observed make essentially the most of its MI sequence of chips appropriate the $1 billion mark for the first time over the three months ending in June, and lifted its full-yr revenue forecast for AI GPUs just by $500 million, taking it to $4.5 billion, even amid a restrained present chain backdrop.

"We continue to see line of sight to continue rising present as we go thru the 2nd 1/2 of the yr," AMD CEO Lisa Su prompt traders on a conference call late Tuesday. "And we'll continue to work both present apart from demand opportunities, and authentic that is accelerating our buyer adoption regular."

Microsoft, which is regarded as Nvidia's biggest buyer, recounted final night that capital spending over its fiscal fourth quarter, which ended in June, rose extra than seventy seven% from final yr to $19 billion, taking its full-yr tally to round $56 billion.

CFO Amy Hood recounted spending this fiscal yr would upward push above that stage, adding that "expenditures are based on demand indicators and adoption of our functions which can very likely be managed thru the yr."

Linked: Analyst locations Nvidia stock on watch; report materials to new China chip

Morgan Stanley's Moore also recounted steady demand prospects for both the H-sequence of Nvidia's AI chips, apart from its presently launched Blackwell imparting.

The new Blackwell GPU structure, named after the African American mathematician David Harold Blackwell, performs AI duties at extra than twice the velocity of Nvidia's most updated-day Hopper chips, whilst the utilization of less vigour and imparting extra bespoke flexibility, the tech crew has recounted.

Nvidia holds commanding market share

Nvidia prompt traders in May that its 2nd quarter earnings would upward push to round $28 billion, with a 2% margin for error, whilst a final end outcomes of of the reality it recounted the Blackwell computing device of processors and tool software would now not supply out shipping until the 2nd 1/2 of 2024.

Linked: Analyst resets Nvidia stock check target in chip-area overhaul

“Visibility will truely enlarge as demand moves from Hopper to Blackwell, as the constraint will shift to come again to silicon," the Morgan Stanley crew wrote. "H100 lead instances are short, but H200 lead instances are already lengthy, and Blackwell wants to be even longer."

Morgan Stanley also sees proof that purchasers are coming to come again to Nvidia products after sampling rival choices, suggesting its dominant market condition will very likely undergo accurately into the arrival yr.

Increased AI Shares:

- Analyst adjusts Nvidia stock ranking on valuation

- Analyst revises Facebook parent stock check target in AI arms race

- Google falling at the to come again of nearby weather dreams as a consequence of AI ramp up

“It definitely is an massive market and is now now not going to be served just by a single Nvidia card, but we're hearing diverse instances of purchasers who've invested in personalized silicon or alternate opportunities coming to come again to Nvidia for upside,” Moore and his crew recounted.

Nvidia shares were marked eight.eight% elevated in early Wednesday trading and altering hands at $112.eighty two every.

Linked: Veteran fund manager sees world of suffering coming for stocks

What's Your Reaction?