AMD Stock Drops After Earnings Report. Is It a Buying Opportunity?

Advanced Micro Devices beat analysts' expectations, but investors chipped the stock. Let's look at the technicals.

Advanced Micro Devices beat analysts' expectations, but investors chipped the stock. Let's look at the technicals.

Semiconductor bulls were looking for Advanced Micro Devices (AMD) - Get Free Report to rally when it reported earnings on Tuesday after the close.

They got the opposite: At last check the shares were off 8.7%. At Wednesday’s low, AMD stock was down about 9%.

That’s on a day when the market indexes are about flat and even as AMD reported a top- and bottom-line beat.

Don't Miss: Take a Bite of Chipotle Stock? Here's Where to Buy the Dip (With or Without Chips).

The problem? Guidance was a bit short of investors’ expectations.

The reaction is weighing on Nvidia (NVDA) - Get Free Report, which is down about 1% so far on the day, while the VanEck Semiconductor ETF (SMH) - Get Free Report is holding up a bit better, down 0.75%.

And investors are wondering whether they should buy the dip in AMD.

Trading AMD Stock

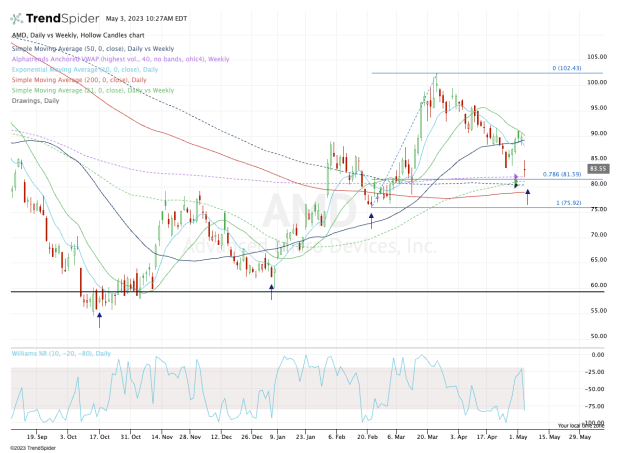

Chart courtesy of TrendSpider.com

AMD stock rode a five-day win streak into its earnings report and then hit a wall.

On the plus side, the shares are holding a key area on the chart, between $80 and $82. In that zone, the stock finds its 78.6% retracement of the current rally, the weekly VWAP measure, and the 50-week and 21-week moving averages.

Just below this zone is the 200-day moving average, near $79.

In other words, this is a key $3 range for AMD stock to stay above. If it fails to hold above this area, then it could trade down to the gap-fill area at $75.20.

Below that and AMD could be vulnerable down to about $70.

Don't Miss: Regional Banks Tumble to 52-Week Lows. Here's the Chart View.

Obviously, this is not the reaction that AMD bulls were looking for. That said, as long as the stock can hold the $80 area, investors waiting for a dip — and AMD is now down about 20% from its recent high — can justify a long position.

If it does hold, let’s see whether AMD stock can fill the earnings gap back up toward $88. Above that and the $92 to $95 area is a potential upside target for longs.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.

What's Your Reaction?