AMD Stock Just Retreated -- How Investors Can Play the Pullback

Shares in Advanced Micro Devices are selling-off despite a big opportunity in artificial intelligence.

Advanced Micro Devices (AMD) - Get Free Report made a splash earlier this month when it unveiled a new lineup of fast, efficient semiconductor chips specially designed for use in artificial intelligence.

Investors initially cheered the news because the move gives AMD a shot at honing in on Nvidia's (NVDA) - Get Free Report lead in what's likely to be a multibillion-dollar market. Unfortunately, gains were fleeting, given AMD's shares have sold off this past week.

DON'T MISS: Advanced Micro Devices Takes Aim At Nvidia’s Lead In AI

Does the pullback in AMD stock make it worth buying, or should investors stay on the sidelines? Xing Yun / Costfoto/Future Publishing via Getty Images

Artificial Intelligence Is a Massive Emerging Market

The potential for machines to optimize industries shouldn't be understated. Artificial intelligence's application will likely surpass students' use of generative AIs like ChatGPT.

Market wizard Stanley Druckenmiller has said artificial intelligence "could be as transformative as the internet." Fellow billionaire Ray Dalio suggested AI could unleash "a tremendous amount of productivity." Meanwhile, billionaire investor Paul Tudor Jones said AI could unleash a huge productivity boom that will lower inflation.

More Business of AI:

- Here's the Startup That Could Win Bill Gates' AI Race

- Meet Your New Executive Assistant, A Powerful AI Named Atlas

- High-Profile Investor Shares Blunt Words on the Current State of AI

These billionaires aren't just talking, either. To take advantage of spending on the infrastructure necessary to train large language AI models, Druckenmiller bought shares in Nvidia. Dalio's former hedge fund, Bridgewater, boosted stakes in companies with ties to AI last quarter, including Microsoft (MSFT) - Get Free Report and Alphabet (GOOG) - Get Free Report. And Tudor Investments increased its stake in Advanced Micro Devices by 844% in Q1.

Upgrading the plumbing necessary to support AI won't be fast, and it will be expensive.

On the company's latest earnings conference call, Nvidia's CEO Jensen Huang said that most of the $1 trillion spent on data center infrastructure has been on CPUs less ideally suited for handling AI workloads than GPUs. Upgrading to the H100, Nvidia's best AI option costs over $30,000 per chip.

AMD hasn't said how expensive its next-generation MI300 series of AI chips will be, but even if they're cheaper, they'll still represent a huge potential new revenue stream.

Advanced Micro Devices CEO Lisa Su believes AI is the company’s “largest and most significant” long-term opportunity. The AI accelerator market could grow by a compounded 50% per year to $150 billion in 2027 from $30 billion this year.

How To Play the Pullback in AMD Shares

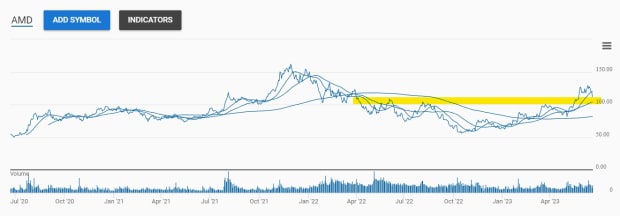

AMD shares have retreated 15% from their intraday high on June 13. That's a substantial drop that's caused AMD's stock price to give back most of the gains generated following its AI announcement.

The drop is stinging existing investors, but they're likely still sitting on big year-to-date gains, given the stock is up 73% in 2023. The good news is that the pullback may be creating an opportunity for those who missed AMD's rally a chance to pick up shares on sale.

Investors interested in buying AMD during this downturn have options.

The post-AI announcement rally caused a spike in AMD shares, creating a gap that's currently in the process of being filled to roughly $108. There's also support slightly below that point near the 50-day moving average, just below $104. Also, additional support from an uptrend of higher lows since September exists near $100 on the weekly chart.

For this reason, investors may want to consider breaking up their usual position size into multiple tranches. One tranche could ideally be bought between $108 to $109, the second between $104 and $105, and a third tranche could be bought near $100. Additional shares could be added on further weakness or rallies toward new highs.

What's Next for AMD Shares

AMD plans to have the first of its new AI chips ready for customer testing in the third quarter, followed by commercial production by year's end. As a result, don't expect AI sales to move the needle when it reports second or third-quarter results.

Until then, AMD remains hamstrung by exposure to consumer PCs, which have seen demand fall during the past year because of strained consumer budgets. However, the company could see tailwinds from rebounding data center demand for servers, offsetting some PC headwinds.

Overall, Wall Street analysts expect the semiconductor company to report revenue of $5.3 billion and EPS of $0.57 for the second quarter. Still, we'll need to wait until August 1 to see if management over or under-delivers on that outlook.

For now, investors should expect AI stocks like Advanced Micro Devices to be volatile, given their big moves already this year. Nevertheless, the sell-off in AMD shares could create a buying opportunity for investors.

What's Your Reaction?