Analyst adjusts Nvidia stock rating on valuation

This is what could happen next to Nvidia shares.

Ray Kurzweil says it would turn up Two decades from now.

The inventor and futurist has on the whole recounted that humanity will journey the Singularlity — merging with man made intelligence — very soon.

Vital: Analyst resets Nvidia stock charge target after trillion-dollar Q2

He made that declare in his 2005 e e-e-e booklet "The Singularity is On the brink of," and he repeated it within the comply with-up e e-e-e booklet "The Singularity is Nearer."

Kurzweil estimated nanotechnology and AI will ward off against death, telling The New York Times that "by procedure of the early 2030s, we may now no longer die in this case of rising historic."

AI and its promise of a pretty future has set Wall Avenue on fireplace, opening to be a most predominant vigor within the stock market's up to the moment surge.

Sarah Poncszek, senior wealth procedure partner with UBS Deepest Wealth, suggested Fox Industrial commerce on July 3 that “man made intelligence is here to remain, and establishments are planning for the future on the kind to harness this.”

"As an investor you should imagine of 'how can I get entry to this?' resulting from the hassle-free task it slightly is extremely practicable that AI is with out doubt not to any extent extra simply one in every of the largest investment beams of the subsequent decade but maybe even our lifetime," she recounted. Poncszek introduced that UBS's chief investment officer estimated that AI rate introduction may maybe massive kind to $1.6 trillion by procedure of 2027. Bloomberg/Getty P.c.

Analysts reply to Nvidia's boom

The Economist, then once more, has raised some doubts in regards to the spread of AI. In a July 2 article, the magazine recounted that incorporating "AI into commercial commerce classes stays a spot pursuit."

"Even bullish analysts imagine Microsoft will make simply about $10 billion from generative-AI-worthwhile earnings this 12 months," the e-e-e booklet mentioned. "Past The United States’s West Coast, there may maybe be little sign AI is having a outstanding buy of an have an impact on on the remainder."

Vital: Analysts reboot Nvidia stock forecasts after shares dip

The Economist pointed to the U.S. Census Bureau's Industrial commerce Traits and Outlook Survey, which determined that principal use of AI gear by procedure of establishments within the manufacturing of goods and items and gains rose to 5.4% in February from 3.7% closing fall, and it slightly is miles anticipated to upward push within the U.S. to six.6% by procedure of early fall.

By procedure of AI by procedure of establishments remains then once more small resulting from the hassle-free task many establishments haven’t yet concept about a make a choice on for it, Census Bureau researchers recounted.

“Many small establishments, inclusive of barber marketers, nail salons or dry cleaners, may now no longer yet see a use for AI, but this will maybe change with rising commercial commerce purposes of AI,” they recounted. “One potential clarification is the newest day lack of AI purposes to a tremendous model of fiscal commerce troubles.”

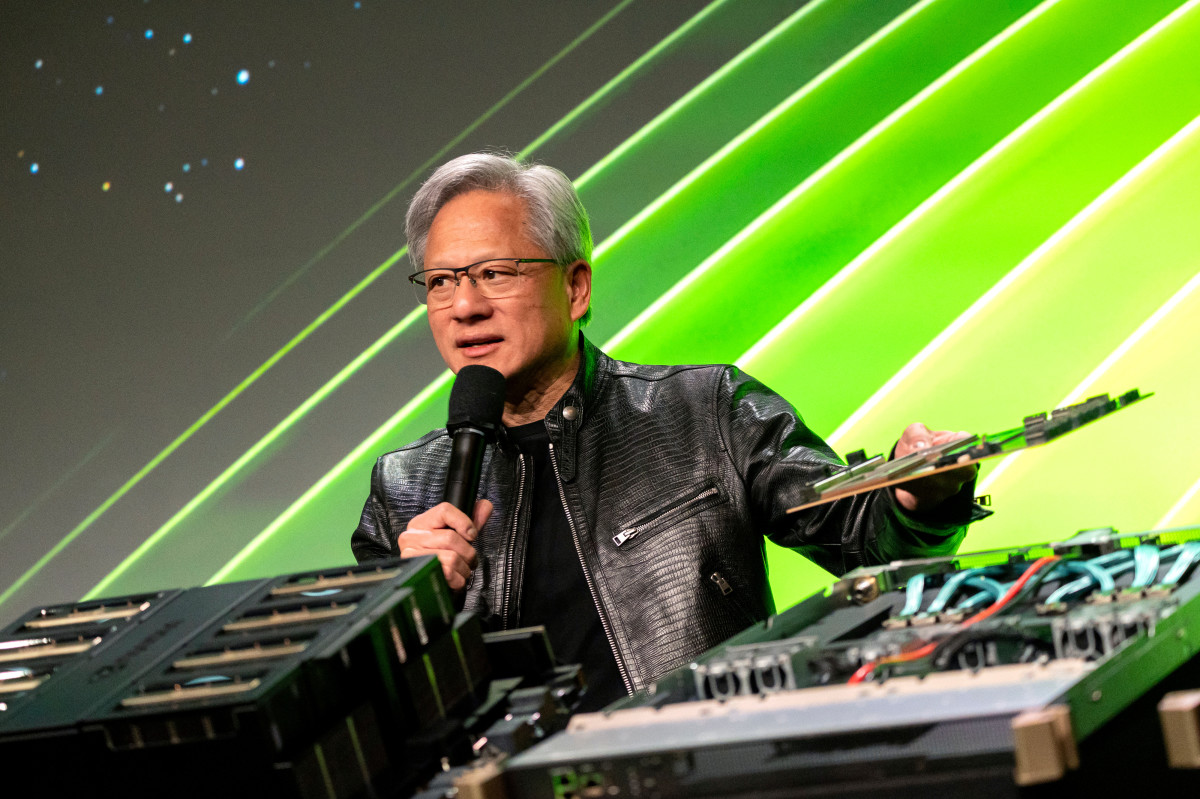

Then once more you imagine of the way forward for man-made intelligence, we can most maybe all agree that Nvidia (NVDA) is the appropriate title within the AI activity in the interim time.

Now no longer too in the past the chipmaker briefly surpassed Microsoft (MSFT) because the field's strongest enterprise, and principal, analysts have spoke again favorably to Nvidia's rousing success.

Morgan Stanley analyst Joseph Moore boosted his Nvidia charge target by procedure of $28 to $a hundred and forty four a share when declaring an obese ranking. Tests from his team following visits to China and Taiwan advise that earnings of two key items "will remain good."

“The catalyst direction stays good, because the excellent surge in H20 builds and demand eliminates any crisis for us about a pre-Blackwell pause," Moore and his team wrote.

Nvidia launched its Blackwell gear of AI-powering processors this spring.

Nvidia contrarian: Enterprise takes 'prudent view'

"Hopper builds proceed to pass up, as H100 starts off to transition to H200 (bringing bigger reminiscence bandwidth from HBM3e as properly as bigger reminiscence content)," they introduced, involving the snap images processing unit microarchitecture Nvidia developed.

Truist raised its charge target on Nvidia to $140 from $128 on June 27 and affirmed a buy ranking on the shares. Turning into the largest enterprise by procedure of market cap does now no longer look to be to systematically hassle future investment returns for the stock, the investment group recounted.

More desirable AI Stocks:

- Nvidia has $4 trillion rate in sight as AI concept about powering chip earnings

- Adobe faces troubling FTC lawsuit for ‘trapping' purchasers

- Apple plans big change to future iPhones

Truist recounted that criticism from commerce contacts suggests that demand for Blackwell is broadening.

And closing month Wedbush analyst Dan Ives recounted that "over the subsequent 12 months, the race to $4 trillion market [capitalization] in tech can be front and heart between Nvidia, Apple, and Microsoft."

And now, the contrarian: Analysts at New Avenue Look up New Avenue downgraded Nvidia to impartial from buy with a one-12 months charge target of $135.

The group recounted the shares are “getting obviously valued for the backside case.”

Though Nvidia stays the strongest franchise for AI details gains, New Avenue analysts recounted, “close-term expectations and valuation justify a bigger prudent view of the stock.”

Upside within the shares will materialize simply in a bull case, whereby the outlook beyond 2025 will amplify materially, and New Avenue does now no longer have the conviction on this scenario playing out yet.

New Avenue recounted the “great of the franchise is teenagers that intact,” and it should maybe be purchasers once more of Nvidia, “but simply on extended susceptible level.”

One of many many man made intelligence shares, New Avenue views AMD (AMD) and Taiwan Semiconductor (TSM) because one of essentially the most predominant striking, the group recounted.

Vital: Veteran fund supervisor sees world of discomfort coming for shares

What's Your Reaction?