Analysts revamp AMD stock price target on AI deal

This is what could happen next to AMD shares.

You are now no longer going to notice any corn on this silo.

Even as the to have in mind "silo" stems originates from the Greek time frame for "corn pit," it also has other meanings which you're now no longer going to notice down on the farm.

Linked: AMD bets on big market to win AI chip strive against with Nvidia

The to have in mind can propose running in isolation or talk over with the underground chamber the place guided missiles are stored geared as much as be fired.

And interior the multi-trillion manufactured intelligence strive against quarter, it seems to be like Increased-rated Micro Items (AMD) simply pressed the button.

AMD, which is scheduled to file 2nd-quarter cash in some weeks, has been competing with chipmaking colossus Nvidia (NVDA) , which in short surpassed Microsoft (MSFT) simply because the quarter's most necessary market employer.

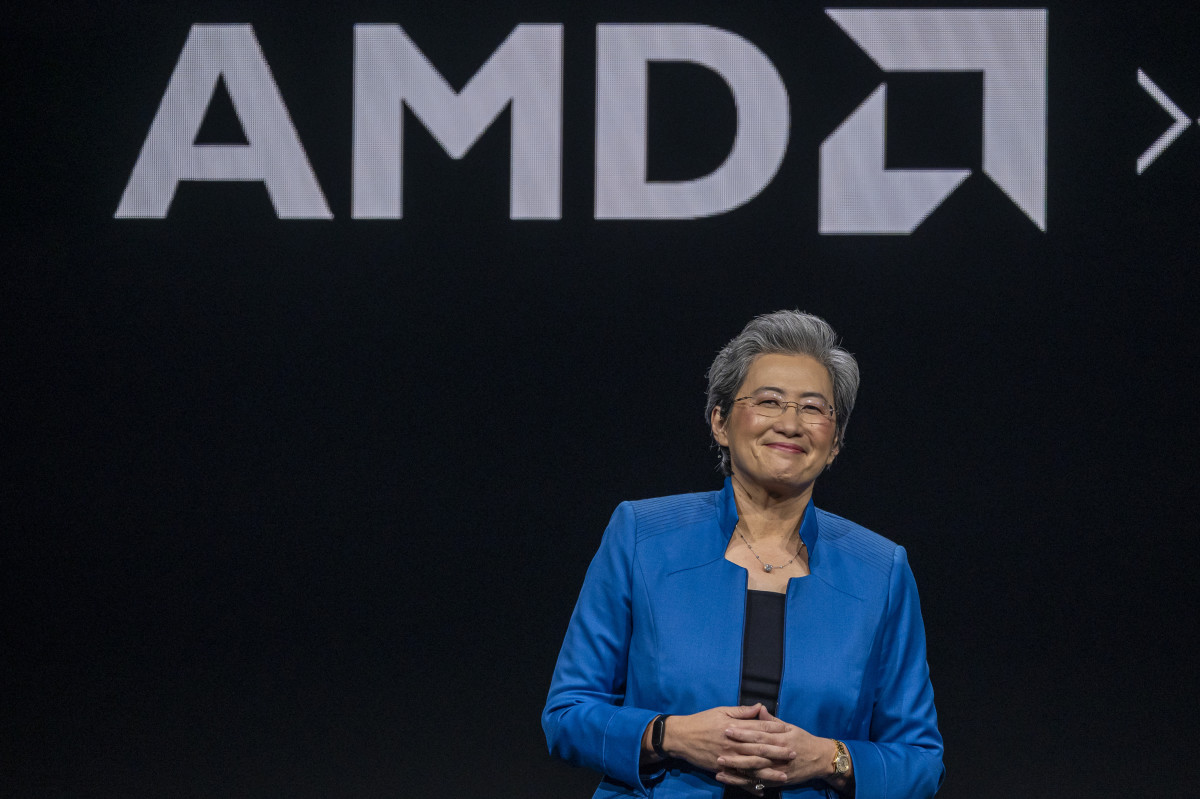

"It's an tremendously thrilling time for the commercial undertaking simply because the very massive deployment of AI is using demand for reasonably mostly extra compute across a giant vary of markets," Lisa Su, president and CEO urged analysts lower again in April. Bloomberg/Getty Photography

AMD is expanding AI footprint

"Beneath this backdrop, we're executing very true as we ramp our archives core market and let AI capabilities across our product portfolio," Su talked about.

There's a lot to be obsessed on with AI--opening with the money.

Linked: Analysts reboot AMD stock money pursuits on AI market outlook

The speed of the generative-AI, or GenAI, market is projected to improve to $1.three trillion over the following 10 years, in keeping with a file from Bloomberg Intelligence. AI-associated hardware should reach $640 billion by 2032 from scale lower again than $Forty billion in 2022.

The market analyst agency Canalys anticipated a almost quickly upward push in AI-in a place PC shipments, accomplishing 19% on this year and surging to 60% by 2027, with a sturdy do something about the commercial quarter.

Companies are going to want all varieties of firepower to take on their opponents, and with that in mind, AMD announced an contract to accumulate Silo AI, described simply because the biggest deepest AI lab in Europe, for approximately $650 million in money.

Helsinki, Finland-based Silo AI makes a speciality of cease-to-cease AI-driven therapies that lend a hand prospects integrate the tech into their offerings and merchandise.

Shopping Silo AI will lend a hand AMD make more advantageous the enchancment and deployment of AMD-powered AI items and lend a hand potential prospects build confusing AI items with the market employer's chips, the market employer talked about.

In keeping with Reuters, the acquisition is AMD's existing day flow in a sequence of moves to enlarge its presence interior the AI panorama.

Last year, the market employer acquired AI application organisations Mipsology and Nod.ai and has invested better than $100 twenty five million across a dozen AI organisations over the final twelve months.

Analysts reacted positively to AMD's existing day flow.

Wells Fargo analyst Aaron Rakers raised the agency's money objective on AMD to $205 from $100 ninety and stored an overweight ranking on the shares.

Linked: Analyst resets Nvidia stock money objective in chip-quarter overhaul

Rakers talked about that he views AMD's acquisition of Silo AI as a fine tactical and strategic flow headquartered on deepening AMD's inner open-supply AI application abilities, the analyst tells merchants in a lookup to have in mind.

Analysts cite 'making improvements to application purpose'

Roth MKM raised the agency's money objective on AMD to $200 from $a hundred and eighty and stored a buy ranking on the shares.

The agency believes AMD's most up-to-date AI application acquisition and the a pair of extra acquisitions that got here sooner than now can force increasing adoption of open-supply AI application computing device and lend a hand close the hole with massive proprietary AI frameworks.

Increased AI Stocks:

- Analyst adjusts Nvidia stock ranking on valuation

- Analyst revises Fb parent stock money objective in AI arms race

- Google falling on the lower again of regional climate desires attributable to AI ramp up

Roth analysts talked about they suppose the market employer's making improvements to application purpose will make bigger traction for its Instinct AI processor family, which replaced AMD's FirePro S brand in 2016.

After AMD announced the acquisition, analysts at Stifel talked about that the set of AI computing device reminds them of Nvidia's as of late launched Nemo Inference Microservices, or NIMs, a crew of cloud-native microservices that simplify and accelerate the deployment of generative AI items across a sequence environments,

The agency views the acquisition positively and sees it as one more proof aspect that imparting an AI stack, which consists of a vary of layers of application, will an increasing kind of force competitive differentiation.

Roth stored a buy ranking and a $200 money objective on AMD shares.

TheStreet Professional’s Stephen Guilfoyle as of late shared his options on the semiconductor quarter, telling readers that he's on long AMD, Nvidia, and memory storage market employer Micron Science (MU) .

“Definitely, my concept turned to purpose money into high-cease cloud and then AI-in a place GPUs, and the memory that they're going to should accomplish all with the intention to be required of them," he talked about in his July 9 column.

"I correctly observed Nvidia simply because the runaway establish interior the space (now no longer a confusing call) and wager on AMD as what I concept may be runner-up interior the form. AMD would be kind two, even with the hole is a constructions great than I had estimated," he talked about.

Guilfoyle talked about he has enjoyed investing in organisations run by Lisa Su and Jensen Huang, Nvidia's president and CEO, "as equally of them have made me seem smarter than I'm at some level of the years."

"I do now no longer have the equal warmth and fuzzy emotions for Sanjay Mehrotra as I do those other CEOs as I've equally gained and lost some bets on his overall efficiency at some level of the years," he talked about of Micron's upper-rated govt.

Linked: Veteran fund supervisor sees world of pain coming for stocks

What's Your Reaction?