Big-Tech titans Apple and Microsoft top huge earnings week on Wall Street

The market's four biggest stocks, with a collective value of nearly $10 trillion, will report December-quarter earnings next week.

Wall Street is riding high this year, with stocks on a run of six consecutive record closes that have extended the market's autumn rally firmly into the start of the new year.

Stocks worldwide are printing new highs nearly every day, powered by data suggesting the U.S. economy is a long way from recession and, indeed, is poised to accelerate gains over the coming months. Other factors include fading inflation concerns and a U.S. Federal Reserve looking to step back from its recent market dominance.

Much of the U.S. market rally, however, has run through the wake of soaring tech stocks, particularly those linked to the global surge in artificial intelligence spending and its promise to be the biggest thing to impact the sector and economy in at least a generation.

That puts next week's earnings slate in sharp focus, particularly given that companies with solid runs over the final months of last year, including Intel (INTC) - Get Free Report, Visa (V) - Get Free Report, and Texas Instruments (TXN) - Get Free Report, were punished hard by investors recently when their outlooks fell shy of Wall Street forecasts.

"This will be the biggest week of the earnings season, sure to be full of surprises in both directions," said Louis Navellier of Navellier Calculated Investing. "But as is usually the case, it's more about guidance than results."

Whether these companies beat Wall Street estimates and raise guidance will set the stage for the S&P 500's next move. TheStreet/Shutterstock/Justin Sullivan/Getty Images

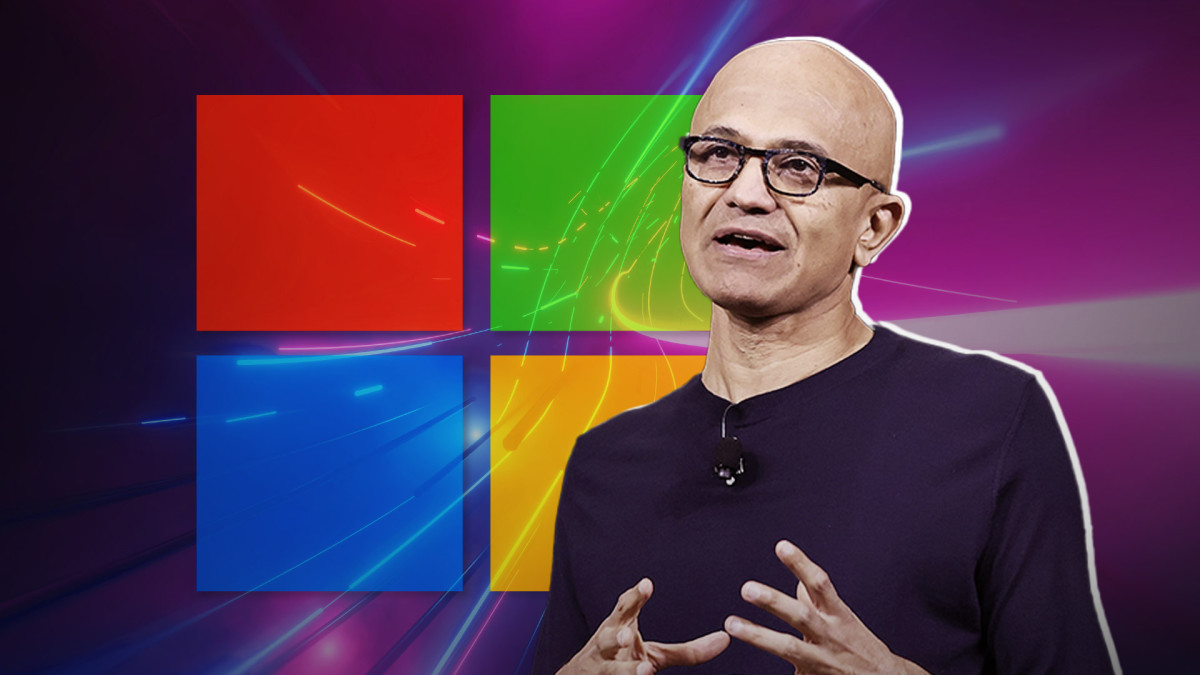

A tech earnings flood is on tap, led by Microsoft

With just under a quarter of the S&P 500 reporting December-quarter earnings so far this season, collective profits are forecast to rise by 4.9% from the same period in 2022 to a share-weighted $456 billion.

Around 86 companies are set to report this week, including a host of tech giants and the market's four biggest stocks: Apple, Microsoft, Google parent Alphabet, and Amazon.

Related: Tesla tumbles as Musk's 'train wreck' call fails to gloss over profit slump

"The leading tech companies are all in spending on AI rollouts, and the market is paying up with the poster children being Microsoft," Navellier added. "The wind remains at the market's back, and the primary fear seems to be fear of missing out."

Last week, Microsoft joined Apple (AAPL) - Get Free Report as the only two companies in the world worthy of a $3 trillion valuation. The software giant's stock hit a record $407.01 on the back of its highly anticipated earnings report coming after the close of trading Tuesday.

Analysts expect Microsoft (MSFT) - Get Free Report to post a 20% surge in its bottom line, which is forecast at $2.78 per share, with overall revenue rising to a record $61.1 billion.

Revenue from Microsoft's Intelligent Cloud division, including the flagship Azure platform, which powers much of the group's AI products, is forecast to rise 17.5% to around $25.3 billion.

Apple's iPhone 15 outlook, Alphabet ads are key

Apple, for its part, will update investors on Thursday, with CEO Tim Cook tasked with challenging the market's current narrative that weakening iPhone demand, particularly in China, will weigh on sales for much of the year.

Analysts are looking for a bottom line of $2.09 a share on revenue of $117.87 billion for Apple, but its near-term outlook is likely to be far more important for the stock's performance.

Google parent Alphabet (GOOGL) - Get Free Report will publish its fourth-quarter results alongside Microsoft on Tuesday. Alphabet shares hit a record last week amid reports the company is preparing a major shakeup of its advertising platform, the world's biggest, to capture more AI-generated sales.

The group is expected to report profit rose more than 50%, to $1.59 a share, with revenue up 12% to a record $65.9 billion.

More Business of AI:

- AI wave takes this stock to record highs as investors look beyond Mag 7

- Google targets Microsoft, ChatGPT with huge new product launch

- AI stock soars on new guidance (it's not Nvidia!)

Looking into 2024 for Alphabet, analysts see the looming presidential elections, alongside the Summer Olympics in Paris and the UEFA Euro 2024 soccer tournament, as boosting global ad sales. Developing AI technologies is also expected to drive further gains for Facebook owner Meta Platforms (META) - Get Free Report.

"We believe the near-term outlook for Google is more positive than negative with the core advertising business set to accelerate in 2024 against minimal headcount growth and continued cost discipline, which should support modest operating margin gains," said Wedbush analyst Scott Devitt, who carries an 'outperform' rating and a $160 price target on Google stock.

Amazon (AMZN) - Get Free Report will round out the top-four earnings parade on Thursday after the close of trading. The e-commerce and cloud-services major will likely post record revenue of $166.1 billion, a staggering total powered in part by 13.1% sales growth at Amazon Web Services.

Mag 7 stocks still dominate the S&P 500

CFRA Research senior analyst Arun Sundaram, who carries a buy rating with a $180 price target on Amazon, says the AWS outlook will be the key earnings focus. But he also notes headwinds tied to Federal Trade Commission lawsuits and a stronger U.S. dollar.

Collectively, the so-called Magnificent 7 tech stocks are set to contribute around half the S&P 500's overall fourth-quarter earnings growth. Bloomberg data, meanwhile, suggest that profits would likely fall by around 7% without them.

Looking ahead, the S&P 500's information technology sector, home to Magnificent 7 members Apple, Microsoft, and Nvidia, (NVDA) - Get Free Report will likely contribute around a fifth of the benchmark's collective first-quarter earnings forecast of $464.8 billion.

The seventh member of the Magnificent 7, electric-car producer Tesla, already reported disappointing fourth-quarter results on Thursday, triggering the stock’s biggest single-day decline in four years.

Related: Microsoft, Magnificent 7 must justify AI hype this earnings season

Nigel Green, CEO of London-based financial consultancy deVere Group, says the Mag 7's dominance of the stock market in terms of performance and earnings generation is "further proof that investing in technology stocks related to AI has become imperative for investors aspiring to build long-term wealth."

“Companies leveraging AI technologies exhibit a competitive edge, leading to increased profitability and sustained growth," he added. "Plus, the scalability of tech companies allows for exponential growth and, in addition, tech stocks can often provide a hedge against economic downturns.”

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?