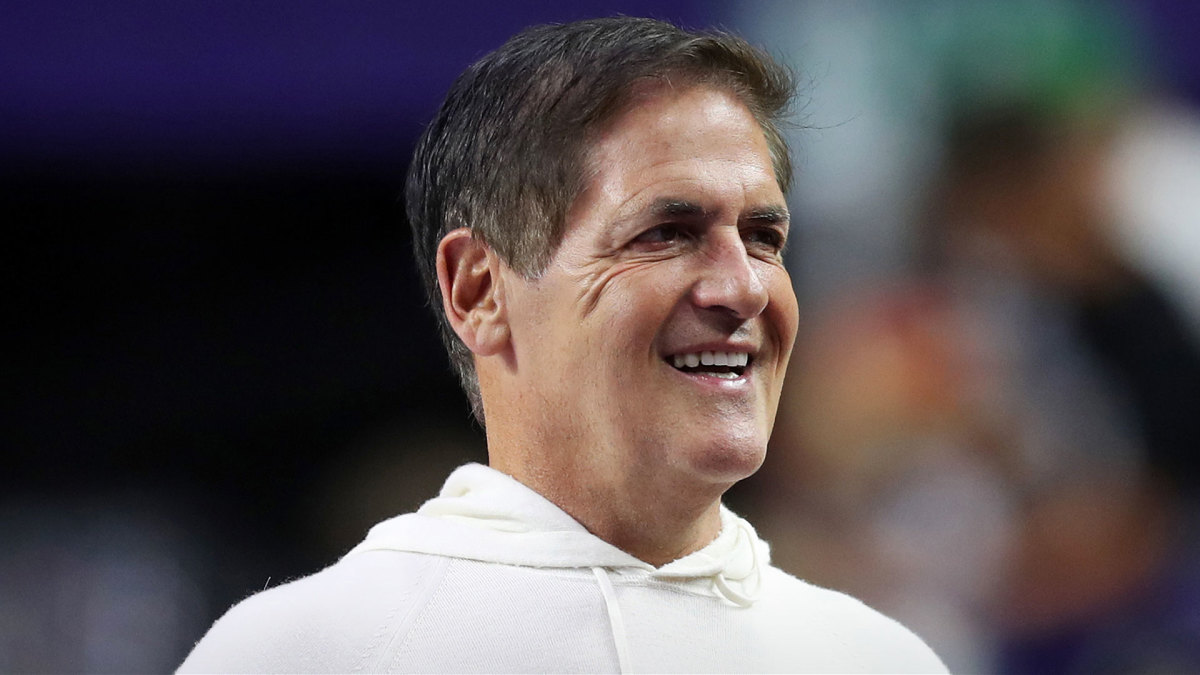

Company backed by Shark Tank's Mark Cuban files Chapter 7 bankruptcy

The billionaire recently sold controlling interest in the Dallas Mavericks, but not every investment he has made has turned into billions.

Mark Cuban has always pushed himself as the digital shark, the "Shark Tank" panelist who understands the internet better than anyone else on the show.

That makes sense because he made his original fortune by selling Broadcast.com to Yahoo for $5.7 billion.

That deal, however, happened back in 1999 and Cuban may not be the digital whiz he once was. He acknowledged that prospect when he closed the sale of a controlling interest in the National Basketball Association's Dallas Mavericks.

Related: Walmart decides to shut down a key part of its business

He commented that he was selling a share to the Adelson family because they were real estate experts and he believed that the advantage of his digital knowledge no longer gave the team an edge.

The rest of the NBA had caught up, so selling made sense because the Mavericks' next advantage could come from developing a new arena/casino complex that would give the team an added revenue stream.

On "Shark Tank," however, which Cuban will leave after the current season, the entrepreneur still touts his digital background. That has helped him make deals on the show, and it also means that digital innovators come to Cuban as an investor even when the television lights are not on.

One of those investments, a brand that counts Cuban as its largest creditor, has filed for Chapter 7 bankruptcy protection in order to liquidate. Image source: Christina Pahnke/sampics/Corbis via Getty Images

Sorfeo bought Amazon resellers

Sorfeo buys and creates brands specifically to sell on Amazon. The company describes itself on its website:

"Sorfeo transforms digital-native brands into brand names you know. We are a consumer products company that grows brands in the Amazon ecosystem, then expands sales to [direct-to-consumer] and multichannel retail," the company posted.

That business model has not worked as the company has filed for Chapter 7 bankruptcy and plans to liquidate.

"The company's secured claims total $3.84 million and unsecured claims are $1.04 million, per the filing. Among its investors is [Cuban,] whose Radical Investments LP is listed as Sorfeo’s largest secured creditor, with a claim of $1.263 million, according to the bankruptcy filing," Washington Business Journal reported.

Cuban did not seem bothered by the filing as he emailed the local business outlet and wrote "win some, lose some."

Sorfeo's website features a prominent picture of Cuban along with an endorsement.

"I'm happy to be a Sorfeo investor. I think they can help Amazon entrepreneurs reach their personal and business goals," he shared.

Cuban is still a digital leader

While Sorfeo has filed for Chapter 7 bankruptcy and plans to liquidate, Cuban remains a digital innovator. His Mark Cuban's Cost Plus Drug Co. seeks to disrupt the traditional drugstore business.

Cost Plus deals directly with drug manufacturers to buy in bulk and sell directly to consumers.

"If you don’t have insurance or have a high deductible plan, you know that even the most basic medications can cost a fortune,' Cuban wrote on the Cost Plus website. "Many people are spending crazy amounts of money each month just to stay healthy. No American should have to suffer or worse — because they can’t afford basic prescription medications."

The company buys drugs from the manufacturers, negotiates good pricing, and then marks them up 15%. That's a very low markup and, aside from a $5 fee for the company's pharmacy to prepare the drug, that's the only fees Cost Plus charges.

"Every product we sell is priced exactly the same way: our cost plus 15%, plus the pharmacy fee, if any. When you get your medicine from Cost Plus Drug Co., you’ll always know exactly how we arrived at the price you pay. And as we grow and our costs go down, we will always pass those savings on to you," he wrote.

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?