Dave Ramsey has straight talk about buying a house

He explains how risk is real.

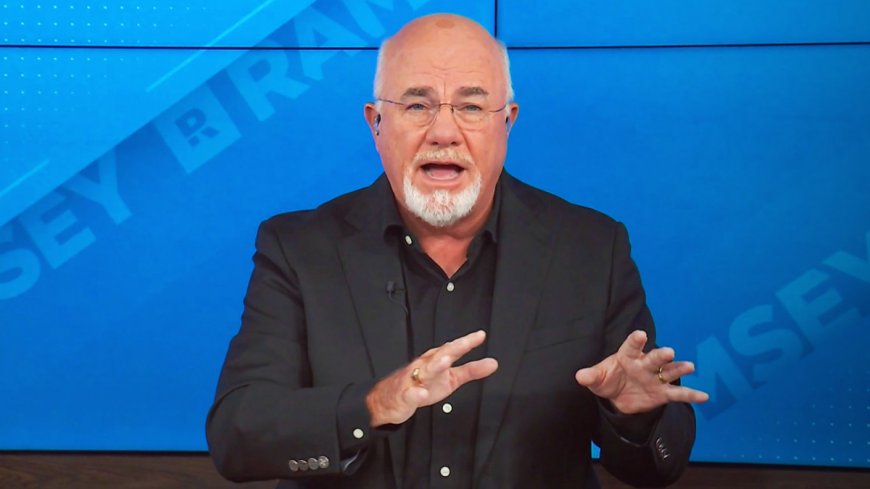

Radio host and author Dave Ramsey speaks frequently with people who are looking advice about major financial decisions.

He strongly advises people that their number one priority, after being sure they have set up an emergency fund, should be to pay off all debts.

Related: Another fast-food operator files Chapter 11 bankruptcy

These include student loans, car loans and credit card debt. But Ramsey does make one exception for homeowners.

Because people are building equity in their homes with their mortgage payments, that is a debt that is worth holding, he says.

Ramsey advises potential home buyers to choose a 15-year mortgage. He also emphasizes that people should not attempt to buy a house that is too expensive.

If you are paying for a mortgage that is too high, that burden can make you "house poor," he explains.

Some people buy homes with the intent to make changes to them that increase their value. Then they hope to sell them, for a higher amount than that for which they bought them, so they can profit from the sale. Shutterstock

Flipping a home as a real estate investment

A woman identifying herself as Erin recently asked Ramsey about exactly such a scenario.

"Dear Dave," she wrote, according to Ramsey Solutions. "My husband and I want to do a live-in and flip real estate purchase. The idea is to buy a fixer-upper and rent out the basement to help with the mortgage payments. How do you feel about ideas like this?"

Ramsey first suggested that the advice-seeker be sure some of the basics are taken care of from a planning perspective.

"In a situation like this you need to do a basic business analysis," he wrote. "You've got to have a plan in place, and you've got to figure out the worst-case scenario. Part of this is determining whether you can survive if things fall apart. In this case, the worst case is that you can't get a renter, and the house doesn’t sell. It puts your family in jeopardy, so to me it's not an option."

The personal finance personality added some thoughts about the questioner's current state of thinking about the decision.

"Want my honest opinion?" Ramsey asked. "I think you've both got a case of house fever right now. The possibility I just mentioned isn't a rare occurrence. Lots of people have had the same idea, with the best of intentions, and still wound up in a big mess."

Ramsey also explained a bit about his personal feelings on the real estate business.

"I love real estate. I mean I really love real estate. And I’ve flipped more than a few houses in my day," he wrote. "But the particulars of this deal make me a little nervous."

"If you and your husband are willing to accept the possibility of things not working out like you planned — and the fact you might have to take additional jobs for an unknown length of time just to make ends meet — then it might be a play," he continued. "But for me? Nope. I don't like putting myself into these kinds of situations."

Then Ramsey added some advice based on his own personal experience.

"When I was much younger, I was willing to do all kinds of dangerous stuff and ignore the risk," he wrote. "But going broke decades ago knocked that kind of thinking out of me in a hurry."

"Any deal that runs the risk of leaving you bankrupt, or the victim of a foreclosure, just isn't worth it, Erin."

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.

What's Your Reaction?