Dave Ramsey offers well-timed advice on buying a house now

There are right and wrong ways of making the big real estate move.

Many people considering buying a home were encouraged in December 2023 when average mortgage rates dropped below 7%.

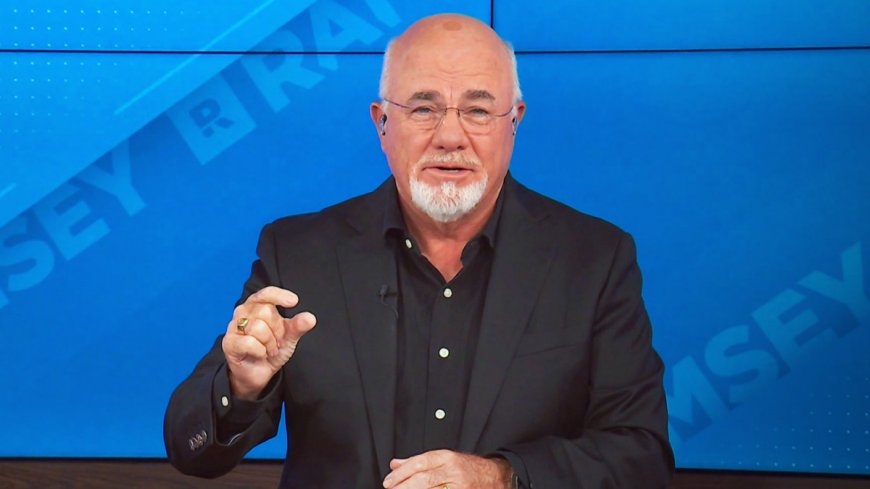

Personal finance personality Dave Ramsey has weighed in with some advice on how (and how not) to approach the opportunity for those who are planning to buy a home.

Related: Dave Ramsey has blunt words on what to do with your money now

Beyond December's mortgage rate developments, expectations that the Fed will cut interest rates in 2024 are on the rise, further fueling the sense that the time may be right to purchase real estate.

Lower rates should also encourage homebuilders to borrow money, which should lead to a greater supply of homes.

In 2024, mortgage interest rates could average 6.3%, according to the National Association of Realtors.

Ramsey emphasized that there are plenty of choices available and multiple ways to go about buying a house, but he has a few essential guidelines that he suggests people follow. David McNew/Getty Images

Ramsey's recommended math on buying a home

Ramsey begins with his belief that the best way to pay for a home is with cash. This, of course, is not an option available for most people, but establishing that as the most desired method (even in theory) helps inform other decisions to be made.

"If that's not feasible for you, the next best thing is a smart home mortgage loan," he wrote on Ramsey Solutions. "It may be easy to dive headfirst into the mortgage option that will allow you to buy a home with next to nothing down."

"But a bad mortgage product can be a liability in your financial portfolio," he added. "A home should be a blessing to your family, not a financial nightmare."

The bestselling author and radio host suggests three preconditions a potential buyer should meet before taking on a mortgage.

First, Ramsey said, be sure you are completely debt free.

Second, have three to six months of expenses saved in an emergency fund.

Third, it's important that you have saved for a big down payment.

"We recommend at least 10%, but 20% is even better since it will allow you to avoid PMI payments," Ramsey wrote.

Private mortgage insurance (PMI) is a type of mortgage insurance you might be required to buy if you take out a conventional loan with a down payment of less than 20 percent of the purchase price, according to the Consumer Financial Protection Bureau. PMI protects the lender — not you — if you stop making payments on your loan.

The best type of mortgage

Ramsey then explains what he advises is the best mortgage option.

"Your home loan should be a conventional, fixed-rate mortgage with a 15-year (or less) term," he wrote.

"Do not get a 30-year mortgage!" he emphasized. "A $175,000, 30-year mortgage with a 4% interest rate will cost you $68,000 more over the life of the loan than a 15-year mortgage will. That's a lot of money you could use to build up your retirement fund or save for your kids' college."

The host of The Ramsey Show has another piece of advice about the size of a potential mortgage payment.

"Your monthly payment should not exceed 25% of your take-home pay. Any more than that will tie up too much of your income," he wrote.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.

What's Your Reaction?