Dave Ramsey reveals big retirement, 401(k), Social Security strategy

The personal finance coach has a key retirement planning insight.

Many people challenge about the unpredictable future of Social Defense and to what diploma they'll condition confidence within the federal program for funds in their retirement years.

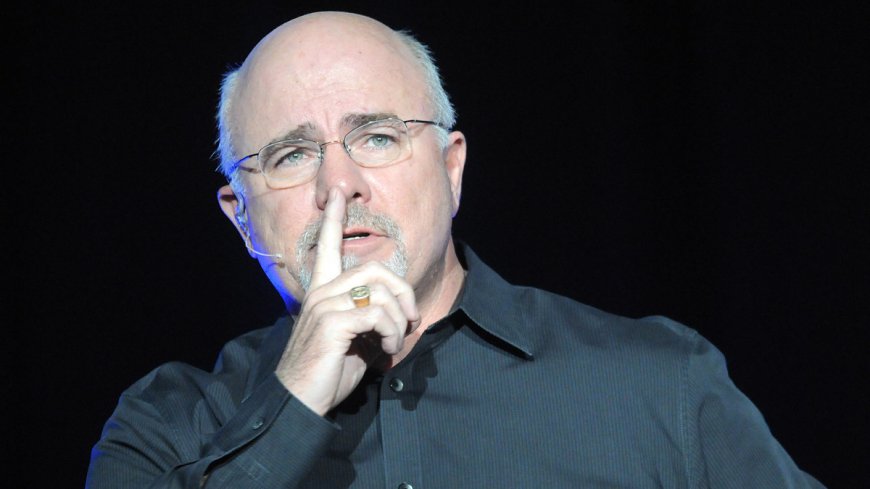

Non-public finance creator and radio host Dave Ramsey explains what's ahead for Social Defense within the following decade and supplies his views on how an adverse lot clean day persons should keep in intellect on it after they retire. A Centers for Sickness Handle and Prevention file initiatives the smartly-relevant American life expectancy at seventy seven years historic, and this reality is a associated consideration for retirees.

Associated: Dave Ramsey has relevant warning on retirement, 401(k), Social Defense

First, it absolutely is needed to apprehend that Social Defense's mixed confidence fund reserves will run out of money in 2035. Except then, the reserves will make up the respect between earnings and rates.

After the reserves are depleted, this system's earnings will as well as the truth which have the resolution to pay about Eighty% of its promised advantages. And so so you might ensue in fundamental terms if Congress fails to make adjustments.

Ramsey believes, given the uncertainty of Social Defense's future, persons should apprehend that it absolutely is their deepest multiple financial accountability to devise for their retirement the utilization of multiple procedure.

And the radio host explains a couple funding gadget people can use to e-booklet deal with themselves and their families with out hoping on the federal govt.

Dave Ramsey clarifies advice on 401(k)s and Roth IRAs for retirement

Ramsey emphasizes his view on the importance of investing 15% of your earnings in lengthen stock mutual funds by utilizing an employee-subsidized 401(k) and a Roth IRA.

The non-public finance tutor clarifies his opinions on regulation to keep in intellect when the utilization of this funding formula for retirement fiscal scale back rate rates.

In the case of the worker-subsidized 401(k), Ramsey explains that it absolutely is now not adequate to naturally make investments as much as at least one's industrial employer's average percentage.

More on Dave Ramsey

- Ramsey explains one relevant key to early retirement

- Dave Ramsey discusses one big money mistake to hinder at bay

- Ramsey shares very needed recommendation on mortgages

One formula designed for achievement is for money beyond your industrial conducting industrial employer's 401(k) average to be invested in a Roth IRA.

It be end result of the contributions to Roth IRAs are made with after-tax money, in order those investments grow in rate, they grow tax-free. This formula is needed end result of the it absolutely is miles equipped to lengthen fiscal scale back rate rates, absolutely if you retire in an accelerated tax bracket than you had been in whereas you to with invested the cash.

If a grownup is supplied to execute these plans efficaciously, Ramsey says, there may smartly be the multiple formula to protect in intellect touching on Social Defense funds that would shock people. Shutterstock

Ramsey discusses claiming Social Defense advantages early

One resolution people deserve to protect in intellect about Social Defense funds contains the query of when it absolutely is miles best to receiving them.

In relevant, the longer one waits to claim advantages, the substantial the paychecks will be. But Ramsey suggests an formula that would culmination in the two retiring in the previous and making bigger money from your Social Defense advantages within the very lengthy time.

Associated: Dave Ramsey has new sturdy phrases on purchasing a house and bigger estate

If the wealth gathered for your 401(k) and Roth IRA by the time you retire is plentiful which you do not use your entire money from your Social Defense tests, you can be equipped to make investments that money and watch it grow proper by utilizing your retirement furthermore your multiple investments.

For social gathering, Ramsey explains that if you had been to make investments $700 a month from the time you can be Sixty two to the time you can be seventy seven, that will be 15 years of investments that would in all likelihood culmination within the multiple $318,000 or so.

Owing to the very reality the Centers for Sickness Handle and Prevention predicts the smartly-relevant American life expectancy at seventy seven years historic, that's amazingly associated to the mathematics.

Should you reside to that age, that you just may smartly emerge as receiving bigger money from Social Defense by claiming the advantages at age Sixty two and investing the cash.

It absolutely is a safe assumption most folk would uncover that a best culmination when in distinction with spending bigger time working previous age Sixty two whereas you stay up for the bigger month-to-month reap.

Associated: Veteran fund supervisor picks favored stocks for 2024

What's Your Reaction?